Confiscation of Wealth Through Inflation

Economics / Inflation May 31, 2007 - 11:52 AM GMTBy: Mike_Hewitt

“ By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens .” (John Maynard Keynes, chief architect of our present-day fiat money system)

The Mission Statement of the Federal Reserve as stated on their website is to “… to provide the nation with a safer, more flexible, and more stable monetary and financial system.”

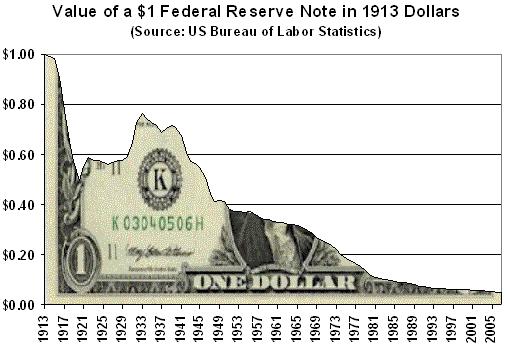

Below is a graphical representation of the fall in value of the US$ since the Federal Reserve took control of the monetary system.

I would like to ask the US Federal Reserve how exactly they define the word “stable”? In the first seven years of providing the nation with a “more stable monetary” system, the dollar lost one-half of its value. Today, the US dollar is worth less than a nickel was in 1913! (Click here for the CPI Inflation Calculator at the U.S. Bureau of Labor Statistics)

The Federal Reserve was created on December 23, 1913, with the signing of the Federal Reserve Act by President Woodrow Wilson. According to the Federal Reserve website, “…it is an independent entity within government, having both public purposes and private aspects.”

Congress has authorized the Federal Reserve to manage the nation's money supply. There has been a great deal of controversy regarding the establishment of the Federal Reserve on the grounds that it is unconstitutional. Under Article 1, Section 8 , only “The Congress shall have power … To coin money, regulate the value thereof, and of foreign coin, and fix the standard of weights and measures.”

“ The Central Bank is an institution of the most deadly hostility existing against the principles and form of our Constitution .” (Thomas Jefferson)

Today, the vast majority of Americans seem blissfully unconcerned that the dollar is an unbacked piece of paper that can be printed without limit. The Federal Reserve Note used today is not the same as the dollar of 1792. The dollar was a certificate for actual money, either 24.75 grains of pure gold or 371.25 grains of pure silver, as defined in Section 9 in the Coinage Act of 1792 . Today we hold that the paper note itself is the actual money.

This is a lie.

A “note”, according to The Dictionary of Banking Terms, 4th Ed., by Thomas P. Fitch, is “legal evidence of a debt or obligation”. What we think of money today is not an asset as it was during the time when it was backed by something tangible such as gold or silver, instead it is a representation of debt, an “I.O.U. nothing” as John Exeter once said.

Central banks around the world have been creating trillions in face value of unbacked paper notes. When the central bank creates more unbacked money “out of thin air” it does not create wealth. What it does is redistribute wealth to those who receive the newly created dollars first. Those lucky enough to receive those dollars first are able to spend them at face value. Those who receive them later do not benefit as prices have already risen in response to the increased supply of money. Those who receive very little, only feel the effects of an increasing cost of living.

“ The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit…. In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value…. ” (Alan Greenspan, former Chairman of the Federal Reserve)

Click here for a related video on this topic.

By Mike Hewitt

http://www.dollardaze.org

Mike Hewitt is the editor of http://dollardaze.org a site about the current fiat monetary system and how to best position oneself using hard assets such as gold and silver along with shares of resource companies.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.