Preserve Your Wealth with Precious Metals

Commodities / Gold & Silver 2009 Jul 02, 2009 - 12:34 PM GMTBy: Nick_Barisheff

“I’m not so much interested in the return on my money as I am the return of my capital." -Will Rogers

“I’m not so much interested in the return on my money as I am the return of my capital." -Will Rogers

n this extraordinary environment, preserving your personal wealth becomes priority one. Before you make another major financial decision, it is imperative to understand the big picture by recognizing and understanding three critical issues. First, we are in a secular bear market for financial assets (stocks and bonds). Second, the consequences of the global bailouts will likely be highly inflationary. Third, we are at a pivotal point in the long-term investment cycle. Let’s examine each of these three keys in more detail.

KEY 1: WE HAVE ENTERED A SECULAR BEAR MARKET

In a secular (long-term) bear market, stocks plunge in value, single digit price/earnings ratios become the norm, and they can stay that way for up to 25 years. The secular bear we are experiencing now actually began when the stock markets crashed in 2000-2001, but few investors noticed because in 2003 the markets were artificially propped up by massive amounts of easy money from the US Federal Reserve under Chairman Alan Greenspan. This was not a new monetary policy. Greenspan’s response to every financial “crisis” he faced starting with the stock market crash of 1987 all the way through to and past 9/11 was to pour money into the system. The system was never allowed to self-correct, allowing a variety of asset bubbles to form.

During a secular bear market such as this one, stocks habitually move down or sideways. But there are occasional and sometimes violent bear market rallies to the upside that suck in naïve investors hopeful of a quick market turnaround. The most recent example was the Spring 2009 rally in which the markets rose 40 percent from their March low to mid-June. Since we are just in the early stages of the secular bear market, investors still have time to rebalance their portfolios into negatively correlated assets. That means selling stocks and bonds (which are expected to decline in 2009 as interest rates rise) and buying an asset class that will maintain its purchasing power through the chaos and confusion.

Cash may seem to be a safe haven but it won’t protect against rising inflation. Bonds did well in 2008 because interest rates were slashed to zero. But rates have nowhere to go but up in 2009, which means adding or keeping bonds in your portfolio is likely to produce a negative return. And bonds won’t provide true diversification protection because stocks and bonds have become positively correlated. As Ibbotson Associates proved in their landmark study (see Figure 1), over the long run the most negatively correlated asset class to stocks and bonds are precious metals gold, silver and platinum.

Buy and Hold Doesn’t Work In A Secular Bear Market

Following traditional bull market mantras such as ‘Buy-and-Hold’ and ‘Stay the Course’ is a recipe for disaster in a secular bear market. Because secular trends last for years, they also take years to break. As Figure 2A and Figure 2B show, there have been two secular bear markets since 1929. History shows us that in a secular bear market, stocks fall below fair value, hit single digit price/earning ratios, and can remain that way for years. The 1972 to 1982 bear in the S&P 500 is the most recent example. In 1979, market sentiment had fallen so low that BusinessWeek famously announced “The Death of Equities” on its front cover. Pessimism ruled and stocks were spurned, which ultimately sowed the seeds for the next bull market.

The horizontal dotted lines in the two charts, Figure 2A and 2B, indicate the length of time in years it took for the markets to recover and make buy-and-hold investors ‘whole’ again. The average recovery time during these two bear markets was more than seventeen years! Seventeen years is a very long time for an investor to wait to break even, and that doesn’t even take into account the effect of inflation. These charts clearly reveal one of the dirty little secrets of Wall Street and Bay Street: Buy-and-Hold doesn’t work in a secular bear market. If you are a retiree or a soon-to-be retiree, a secular bear carries a double whammy: it will not only decimate your wealth but eliminate any chance of recovery. Even if you are much younger than retirement age, buying and holding the wrong asset class during a secular trend change is fatal, because investors are supposed to build nest eggs, not shrink them.

If you bought and held the Dow 30 stocks from 1966 through to 1982 (the last bear market in the Dow), your nominal returns would have been zero. As Warren Buffett points out: “During these 17 years, the stock market went exactly nowhere.” But that’s only part of the story. On an inflation-adjusted basis it would have taken until 1995, nearly 30 years, to break even. And remember, this period was not even considered a depression. One more fact: if you are counting on stock dividends to help you get through this downturn, consider this: at the time of writing, companies are cutting dividends at the fastest and deepest pace in at least 50 years, and by many companies that have never previously cut dividends before.

KEY 2: MASSIVE BAILOUTS WILL TRIGGER MASSIVE INFLATION

As Merrill Lynch economist David Rosenberg wryly points out, “the new growth engine for the economy is government spending.” We are in the early stages of a global government spending spree of unprecedented proportions which, coupled with zero percent interest and extraordinary money supply growth, will be hugely inflationary. Financial assets will continue to lose purchasing power in this kind of environment, but gold and precious metals will hold theirs because they are a proven hedge against an investor’s two worst enemies -- inflation and economic turmoil.

Estimates suggest it will cost upwards of *$10 trillion dollars for global governments to bail themselves out of the crisis, and these estimates could rise further. There is some talk of deflation, but deflation requires a contraction in the money supply, not the increase that will result from printing of truckloads of fiat money to cover enormous global stimulus packages.

Even hyperinflation is a possibility. Economists Joachim Fels and Spyros Andreopoulos of Morgan Stanley Economics report that if the following three conditions play out, a hyperinflationary spiral will be hard to contain: First, the Fed, European Central Bank and Bank of England would need to rapidly and continually expand the monetary base. This is already happening. Second, governments would have to face increasing difficulty financing their bailout packages and funding their debt. This is very likely to happen. Third, public confidence in the government’s ability to service its debt might disappear. A crisis of confidence could easily happen in Europe or Asia, and then spread to the US.

In recent years, the US money supply has been growing at an alarming rate. In 2008, despite a slowdown in lending and credit, money supply still grew dramatically with M3 (the broadest measure of money supply) increasing at about 11 percent, as Figure 3 shows. Over the long term, M3 increases have been the best leading indicators of future increases in the price of goods and services.

Most people think of inflation as a rise in the price of goods and services but in actuality price rises are the effect, not the cause, of inflation. As Milton Friedman pointed out many years ago, inflation is always and everywhere the result of an increase in the money supply.

Precious metals are the only currency to own when central bank printing presses are debasing global currencies at a historic rate. And because they are a proven store of value, precious metals may be the only asset class that will preserve your portfolio’s purchasing power as we enter into a prolonged period of ‘–flation’: deflation, stagflation or inflation, one of the latter two being much more likely.

KEY 3: RIDE THE INVESTMENT CYCLE

A buy and hold strategy might work if it weren’t for the existence of cycles that drive bull and bear markets. Stocks are highly sensitive to these cycles, as witnessed by a simple fact. Of the 30 stocks that made up the Dow in 1929, only General Electric remains in the Dow today. A good way to understand the investment cycle is to look at what is called the Dow:Gold ratio. The Dow:Gold ratio (Figure 4) calculates the number of ounces of physical gold bullion it would take to ‘purchase’ one share of the Dow Jones during any given time period. When the ratio rises, as it did in the 1920s, 1960s and 1990s, it tells us that portfolios should be overweight stocks. When the ratio slumps, as it did in the 1970s and today, it tells us that portfolios should be overweight precious metals bullion.

The last three major stock market bubbles ended with the Dow:Gold ratio above 18:1, while the last two major bear markets in 1932 and 1980 ended with the ratio near 1:1 At the height of the equities bull market in 1999, the Dow:Gold ratio peaked at over 40:1. At time of writing, the current ratio is 9:1 and falling. Now is the time to increase your allocation to gold and precious metals.

Precious metals preserve wealth

Precious metals have successfully preserved wealth for thousands of years because, unlike stocks and bonds and paper currencies, they are not someone else’s promise of performance and they are not subject to the whims of the printing press. Massive credit expansion in the US has led to a total ‘official’ debt of $10 trillion, but if we add the $50 trillion in unfunded pension liabilities and Medicare obligations that the US owes its citizens, actual debt is a staggering 400 percent of GDP.

America’s spiralling debt crisis is leading many experts to consider the previously unthinkable: that the US might become the next Argentina. To learn more about the debt crisis, visit www.ChrisMartenson.com. Martenson, a PhD, has created a superbly researched video called the “Crash Course” which explains how massive debt is destroying investors’ wealth.

Precious metals are a safe haven

In 2008, stocks lost 30-70 percent of their value, while gold increased about 5 percent in US dollars. But equally significant, in a year of record-setting volatility, gold’s volatility was reassuringly low. At its lowest point, gold was only down 14 percent and at its highest it was up 21 percent. Both Goldman Sachs and UBS see gold rising in 2009, and UBS expects investment demand for gold to pull the price of silver and platinum up along with it. Citigroup is calling for gold to rise above $2,000 in 2009.

Precious metals protect against depreciating dollars

Since gold and precious metals are priced and traded in US dollars, they surge in value when the US dollar declines. As trillions in new money is printed, the dollar will fall precipitously relative to gold. In an environment where the dollar is already weak and other currencies are weaker, investors seeking to preserve and grow their wealth in 2009 must understand the impact of declining currencies on their portfolios.

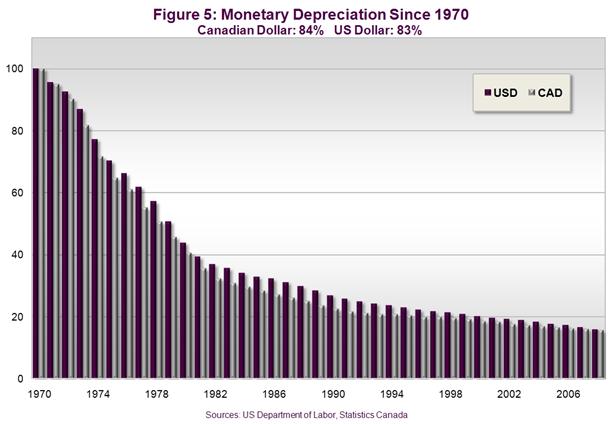

Figure 5 shows how much the Canadian and US dollars have declined in purchasing power since 1970. The world’s other currencies have fared no better. Not coincidentally, 1971 was the year the link to the gold standard was cut.

Only gold, along with its two precious metals brethren – silver and platinum – will hold their value in periods of severe deflation and inflation.

Physical bullion versus proxies

Few investors are aware of all the precious metals investment options available to them. Some precious metals investments such as futures contracts and options are better suited for speculation and a higher tolerance for risk. But certificates, pooled accounts, ETFs and even mining stocks also bring risk. Only physical bullion can guarantee peace of mind because it gives the investor exclusive title to the safest and lowest risk precious metals investment of all.

Figure 5: Since 1970, the Canadian and US dollar have lost more than 80 percent of their purchasing power

Much of the physical bullion that is purchased and traded on the world’s bullion markets is owned in unallocated form. This is an important fact because holders of unallocated bullion do not own any specific bullion bars, they merely have a claim on an unspecified portion of a general pool of bullion or an equivalent liability. As a result, they take the risk that their bullion may be lent out without their knowledge or consent or may not be there at all.

Today, buying and storing allocated bullion has never been simpler. You can privately and securely purchase bars of gold, silver and platinum in large bar sizes and have them insured and stored for you at a registered LBMA vault without ever breaking the Chain of Integrity. Visit www.bmgbullionbars.com to learn more or read our BMG Special Report on investing in precious metals at: www.investinpreciousmetals.ca

Preserve your portfolio’s purchasing power

A minimum 10-15 percent allocation is considered adequate in a bull market, but a much larger allocation is suggested for protection in a secular bear market. If you have not already done so, now is the time to rethink your investment strategy. Physical bullion adds an asset class that will keep its value, regardless of where the economic downturn takes us inflation, deflation or hyperinflation.

For the first time in history, the central banks have an unlimited ability to print as much money as they need to avoid a deflationary depression. Precious metals are the only currency that will survive intact, because while governments can print infinite amounts of money, they cannot increase the supply of hard assets with intrinsic value. Investors, institutions and central banks will turn in droves to the historical safe haven of precious metals, as real wealth replaces wishful thinking. This secular bear market is expected to last for many years, eating away at investors’ hopes and dreams and portfolios along the way. Don’t let your portfolio be one of them. Now is the time to make an investment in your future, because the future is precious metals bullion.

*All amounts are in US dollars unless otherwise noted.

By Nick Barisheff

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

Nick Barisheff is President and CEO of Bullion Management Group Inc., a bullion investment company that provides investors with a cost-effective, convenient way to purchase and store physical bullion. Widely recognized in North America as a bullion expert, Barisheff is an author, speaker and financial commentator on bullion and current market trends. He is interviewed monthly on Financial Sense Newshour, an investment radio program in USA. For more information on Bullion Management Group Inc. or BMG BullionFund, visit: www.bmginc.ca .

© 2009 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.