U.S. Dollar Collapse Starting Next Monday ?

Currencies / US Dollar Jul 31, 2009 - 05:51 PM GMTBy: Frederic_Simons

The trading week finished with a further attack against the US Dollar, reversing a short-lived strenghening of the US Dollar that could be observed during the last two days.

The trading week finished with a further attack against the US Dollar, reversing a short-lived strenghening of the US Dollar that could be observed during the last two days.

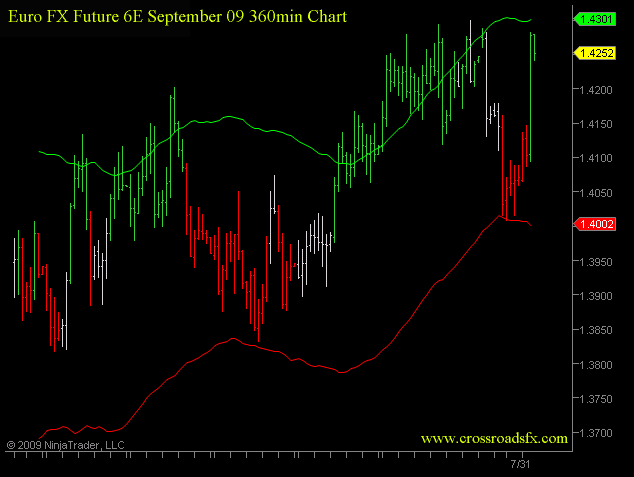

The following chart shows the dramatic reversal that happened today, indicating the strength of the US Dollar bears.

[Please click here for additional information about the trading system and how to read the charts]

If you take a look at a 360min chart of the EUR/USD Future, you can see that the short-term correction has not done any damage to the bullish EUR/USD picture. The line of least resistance is safely pointing to the upside, predicting higher prices in the near future, which means a lower US Dollar.

The temporary strengthening of the USD has certainly caused some irritation in the goldbug-camp, as we got a sell-signal on the short term gold chart on 7/28, which has been reversed today.

In our last update, the following chart was shown:

Today, the US Dollar finished its day at the lows of the week, and - in fact - also at the lows of the entire year, at 78.35:

You can be sure that a such a low closing price will not remain unnoticed, as the US Dollar is literally staring into the abyss, with the descending triagle pattern looking at a target of around 67, as we have illustrated in our last comment:

What will happen next week ? Our guess is that the US Dollar Collapse could start as early as Monday next week. It is possible though that when Foreign Exchange markets open on Sunday in Asia, the EUR/USD might sell off very briefly, about 0.5 per cent, as big institutional traders might try to get in on the cheap by first selling EUR/USD in order to trigger some stop losses, and then building their EUR/USD bull-position during this short period of weakness.

But these are just meaningless details in what might turn out to be a historic devalutation of what is currently considered as the world reserve currency. Put your seat in the upright position and fasten your seat belts.

If you have any questions, please do not hesitate to contact us by writing an email to

New: Discounted subscription fees for retail (non-professional) investors. 3 Month subscription for only 75 USD !

By Frederic Simons

http://www.crossroadsfx.hostoi.com

© 2009 Copyright Frederic Simons - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.