Basic Financial Markets Analysis Part2

InvestorEducation / Learning to Invest Jul 02, 2009 - 05:01 PM GMTBy: Andy_Sutton

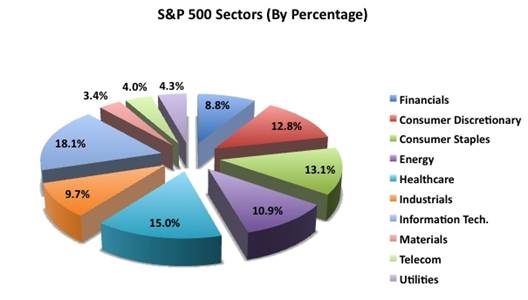

Last time we discussed the concept of valuation for some different types of investments and the formation of themes that can be used to help zero in on potential areas for focus. This week we’ll take a look at some ways of breaking down industries and sectors, sizing companies, then connecting the dots between economic themes and investment needs.

Last time we discussed the concept of valuation for some different types of investments and the formation of themes that can be used to help zero in on potential areas for focus. This week we’ll take a look at some ways of breaking down industries and sectors, sizing companies, then connecting the dots between economic themes and investment needs.

If you go to the NYSE website, you will be able to find what is called an Industry Classification Breakdown or ICB. There are ten major industries with varying numbers of supersectors, sectors, and subsectors under each major heading. Now let’s say for example, in your reflections on what the major economic and investing themes happened to be that you zeroed in on consumer staples as an area that is positioned for success. At this point we are assuming that you’re not interested in just finding an ETF or Closed-End Fund that gives exposure to firms that produce consumer staples, but are interested in becoming more acquainted with some of the individual firms themselves. Once you have performed your basic analysis, you’ll know which firms you’d want an ETF or other Fund to include or can purchase them outright and will be an informed shopper so to speak. That said, when you go to the ICB listing for Consumer Goods, you will find the following:

Consumer Goods

- Automobiles and Parts

- Automobiles and Parts

- Auto Parts

- Automobiles

- Tires

- Food & Beverage

- Beverages

- Brewers

- Distillers and Vintners

- Soft Drinks

- Food Products

- Family & Fishing

- Food Products

- Personal and Household Goods

- Household Goods

- Durable Household Products

- Furnishings

- Home Construction

- Non-durable Household Goods

- Leisure Goods

- Consumer Electronics

- Recreational Products

- Toys

- Personal Goods

- Clothing and Accessories

- Footwear

- Personal Products

- Tobacco

Clearly you are not interested in examining all of these areas. Your focus as decided above is on staple goods. Immediately, the broad category of Leisure Goods can be eliminated. Automobiles can probably be eliminated as well if we’re focusing totally on staples or necessities. This leaves a wide sampling of categories. For the purposes of this discussion and in the interests of brevity, we’ll limit our analysis to a single sub sector – Food Products.

Before we continue, some limitations of this search methodology must be identified as well. The NYSE search is only going to show the firms that are listed on NYSE. It will not show international firms that are listed on other major exchanges, but not on the NYSE. The good news is that many of the larger firms are dual-listed. The bad news is that by limiting your search to only NYSE-listed issues, you will likely miss some good possibilities. Many of the other major exchanges such as the TSX also have similar search capabilities and by spending a little time, you can quickly assemble a rather comprehensive list of investment possibilities within any given sub-sector.

A look into the Food Products sub-sector reveals no less than 46 US-listed companies and their related securities. The information provided is limited to the name of the firm, the ticker symbol, last trade / trade date, volume, change($), and change(%). At this point, the biggest tendency for individual investors is to scan the list, find the name of a firm they know and start their search there. This is not the way to go; emotion has already entered the equation and in your mind you’re already playing favorites and biases have taken control of the process. At this point, you must consider your own objectives:

- When will you need this money?

- What do you anticipate eventually using the money for?

- How much money do you have to work with?

- What is your risk tolerance?

The answers to these questions will help you decide on what types of firms you’re looking for. Do you want large companies with low volatility that pay high dividends? If you’re approaching retirement, this might be the way to go. If you’re younger and are looking for capital appreciation, you might consider looking at some of the smaller companies that are more volatile, but have more room to grow. Are you risk averse? The fact that you’re looking at consumer staples to begin with might say something about your willingness to accept risk (wait, I picked that category!).

This is an important part of the process. We are now connecting the economic themes that we decided will be important with our own personal situation. The worst thing anyone can do is take his or her own themes, then just grab someone else’s prepackaged strategy without considering if it actually fits. It is the financial equivalent of buying a pair of trousers without bothering to look at the size, choosing rather to buy them because you thought they looked good on somebody else.

So in our hypothetical analysis, we decided that the economy is in recession and is likely to be there for some time, and have come to the conclusion that people will cut back on discretionary spending (which they have). We realize that inflation is a problem, and so leaving our capital in a bank account is not the greatest idea if we expect to maintain our purchasing power. Food products will certainly not be the only theme we invest in, but it is a good starting point.

Large or Small?

The next issue becomes the determination of what constitutes a large company and what constitutes a small one. Obviously, there are a number of characteristics that may be used to determine this, but one of the most generally accepted definitions is the firm’s market capitalization. Market capitalization is the share price multiplied by the number of outstanding shares. Another way of expressing market cap is that it represents the public opinion of the value of the company. The sizing of companies can generally be lumped into the following brackets:

- Large-Cap Companies $10 Billion - $200 Billion (or more)

- Mid-Cap Companies - $2 Billion - $10 Billion

- Small-Cap Companies - $200 Million - $2 Billion

- Micro-Cap Companies – Less than $200 Million

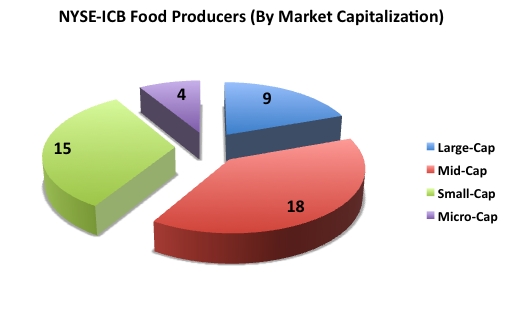

Using the Food Products sub-sector as our continuing example, of the 46 issues in that category, the breakdown is as follows:

As is evidenced by the chart above, there is a solid distribution of firms in this sector according to size as measured by market capitalization with most of the companies (33) falling in the small or mid cap range. This distribution is good news as it means that no matter what your investment goals and risk profile, you should be able to find a reasonable number of firms that are desirable for addition into a portfolio, or are firms that should be looked for when looking at ETFs and open/closed end funds.

Using this methodology it is fairly easy to drill down to potential specific investment possibilities from a variety of economic themes. What we need to accomplish next is creating a definition of value and the parameters by which we will measure it. Next time we’ll take a look at some of the popular valuation metrics and develop a few of our own as well, which we can add to our toolbox as we continue to chase the oftentimes elusive concept of value.

Individuals interested in learning more about the major macroeconomic themes should take a moment to listen to some of our informative podcasts. We’ve recently had guest experts like Laurence Kotlikoff; John Williams of shadowstats.com, and Bill Murphy of GATA appear to discuss their areas of expertise. For more information or to listen, please take a moment to visit www.my2centsonline.com/radioshow.php

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.