Real U.S. Treasury Yields Highest In History

Interest-Rates / US Interest Rates Jul 27, 2009 - 01:18 PM GMTBy: Mike_Shedlock

Bloomberg is reporting Real Yields Highest Since 1994 Aid Record Debt Sales.

Bloomberg is reporting Real Yields Highest Since 1994 Aid Record Debt Sales.

The highest inflation-adjusted yields in 15 years are helping provide the Treasury with record demand at auctions as the U.S. prepares to sell $115 billion of notes this week.

Treasuries are the cheapest relative to inflation since 1994 after consumer prices fell 1.4 percent in June from a year earlier. The real yield, or the difference between rates on government securities and inflation, for 10-year notes was 5.10 percent today, compared with an average of 2.74 percent over the past 20 years.

The gap helps explain why investors are buying bonds after losing 4.8 percent this year, the steepest decline on record, according to Merrill Lynch & Co. indexes that date back to 1978.

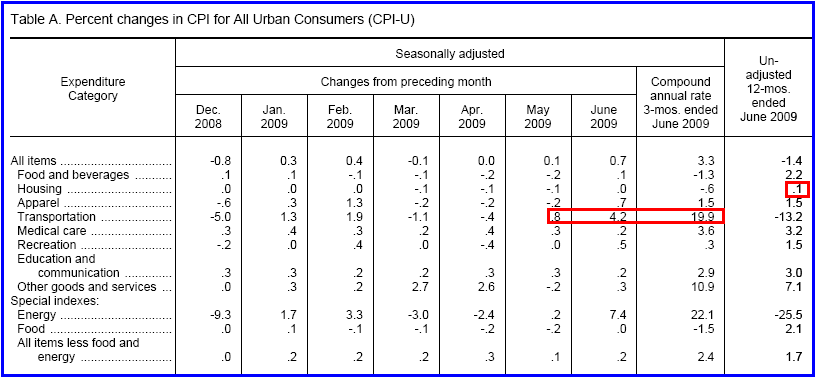

June CPI - All Urban Consumers

The above chart from Consumer Price Index June 2009 by the BLS.

The most noteworthy thing is housing costs, supposedly flat for a year. The next noticeable item is auto prices supposedly jumping at an annualized rate of 19.9% over the last 3 months. In the wake of clearance sales, rebates, incentives, cash for clunkers, etc., does anyone believe that?

Huge Housing Errors In CPI

The biggest error in the the CPI is housing and that error is compounded because housing has the highest weighting in the CPI.

I talked about the effect of housing on the CPI in What's the Real CPI?

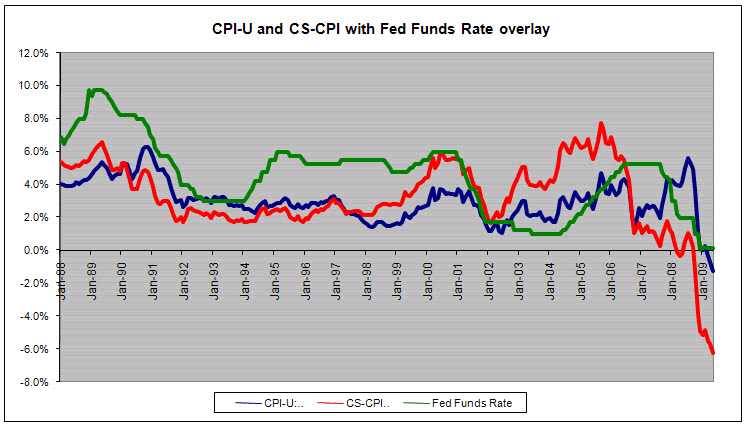

Case Shiller CPI vs. CPI-U

The above chart is courtesy of my friend "TC".

CS-CPI fell at the fastest pace on record to measure at -6.2% year over year (YOY). Meanwhile the government’s CPI-U declined at the fastest rate since the 1950s at a -1.3% YOY pace.

The diverge is to due to the government’s housing metric of Owners’ Equivalent Rent (OER) continuing to show price increases (+2.1% YOY) vs. Case-Shiller data showing price decreases (-18.1% YOY). In fact, since the housing market peak in June 2006 OER is up +7.6%, while the Case-Shiller index is down -32.6%, an amazing 4020 basis point divergence!

CS-CPI Year over year has now fallen for 8 consecutive months and 11 of the past 15. High Year over year comparison data points for the next several months will likely result in CPI deflation coming in at -7% to -8% in the coming months.

The Real Yield

Bloomberg reported "The real yield, or the difference between rates on government securities and inflation, for 10-year notes was 5.10 percent today, compared with an average of 2.74 percent over the past 20 years."

Based on actual housing costs as measured by Case-Shiller, I have the real yield at an astonishing 9.92%, the highest in history. That number is achieved by subtracting CS-CPI at -6.2 from the current 10-year yield of 3.72).

Inflation Fears and Huge Supply Weigh on Prices

Many are uninterested in treasuries out of inflation fears. Real yields may be 9.92% (or 5.10% if you believe Bloomberg), but what will the rates be 3 years from now?

With the trade deficit shrinking, foreign governments will buy fewer treasuries, so the massive supply is for now forcing up yields.

Moreover, who wants treasuries at a nominal yield of 3.72% given the pervasive "bottom is in" belief in equities?

Pension plans with long-term assumptions of 7.75% are not going to buy them as noted in Calpers Rolls the Dice, Gambling that Riskier Bets will Restore its Health.

Reflation Trade Back On

If the bottom is in and Bernanke's reflation efforts work, treasuries will not do well. Otherwise, 3.72% nominal and somewhere between 5% and 10% real yields are far more attractive than most participants seem to think, at least for now.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.