Stock Markets Resumed their Five Month Uptrend Part2

Stock-Markets / Financial Markets 2009 Aug 23, 2009 - 08:26 AM GMTFinancial Times: Corporate bond defaults hit record “The number of companies defaulting on their debts has risen to record levels this year, according to Standard & Poor’s, while investment returns for risky corporate debt have skyrocketed since January.

“S&P said 201 borrowers with $453.1 billion in debt have defaulted this year, exceeding the 126 defaults for all of 2008, which comprised debt worth $433 billion.

“It also surpassed the number of defaults from the comparable period in 2001, the previous worst year on record.

“‘Recessionary economic conditions and ongoing uncertainty in the financial markets are pushing the number of corporate casualties higher,’ said S&P.

“The defaults have not stopped speculative debt from being this year’s best performing sector for investors as they look instead to a virtuous cycle that enables more financially strapped companies to refinance as the market rallies, a scenario that portends lower future defaults.

“‘The number of defaults is impressive but, on an absolute month-to-month basis, it has been coming down steadily,’ said Martin Fridson, chief executive of Fridson Investment Advisors. ‘It makes sense that the market has been rallying since then.’ He added: ‘The virtuous cycle is a function of the high-yield new issue market reopening in response to the increased confidence in credit that provides the bridge for companies to get over any near-term maturities that could threaten their solvency.’

“US high-yield debt has generated a return of nearly 40% so far this year, outstripping the 10% rise in equities, while pan-European high yield is up 63%, according to data from Barclays Capital.”

Source: Michael Mackenzie and Nicole Bullock, Financial Times, August 19, 2009.

MoneyNews: Hussman - investors guzzling Kool Aid “John Hussman says if you look carefully at the economic data that shows improvement, and adjust it to reflect the impact of government outlays, it’s hard to see anything other than continued deterioration in private demand and investment.

“‘What we do see is a government that has run what is now a trillion dollar deficit year-to-date, representing some 7% of GDP,’ Hussman writes in a note to investors.

“‘That sort of tab will undoubtedly buy some amount of Kool-Aid, but it has been something of a disappointment to watch how eagerly investors have guzzled it down.’

“It is not at all clear that short-term, deficit-financed improvement spells economic growth, Hussman notes. ‘This is like somebody borrowing money from their Uncle and then celebrating that their income has gone up,’ he says.

“And while imagining a return to 2007 S&P 500 returns is pleasant, Hussman points out that investors should remember that those highs were based on profit margins about 50% above historical norms, combined with an elevated P/E multiple of about 19 against those earnings.

“‘Even if the economy is poised for a sustained recovery here, the belief that those joint outliers will be quickly re-established goes against historical precedent,’ Hussman says.

“Recent data dulled hopes for a consumer-led US recovery, a trend some forecasters see as part of the ‘new normal’ economy.

“Markets need to get used to ‘a world without the US consumer as last resort’, Alan Ruskin, chief international strategist at RBS Securities told Reuters.”

Source: Julie Crawshaw, MoneyNews, August 17, 2009.

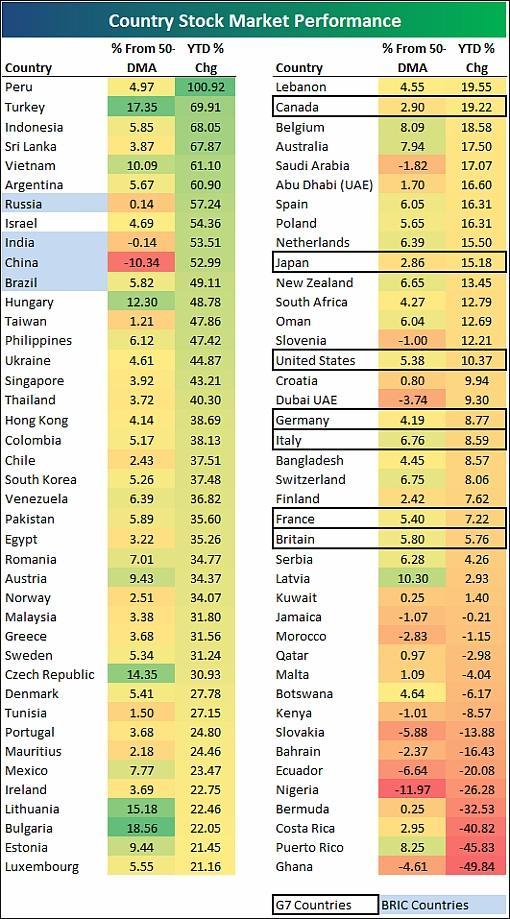

Bespoke: China falls down the country performance list “Just a couple of weeks ago, China was riding high as the top dog in terms of global stock market performance in 2009. After a 20% decline in a matter of days, China is now just the third best performing BRIC (Brazil, Russia, India, China) country year to date. Russia is up 57.24% year to date, India is up 53.51%, and China is up 52.99%. But it could be worse for China. At least they’re not down 50% year to date like Ghana.

“You can tell how much China has sold off versus the rest of the world by looking at its percentage from its 50-day moving average. China is one of just five countries that are up year to date and currently trading below their 50-day moving averages, and it is the second furthest below its 50-day (-10.34%) out of all countries behind only Nigeria (-11.97%).”

Source: Bespoke, August 19, 2009.

Jing Ulrich (JPMorgan): Correction for Shanghai “The 17% slide in the Shanghai Composite index since August 4 is mainly a ‘phase of correction’ soon to run its course, says Jing Ulrich, chairman of China equities and commodities at JPMorgan.

“‘The recent selling has been fuelled by concern about imminent policy tightening and stretched valuations,’ she says. ‘Economic data for July were reasonably strong, but a sharp fall in bank lending has stoked fears that liquidity could dry up in the second half.’

“Ms Ulrich believes bank lending will moderate this year but says this reflects the seasonal tendency of banks to front-load new loans. ‘Liquidity conditions will remain favourable, as authorities may accelerate mutual fund approvals and insurance and pension funds could step up their equity purchases.’

“Official pledges to stick to a proactive fiscal policy and moderately loose monetary policy are believable, given the challenging outlook for exports and continued deflation, she says. ‘We believe the A share market will resume its upward trajectory after this period of correction.

“‘Since April, the share of demand deposits as a proportion of total household deposits has risen, suggesting investors are favouring liquid savings products in anticipation of possible investments. Last month the number of new individual stock trading accounts reached the highest since late 2007.’”

Source: Jing Ulrich, (JPMorgan via Financial Times), August 17, 2009.

Yahoo Finance, Tech Ticker: Professionals are buying the stock market rally “After starting the week with a big knock, the stock market has resumed its rallying ways, with the Dow closing above 9300 on Thursday while the S&P again surpassed the 1000 level.

“Professional money managers are buying into the rally in a big way, according to a Merrill Lynch Survey of Fund Managers:

• 75% believe the world economy will improve in the next 12 months. That’s the highest level in nearly six years and up from 63% in July. • Average cash balances have fallen to 3.5%, the lowest since July 2007. • 34% of managers surveyed are now overweight stocks, the highest since Oct. 2007. • Risk appetite is also increasing, to the highest levels in two years.

“The contrarian in you probably thinks that signals a market top. But Barry Ritholtz, CEO of FusionIQ and author of Bailout Nation, isn’t ready to call an end to the move. ‘We’ve worked off lots of that oversold condition,’ he admits, but that doesn’t mean the rally can’t continue for some time.

“Ritholtz, who told Tech Ticker in early March we were in for a monster rally, has 1,050-1,080 as an upside target for the S&P 500, with a slight chance it can go as high as 1,200. If the rally does extend to those outer limits, Ritholtz sees the Dow topping out ’somewhere around 12,000′.

“Regardless of your position, long or short, Ritholtz’s key message is to remain cautious. ‘This is a trading rally not a multi-year rally,’ he says. Eventually something’s got to give: ‘We’ve never had six-month period before where we’ve lost two million jobs and the market’s gained 50%,’ he says. ‘That’s simply unprecedented.’”

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2009 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.