Inflation, Stock Market sentiment and the Kress Cycles

Stock-Markets / Stock Market Sentiment Jul 07, 2009 - 01:23 AM GMTBy: Clif_Droke

Despite a 40% market recovery and an abatement of the credit crisis, a climate of high fear abounds among market participants. Investor sentiment polls continue to show an excess of bears over bulls as few believe that a recovery can be sustained.

Despite a 40% market recovery and an abatement of the credit crisis, a climate of high fear abounds among market participants. Investor sentiment polls continue to show an excess of bears over bulls as few believe that a recovery can be sustained.

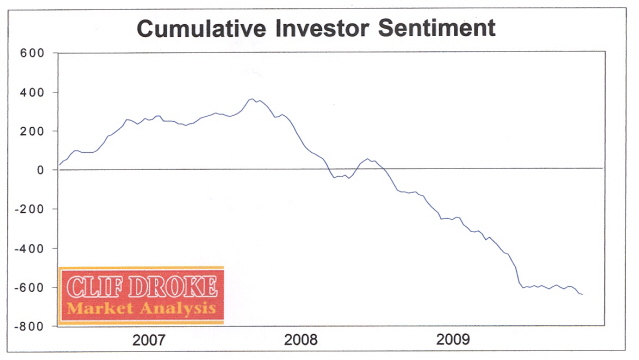

If anything, fear has been increasing the last few weeks as the stock market has stalled out in a lateral trading range. While the benchmark S&P 500 Index has come up significantly from its March low, the cumulative AAII investor sentiment index continues to make lower lows as investor psychology continues to divergence against the market’s interim recovery.

Investors it seems have developed a tendency to “just say no” when it comes to believing in a recovery. Until they can see it, taste it, feel it, they simply don’t believe it can happen. The immediate “cause” of this ingrained negative sentiment is obvious enough: the media inflames emotions by hyping “bad news” stories concerning the employment outlook, personal consumption, etc. Most market participants are so finely tuned into mainstream news that they are easily swayed by the negativity and emotionalism of the leading stories of the day.

But where does the negative bias of the news media originate from? And why has the inveterate optimism of the ‘80s and ‘90s been replaced by a perpetual pessimism since 2001? The answer can be found in the all-encompassing influence of the Kress Cycles.

The 120-year Master Kress series is the keystone to long-term financial market planning and economic analysis. Its influence extends to virtually every endeavor in a capitalist economy and its impact on the mass psyche can’t be underestimated. The 120-year series subdivides into the smaller components which govern long-term market and economic trends. These include the 10-year, 12-year, 20-year, 30-year 40-year and 60-year cycles among those of shorter duration.

Two of the most dominant cycles in the 120-year series are the 30-year and 40-year cycles. Together they form the dominant long-term trend (30-year) and bias (40-year) for the financial markets. They also form the composite investor psychological bias and set the tone for how news is interpreted.

The 30-year cycle bottom in 1984 combined with the rising 40-year cycle helped create the “go-go” atmosphere and mass optimism of that era. When the 30-year cycle peaked in late 1999 it marked the end of the “feel good” era of the ‘80s and ‘90s and the start of the current “bad news” era. The 30-year trend cycle being in decline now is exacerbated by the fact that the 40-year bias cycle is also in decline. To see the effects of the 30-year and 40-year cycles in history, consider the following select dates:

1894:120-year cycle bottoms. Major industrial depression/market crash. End of U.S. agricultural era; start of industrial era.

1914: 40-year cycle peaks. First World War begins.

1934: 40-year cycle bottoms. U.S. economy, stock market recovers from lowest levels of Depression.

1939: 30-year cycle peaks. Stock market peak; World War II era begins.

1969: 30-year cycle peak. Major stock market/economic peak.

1974: 40-year cycle bottoms. End of major recession period; birth of long-term bull market.

1984: 30-year cycle bottoms. Start of runaway phase of ‘80s bull market/productivity.

1999: 30-year cycle peaks. End of long-term bull market; start of turbulent 2000s.

The “Age of Turbulence” that Alan Greenspan wrote about is a creation of the Kress Cycles, among other influences. The 30-yar and 40-year cycles are no longer supportive of America’s multi-decade economic expansion. The final “hard down” phase for any cycle regardless of duration is roughly the last 10 percent of the cycle’s length. The “hard down” phase of the 40-year cycle is equal to four years, i.e. 2011, 2012, 2013 and 2014 represent the final part of the current 40-year cycle. The last three years of the current 30-year cycle, viz. 2012, 2013, 2014 will encompass its “hard down” phase.

In the interim years between 1999 when the 30-year cycle peaked and 2014 when the 120-year series will complete itself, there have been and will continue to be contra-cyclical influences. For instance, the 12-year cycle bottomed in 2002, ending a vicious bear market in tech stocks. The 10-year cycle bottom in 2004 created an additional lift for stocks and the economy in the subsequent years. The 12-year cycle peak/6-year cycle bottom of last year added to the downward pressure of the credit crisis. The peaking 10-year cycle this year, coupled with the newly rising 6-year cycle, has facilitated the year-to-date recovery.

The market will no longer have the benefit of the rising 10-year cycle beyond this year. That will mean that money supply regulators will have only one major cycle left to work with, viz. the Kress 6-year cycle is still in its ascending phase until 2011, when it peaks. Is it possible for the economy to recovery, albeit haltingly and in limited fashion, until the “final curtain call” of 2011? History answers in the affirmative. The last time the U.S. faced a Kress cycle configuration identical to the current one was in 1889-1891, which answers to the forthcoming 2009-2011 period.

The last time the 120-year series bottomed was in 1894, with the final “hard down” phase of the 30-year and 40-year cycles occurring in the 1892-1894 period. Despite massive deflationary pressures at that time, the stock market as measured by the Axe-Houghton index made its final peak at the end of 1891, just in time for the “hard down” phase of the 30-year/40-year cycles to make their crushing effect known on prices.

The feds could theoretically repeat the 1889-1891 experience but only at the expense of constant and vigorous pumping of the money supply. But wouldn’t this create hyper-inflation as many seem to believe? Not likely, according to the Kress Cycles. The long-term inflation/deflation cycle of the Kress series is the 60-year cycle, which last peaked in 1984 and is now in its final “hard down” phase as of 2009. A subset of the 60-year inflation cycle are the 6-year and 12-year cycles. The final 12-year cycle of the current 120-year series peaked last year (which in turn facilitated the sharp collapse of the oil price/commodity price level last year). The final 6-year cycle in the 120-year series is up until 2011, as previously discussed. From now until 2011 there is the possibility of some mild and periodic flare-ups of inflationary pressures but nothing like what we witnessed in the 2002-2008 period.

Since last summer, long-term deflation will be the dominant theme from now until 2014. The challenge facing monetary system regulators is no longer one of maintaining economic growth without creating inflation, but one of maintaining financial market and economic buoyancy against the ever-increasing pressure of hyper-deflation.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.