Banks Prepared to Pay You to Bank With Them

Personal_Finance / UK Banking Jun 19, 2007 - 09:51 PM GMTBy: MoneyFacts

Michelle Slade of Moneyfacts.co.uk – the money search engine, comments:“Current accounts are big business for the banks, and this has been made clear by several banks who over the last six months have been offering deals to entice you to switch. Not only does it secure them your prime current account, more importantly, it offers the opportunity to cross sell their whole range of other products.

Michelle Slade of Moneyfacts.co.uk – the money search engine, comments:“Current accounts are big business for the banks, and this has been made clear by several banks who over the last six months have been offering deals to entice you to switch. Not only does it secure them your prime current account, more importantly, it offers the opportunity to cross sell their whole range of other products.

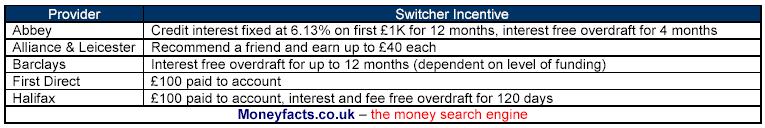

“It is great news for consumers to see the return of Halifax’s £100 switcher incentive. Not only will consumers benefit from this cash payment, they are also signing up for one of the best paying credit interest accounts on the market. Should they choose to also take advantage of the Halifax One Credit card and transfer a balance to it, a further £25 bonus is up for grabs.

“First Direct is the only other provider to offer a cash incentive, but several other accounts offer either preferential credit or debit interest rates in an attempt to secure their share of this potentially lucrative sector. Alliance & Leicester for example operates a recommend a friend incentive, where by each party receives up to £40.

“Other accounts will also offer 0% overdrafts during the switching process, and HSBC offers the promise to pay £10 if any mistakes are made e.g. direct debits set up incorrectly or cards arriving later than promised.

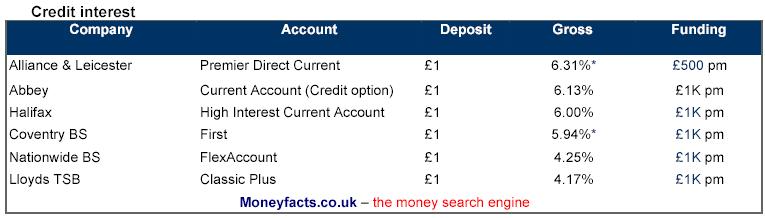

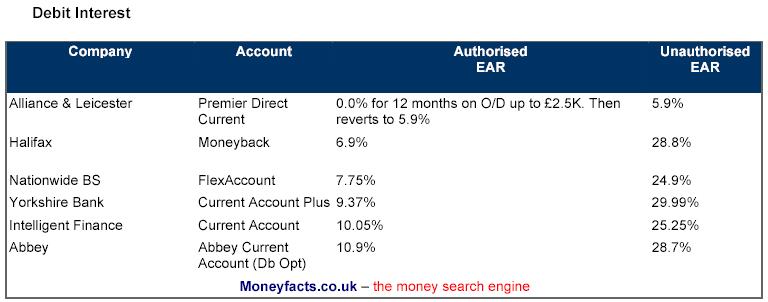

“But don’t be lulled by upfront incentives, unless you know you are also getting an account which matches your needs. Some deals are aimed at borrowers, whilst others are designed for those who remain in credit. The following tables highlight a selection of the best accounts for each customer type:

“When the banks announce their annual profits, most of us are shocked by the amount of money they make, although UK retail banking is not the most lucruative areas for the banks. Why then do we complain about the profit they make, yet let them get away with paying us poor rates of returns or charging us high rates to borrow?

“Why not take a slice of the banks’ profits and reward yourself with a better paying account and a cash bonus to boot? The apathy shown by many consumers who continue to put up with credit interest rates as low as a paltry 0.1% is just playing into the hands of some of the big high street names.

“Switching is simple. Often your bank will either insist on managing the switch for you or give you the option to do it yourself. Take the time to review your accounts, you may be shocked at the dismal rate your bank is paying you. Why remain loyal to a provider that doesn’t offer you decent value products?”

Follow in the footsteps of the Moneyfacts experts, who say ‘it pays to switch’….

Andrew Hagger of Moneyfacts says, "I recently switched my account to the Halifax HICA. After a couple of initial hiccups with the switching service, my account has been successfully been transferred and I'm now getting 60 times more credit on my current account – I wish I'd done it years ago"

Lisa Taylor of Moneyfacts adds, “My new year’s resolution this year was to practice what I preach and get the best possible deal for my financial products. I chose to switch to the Alliance & Leicester Premier Direct Account, transferring my direct debits and standing orders myself. While it took a bit of work and a careful eye, it was certainly worth it. I have immediately seen the benefits of a higher interest rate. Before it was almost like giving my money away!”

www.moneyfacts.co.uk - The Money Search Engine

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.