Financial Markets React to the Streamlining of America's Bankrupt Corporations

Stock-Markets / Financial Markets 2009 Jul 11, 2009 - 12:25 PM GMT A leaner GM? - General Motors Corp., which is preparing to sell its best assets to a streamlined new entity, will carry with it liabilities of $48.4 billion, a bankruptcy judge said. Among the liabilities are more than $17 billion of debt to the U.S. and Canadian governments, a workers’ health trust and unspecified foreign lenders, GM said in a June 1 statement. The $48.4 billion also includes accounts payable, pension and other employee obligations and warranties.

A leaner GM? - General Motors Corp., which is preparing to sell its best assets to a streamlined new entity, will carry with it liabilities of $48.4 billion, a bankruptcy judge said. Among the liabilities are more than $17 billion of debt to the U.S. and Canadian governments, a workers’ health trust and unspecified foreign lenders, GM said in a June 1 statement. The $48.4 billion also includes accounts payable, pension and other employee obligations and warranties.

Will Ford be No. 1?

Ford Motor Co., gaining ground on its distressed domestic rivals, may surpass General Motors Corp. this year to become the top-selling automaker in the U.S. for the first time since 1931. Surpassing GM would validate Ford’s strategy to go it alone and spurn government aid. While GM and Chrysler LLC seek to change themselves through bankruptcy, Ford benefits from its status as the only independent major U.S. automaker as it builds momentum, said John Wolkonowicz, an industry analyst with IHS Global Insight of Lexington, Massachusetts.

“Ford is on a real roll right now,” Wolkonowicz said. “Ford could overtake GM this year.”

Have we lost our “animal spirits?”

The worst recession in half a century may be prolonged because consumers see few signs job losses and declines in home prices are ending, economists Nouriel Roubini and Robert Shiller said. “The fundamental problem, as Franklin Delano Roosevelt said in 1933, is fear,” Shiller, a Yale University professor, said yesterday on Bloomberg Radio’s “Surveillance.” The Great Depression was deepened by a “sense of lost confidence or animal spirits that was a self-fulfilling prophecy. The worry is that we will have the same kind of issue arising again,” he said.

Two important supports lost!

--U.S. stocks declined Friday as worries over earnings and the economy were back in the spotlight. There are two important supports to a rising market that were lost this week. The first is the 200-day moving average, which defined the top of the market in May 2008. The S&P 500 managed to stay above it longer this time, but lost its grip earlier this week. The second support is known as a head & shoulders support, which was also lost this week.

--U.S. stocks declined Friday as worries over earnings and the economy were back in the spotlight. There are two important supports to a rising market that were lost this week. The first is the 200-day moving average, which defined the top of the market in May 2008. The S&P 500 managed to stay above it longer this time, but lost its grip earlier this week. The second support is known as a head & shoulders support, which was also lost this week.

Treasury bonds gain a new support this week.

-- Treasuries rose, headed for a fifth weekly advance, as a global retreat in stocks over the past month and speculation the economic recession may be prolonged boosted demand for the relative safety of government debt. The chart to the left shows that the 30-Year Treasury Bond Index rose above an important support which suggests more gains ahead. This is having the opposite effect from what you see in stocks.

-- Treasuries rose, headed for a fifth weekly advance, as a global retreat in stocks over the past month and speculation the economic recession may be prolonged boosted demand for the relative safety of government debt. The chart to the left shows that the 30-Year Treasury Bond Index rose above an important support which suggests more gains ahead. This is having the opposite effect from what you see in stocks.

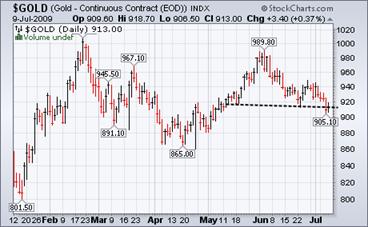

Support also lost in gold.

Gold fell in New York and London as a stronger dollar and lower oil prices curbed the metal’s appeal as an alternative investment and hedge against inflation. Silver dropped. Gold futures are heading for their biggest weekly decline in 10. The metal, which typically moves inversely to the greenback, has lost 2.4 percent this week as the dollar has added 0.6 percent against the euro.

Gold fell in New York and London as a stronger dollar and lower oil prices curbed the metal’s appeal as an alternative investment and hedge against inflation. Silver dropped. Gold futures are heading for their biggest weekly decline in 10. The metal, which typically moves inversely to the greenback, has lost 2.4 percent this week as the dollar has added 0.6 percent against the euro.

The Nikkei forms a “double top.”

-- Japanese stocks have formed a “double top” in a chart, signaling the end of a four- month rally, according to Nomura Holdings Inc. A double-top formation, a chart pattern some technical analysts read as a sign to sell, appears when prices fall before overtaking a previous high. The Nikkei rose to as much as 10,086.18 on July 1, short of an eight-month high on June 12. Since then, the gauge declined for seven days and dropped beneath a low of 9,511.45 on June 23, completing the formation.

-- Japanese stocks have formed a “double top” in a chart, signaling the end of a four- month rally, according to Nomura Holdings Inc. A double-top formation, a chart pattern some technical analysts read as a sign to sell, appears when prices fall before overtaking a previous high. The Nikkei rose to as much as 10,086.18 on July 1, short of an eight-month high on June 12. Since then, the gauge declined for seven days and dropped beneath a low of 9,511.45 on June 23, completing the formation.

China’s market may be weakening.

-- China’s stocks rose, with the Shanghai Composite Index capping a fourth weekly advance, as higher metals prices spurred gains by raw materials producers.Chinese imports are down, but the government’s stimulus package boosted domestic loans beyond expectations. Loans were up 48% more than targeted. Car sales also rose 48% in June, the most since February 2006, according to industry figures.

-- China’s stocks rose, with the Shanghai Composite Index capping a fourth weekly advance, as higher metals prices spurred gains by raw materials producers.Chinese imports are down, but the government’s stimulus package boosted domestic loans beyond expectations. Loans were up 48% more than targeted. Car sales also rose 48% in June, the most since February 2006, according to industry figures.

Renewed interest in the dollar as stocks fade.

-- The dollar advanced against the euro and Japan’s currency headed for its biggest weekly gain since May as speculation the global recovery may be delayed encouraged demand for a refuge. “The general theme is the continued rally in the yen and dollar, which reflects more risk aversion,” said Michael Woolfolk, senior currency strategist in New York at Bank of New York Mellon Corp., the world’s largest custodial bank. “The green-shoots recovery story is getting ahead of itself.”

-- The dollar advanced against the euro and Japan’s currency headed for its biggest weekly gain since May as speculation the global recovery may be delayed encouraged demand for a refuge. “The general theme is the continued rally in the yen and dollar, which reflects more risk aversion,” said Michael Woolfolk, senior currency strategist in New York at Bank of New York Mellon Corp., the world’s largest custodial bank. “The green-shoots recovery story is getting ahead of itself.”

Homeowners won’t pay for a house worth less than their mortgage.

Up to 26% of U.S. homeowners who stop paying their mortgage may be doing so intentionally, not because they can't make the payments but because they don't want to put money into a house that's worth less than what they owe. That finding, from a paper by economists at the University of Chicago, Northwestern University and the European University Institute, raises some doubt about the approach the Obama Administration has taken toward stabilizing the housing market.

Up to 26% of U.S. homeowners who stop paying their mortgage may be doing so intentionally, not because they can't make the payments but because they don't want to put money into a house that's worth less than what they owe. That finding, from a paper by economists at the University of Chicago, Northwestern University and the European University Institute, raises some doubt about the approach the Obama Administration has taken toward stabilizing the housing market.

Consumers benefit from the lower price of gasoline.

Energy Information Administration Weekly Report suggests that, “Falling for the second consecutive week, the U.S. average price for regular gasoline dropped three cents to $2.61 per gallon – $1.50 below the all-time high price set a year ago on July 7, 2008. Prices decreased throughout the country, with the largest drop occurring on the Gulf Coast.” Note: The chart shows wholesale prices.

Energy Information Administration Weekly Report suggests that, “Falling for the second consecutive week, the U.S. average price for regular gasoline dropped three cents to $2.61 per gallon – $1.50 below the all-time high price set a year ago on July 7, 2008. Prices decreased throughout the country, with the largest drop occurring on the Gulf Coast.” Note: The chart shows wholesale prices.

Natural gas may see new lows.

The Energy Information Agency’s Natural Gas Weekly Update reports, “Moderate temperatures across the lower 48 States outside of Texas and a favorable supply situation led to widespread declines in natural gas spot prices at almost all market locations since last Wednesday, July 1. In addition, the decrease in demand resulting from the holiday-shortened week provided further downward pressure on prices.”

The Energy Information Agency’s Natural Gas Weekly Update reports, “Moderate temperatures across the lower 48 States outside of Texas and a favorable supply situation led to widespread declines in natural gas spot prices at almost all market locations since last Wednesday, July 1. In addition, the decrease in demand resulting from the holiday-shortened week provided further downward pressure on prices.”

Advice from an economist who saw 1929.

The Obama Administration should stop bailing out corporate disasters and abandon plans to move health care onto the backs of taxpayers.

Tough talk from Anna Schwartz, a financial sage who has seen it all, having lived through the crash of 1929 and co-authored with Nobel laureate Milton Friedman the highly acclaimed financial bible, A Monetary History of the United States (Princeton University Press, 1963).

The financial matriarch has carefully tracked recessions, studied boom-and-bust trends and spent her life — all 93 years — mastering the intricacies of the monetary system and banking world. She's worked as an economist with the National Bureau of Economic Research since 1941 and now serves as an adjunct professor at the Graduate Center of the City University of New York.

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.