Home Buying Valuations - The Forgotten Mortgage Fee

Personal_Finance / Mortgages Jun 22, 2007 - 10:37 AM GMTBy: MoneyFacts

Julia Harris, mortgage analyst at Moneyfatcs.co.uk – the money search engine comments:“As we move away from a totally rate driven mortgage market, much focus has been placed on total cost, inclusive of rising arrangement and exit fees. We also talk of higher lending charges, procuration fees and redemption charges, and even go so far about complaining about the money transfer fee. But one fee, which perhaps we view as a service charge, has slipped through the net – the valuation fee.

Julia Harris, mortgage analyst at Moneyfatcs.co.uk – the money search engine comments:“As we move away from a totally rate driven mortgage market, much focus has been placed on total cost, inclusive of rising arrangement and exit fees. We also talk of higher lending charges, procuration fees and redemption charges, and even go so far about complaining about the money transfer fee. But one fee, which perhaps we view as a service charge, has slipped through the net – the valuation fee.

“As many first time buyers struggle to step on the housing ladder, lenders are using fee free deals to entice borrowers who are unable to afford the start-up costs. But of course you will be paying for this by way of a higher rate. Other lenders will offer free valuations to remortgage customers, simply because there is little work involved and normally a surveyor is not required.

“When lenders talk of free valuations they are referring to a Basic Valuation – a brief report commissioned by the lender comparing your property with similar homes and assessing the general order of the property. It provides a value for the property that ensures the lender is not advancing you more than the property is worth. So although you are footing the bill, the lender receives the benefit.

“Further to the basic survey you can commission either a Homebuyer or Full Structural Survey. The exact type will depend on the level of information you require and the age and build of the property.

“But don’t assume all valuations will involve the same dept of information, particularly on the standard valuations, some lenders will perform drive bys or use AVMs, but some do insist on an internal and external viewing.

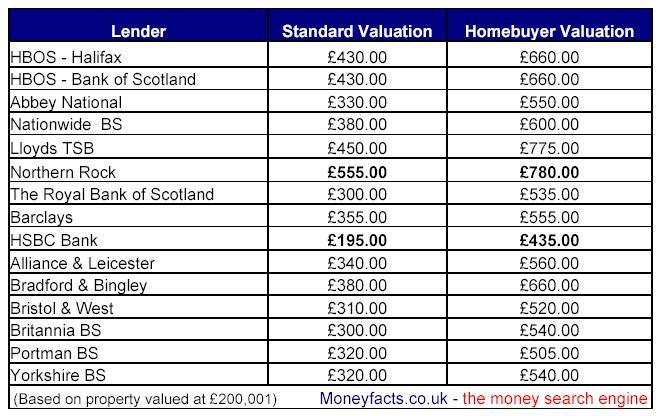

“If you do find yourself faced with paying a valuation fee, the cost varies considerably between lenders.

“The difference in costs between the top ten mortgage lenders, even for the basic valuation, is as much as £360 and for a homebuyer report is £345. Over a two-year deal (based on £200K mortgage) this is the equivalent of a 0.13% rise in your interest rate.

“Earlier this year it was reported that the Financial Services Authority may consider a review of valuation fees. This becomes even more pertinent with the rising number of mortgage cases valued by means of an Automatic Valuation Model. The Council of Mortgage Lenders predicts that by 2011 a third of purchase cases (up to 80% LTV) will use AVMs.

“With such large variations in the size of fees, the valuation must be yet another part of the mortgage package to compare when shopping for the best deal. It’s vital that you look at the true cost of the deal, as comparing just the rate will leave you in a very vulnerable position and some less obvious expenses could catch you out.

“If you do want a more in-depth survey over and above that required by the lender, then remember you are free to get an independent surveyor of your choice.

“With four digit arrangement fees now commonplace, stamp duty at crippling levels and valuations fees running into hundreds of pounds, not to mention the legal costs involved, it’s no wonder borrowers are struggling to find the upfront costs needed to move home or to step on to the property ladder.”

www.moneyfacts.co.uk - The Money Search Engine

Money Facts Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.