Banking Stocks Short Selling Ban Reinstatement SEC Idiocy

Stock-Markets / Market Manipulation Jul 03, 2009 - 09:49 AM GMTBy: Mike_Shedlock

Inquiring minds are reading S.E.C. May Reinstate Rules for Short-Selling Stocks.

Inquiring minds are reading S.E.C. May Reinstate Rules for Short-Selling Stocks.

They have been reviled as the bad hats of Wall Street, nefarious traders who cashed in on the market collapse and, some insist, helped precipitate it.

Now short-sellers, the market skeptics who correctly called last year’s downturn, are coming under even more unwanted scrutiny, this time from federal regulators. The Securities and Exchange Commission appears poised to reverse itself and reinstate rules that would make shorting stocks — that is, betting their prices will decline — somewhat more difficult.

Many banks, whose stocks came under attack last autumn, maintain that unfettered short-selling is dangerous. The shorts, their argument goes, helped bring down Bear Stearns and Lehman Brothers last year.

Mary L. Schapiro, chairwoman of the S.E.C., has said that considering new rules restricting short-selling is a priority.

For the moment, the most likely outcome may be for the S.E.C. to reinstate a rule that the commission itself abolished with a unanimous vote in 2007, under its previous chairman, Christopher S. Cox. Known as the uptick rule, it would bar investors from shorting a stock until its price ticks at least a penny above its previous trading price.

To some, the issue is clear-cut. The American Bankers Association, a trade group representing the vast majority of American banks — whose equity values have been especially battered in the last 18 months — recently submitted an opinion in favor of reinstating the short-sale restrictions.

Sally Miller, a spokesman for the A.B.A., said the member banks thought there was a clear link between the market turmoil and the rule change.

The American Bankers Association Group of Idiots

What brought down the banks was excessive leverage (40-1 or greater at Bear Stearns and Lehman), excessive dependence on real estate investments (both residential mortgages and commercial real estate), lax lending standards, off balance sheet investments ($1 Trillion at Citigroup alone), and a host of other piss poor discretions.

If the American Bankers Association wants to place the blame on who is responsible for this mess they ought to look straight in the mirror and blame themselves.

Moreover, Sally Miller is obviously a complete dunce as to how stock markets work. sally says there is a "clear link between the market turmoil and the rule change". Hello Sally, correlation does not imply causation.

The rooster crows at the crack of dawn every day and the sun comes up. The sun does not comes up because the rooster crows, no matter what the ABA says.

Citigroup's Ridiculous Short Selling Claim

Flashback November 20, 2008: Citigroup Blames Short Sellers For Collapse.

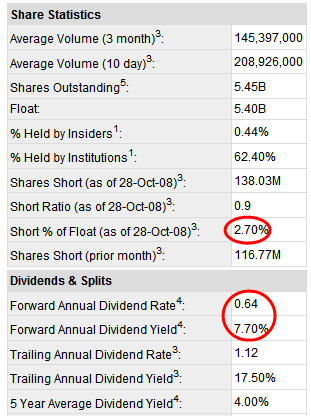

Inquiring minds are looking at Citigroup Statistics as of October 28, 2008.

Citigroup is blaming shorts when the short interest is under 3%. That's ridiculous. If Citigroup does not understand this, it is a sign of incompetence. If Citigroup does understand how ridiculous their claim looks (and is), that is additional support for the desperation thesis.

Note the dividend. Citigroup is paying a dividend when it is clearly in need of capital . Is that a sign of arrogance or incompetence? That Citigroup is in this mess in the first place is clearly sign of incompetence somewhere, at some point in time. Current management will attempt to place that blame on Chuck Price, but the culture of greed, arrogance, and excessive risk taking, permeated the entire financial industry.

Looking ahead, foreclosures, credit card defaults, and bankruptcies are going to soar along with a soaring unemployment rate. Banks in general, and citigroup specifically, are woefully undercapitalized and unprepared for what is about to happen. One look at a chart of Citigroup should be proof enough.

The market seems to believe Citigroup is insolvent and so do I.Citigroup The Bank That Gets Nothing Right

While on the subject of Citigroup, and Citigroup whiners, I offer Listen to Citigroup Analysts at Your Own Peril.

Who Are The Short Sellers?

Inquiring minds are asking, who is doing the bulk of short selling?

It's a good question, too. And I have an answer: The market makers like Goldman Sachs, Citigroup, and Merrill Lynch.

Yes, the whiners complaining about short selling are doing the bulk of it! For every buyer there is a seller, and when markets are screaming higher, the market makers are frequently shorting as a pure function of what they do. Moreover, when people buy PUTs, the market makers selling those options short stock as a hedge.

Not only are the market makers shorting, but these actions are where the bulk of naked shorting comes from.

By the way, the SEC initiated a huge short squeeze once before by restricting shorts on financials. Guess what happened when the short squeeze ended and Goldman Sachs, Citigroup, and the other market makers were the ones left holding the shorts? The market plunged is what.

Finally, there is no uptick rule for market makers. There never was. This is how ridiculous this nonsense about shorting is.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Richard

04 Jul 09, 08:38 |

Stock Shock - the Movie

Mike, How about an article on the movie STOCK SHOCK |