Bob Farrell, 10 Rules to Follow for this Stock Market

Stock-Markets / Stock Market Valuations Aug 21, 2009 - 01:08 PM GMTBy: Q1_Publishing

There aren’t too many hard and fast rules to be a successful investor.

There aren’t too many hard and fast rules to be a successful investor.

After all, investing successfully at times requires you to flexible or rigid, take action in a plodding or swift manner, patient or impatient, and it all depends on ever-changing circumstances.

As we’ve discussed in the Prosperity Dispatch, there are a few rules, however, which can be used in any market. Below are 10 rules developed by Bob Farrell who rose to the chief market analyst spot at Merrill Lynch during his 25 year career. The rules, although developed years ago, seem tailored for the current market conditions (Pay close attention to #8 – describes what is happening right now perfectly).

Bob Farrell’s Market Rules

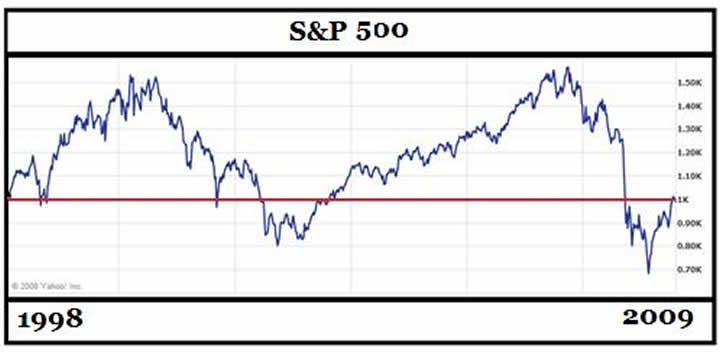

1) Markets tend to return to the mean over time.

2) Excesses in one direction will lead to an opposite excess in the other direction.

A Barrel of Oil: $10, 2000; $147, 2008; $40,2009; ????, 2010 (a reasonable case could be made for $40 or $100)

3) There are no new eras — excesses are never permanent.

“These milestones reflect a new era in oil markets.” – Federal Reserve, May, 2008

“Expectations of a new era of low inflation and sustained economic growth…[was] a prime suspect for explaining the stock market developments in the second half of the 1990s.” – Bank for International Settlements, June 2001

“We are living in a new era…Stock prices have reached what looks like a permanently high plateau.” – Irving Fisher, 1929

4) Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

How many folks missed out on this rally completely?

A recent survey by Bank of America Merrill Lynch (that never gets easier to say) found that 41% of fund managers have been “overweight” cash. Those were the only the ones who openly admitted it too.

Clearly, this market has rallied a lot higher than most everyone ever expected and, based on this rule, the rally could still have some gas left in the tank. For me, it’s still a bit too early to be betting against the market as a whole, but things like the China bubble is showing signs of weakness.

5) The public buys the most at the top and the least at the bottom.

In 1999 and 2000, money flowed into technology-focused mutual funds. At the peak of the tech bubble in March of 2000, about 80% of all money in mutual funds was in the technology funds. All of that new money pushed the NASDAQ to a peak of more than 5,000.

When the downturn came, which it always does, the leading technology mutual funds lost 60% to 80% of their value as the NASDAQ plummeted back to 1,000. And most mutual fund investors weren’t selling out along the way.

Mutual fund investors waited and waited for a rebound to come. In typical fashion, most were unwilling to give up hope and take a loss at first. However, after the NASDAQ slid lower and lower each day over the next two years, they began to sell out.

As usual, they were selling at the worst possible time. In 2002 and 2003 when the major market indices were bottoming, mutual fund outflows were at their peaks.

6) Fear and greed are stronger than long-term resolve.

How often have you held a stock simply waiting and waiting for it to move? Got bored, sold out, and moved on, and then kicked yourself for missing out on what turned out to be a big opportunity?

Don’t worry, everyone has. And we all will in the future. But there are things you can do to limit the high costs of fear and greed. The best way I’ve found is to look at risk first, then move on to potential reward, and, if the idea passes muster, develop a plan and go for it.

The preparation helps prepare you for any volatility and the plan helps keep your discipline.

7) Markets are strongest when they are broad and weakest when they narrow to a handful of blue chip names.

How weak has the market been so far in 2009? According to Rule #7 it’s very week.

In January, February, and March there were no IPOs. April saw one for $100 million. May had two for $1.0 billion. June had six in all totaling more than $2 billion.

Although it sure didn’t seem like it earlier this week, the IPO activity which creates a broader market, signals the market is actually getting stronger.

8) Bear markets have three stages — sharp down — reflexive rebound —a drawn-out fundamental downtrend.

This is how Mr. Market does his best to take most investors money away from them. He hits them once hard and by surprise. Then he lets them build confidence again slowly. He waits for the “get in now or you’ll never be able to get in this low again” crowd comes in at the end. And then a long, slow, bear market begins.

9) When all the experts and forecasts agree – something else is going to happen.

Think the recession is over?

Well, it may be technically, but there’s something a bit odd about it all though.

Last week a Wall Street Journal survey found 44 of the 45 economists who responded said the recession is already over.

Earlier today a Pew Research poll discovered “90 percent of respondents rated economic conditions as poor or ‘only fair.’”

Clearly, the “herd” is turning more bullish on the economy, but we’re still a good ways away from the euphoria which brings most investors back to stocks in a big way.

10) Bull markets are more fun than bear markets

Is it too early to start talking about the “good old days” yet?

September 2007: Oil just passed $90 a barrel. All those predictions for $200 were starting to seem “reasonable.” And your editor found himself on a Lear jet to headed to the oilfields of Alberta, Canada.

Shortly after landing, the only rational move to make was to tighten up trailing stop-losses on oil stocks and vow not to buy on any dips.

Ahhh…the good old days.

Remember, Farrell’s Rules were created by a man who experienced all the market cycles.

He started out in the booming 60s. Made it through the tumultuous 70s. Hung on for the ride throughout the mega-bull of the 80s and 90s. He didn’t completely retire until 2004 as a new mini-bull was emerging.

He has seen it all, the great bulls, bears, and a few crashes and panics. And I’m sure his 10 timeless rules undoubtedly helped him be a very successful investor. And I hope you use them to your advantage as well.

After all, learning how to become a very successful investor can be very costly. By learning these rules early on (and sticking to them) novice investors with save a fortune and experienced investors will stay more grounded. Investing is a high stakes venture and there is a lot of emotion involved and discipline needed, but the few rules that do exist, never really change at all.

Good investing,

Andrew Mickey

Chief Investment Strategist, Q1 Publishing

Disclosure: Author currently holds a long position in Silvercorp Metals (SVM), physical silver, and no position in any of the other companies mentioned.

Q1 Publishing is committed to providing investors with well-researched, level-headed, no-nonsense, analysis and investment advice that will allow you to secure enduring wealth and independence.

© 2009 Copyright Q1 Publishing - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Q1 Publishing Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.