Stock and Commodity ETF Funds DIA, UUP, GLD, SLV and XLE Momentum Shift

Stock-Markets / Exchange Traded Funds Sep 24, 2009 - 01:42 AM GMTBy: Chris_Vermeulen

Today we had a reversal day for the broad market, us dollar, precious metals and oil. The market is over extended. We have seen the market rally 20% since the July low.

Today we had a reversal day for the broad market, us dollar, precious metals and oil. The market is over extended. We have seen the market rally 20% since the July low.

Inter-market analysis is important to understand because everything is related in some way. The next month will be very interesting with the US dollar trying to rally, which will put pressure on precious metals, stocks and commodities.

DIA ETF – Dow Industrial Fund

Stocks look to have formed a similar pattern as the March rally this year. The market has the same feel and price action that we saw during the June high, which is telling me we should move stops up to protect profits. Wednesday the market had an intraday reversal and that is a sign of weakness. The past four trading day’s is the same as the July bottom (multiple Doji Candles). Doji candles indicate a possible reversal.

DIA ETF Trading Newsletter

Broad Market Volatility Index

Here is a weekly volatility chart that shows we are at a long term support level. The saying is, buy when the VIX is high, sell when the VIX is low. Just to be clear, I am not saying sell everything. I am just pointing out that the market is ready for a multi week correction. I am tightening my stops and limiting my position size for new log positions.

VIX Volatility Index Trading

UUP ETF – US Dollar Intraday Price Action

The dollar sold down Wednesday, then rallied very strong into the close, indicating a shift in momentum. The dollar has been trending down for several months and ready for a bounce.

UUP US Dollar Trading Fund

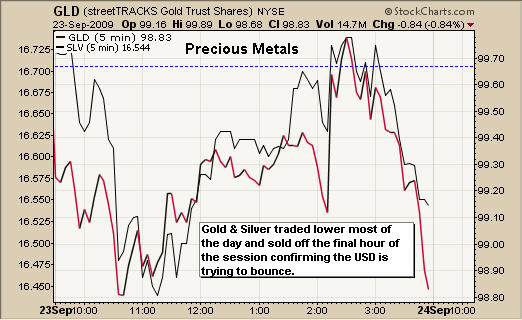

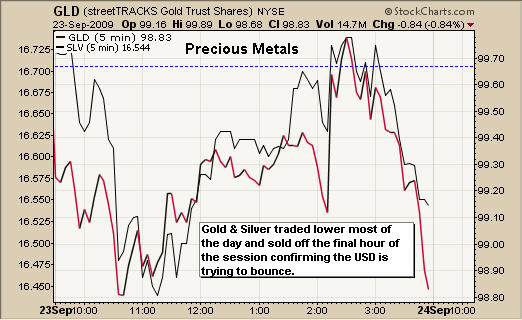

Precious Metals Under Pressure

Below is a chart of Gold and Silver showing the weakness on Wednesday and the sharp sell off late in the session, when the US dollar started to rally.

Precious Metals Trading Newsletter

XLE Energy ETF – Intraday Chart

Energy sector moved down in the morning and managed to wiggle its way back to positive territory late in the day, but when the US dollar rallied, crude oil and the energy sector sold off sharply.

XLE Energy Trading Newsletter

Inter-Market Analysis Conclusion:

In my opinion things look to be setup for a multi week shift in momentum. It looks like the US Dollar will bounce putting pressure on precious metals, stocks, and commodities like crude oil.

Stocks look ready to correct and a bounce in the dollar will trigger the correction.

Gold is at a major resistance level, and taking a breather at this level would be normal price action. Gold has also been trading in sync with stocks, so this relationship is most likely still in place. If stocks move down, so will gold.

Crude oil is having a tough time moving higher and with Wednesday’s higher than expected oil inventory levels, there will be more down side pressure.

Currently we have several profitable position and we will be tightening our stops and looking for new opportunities in the coming days.

If you would like to receive my Free Weekly Trading Reports via email please enter your email address on my website: www.GoldAndOilGuy.com or Stock Trading Reports at www.ActiveTradingPartner.com

llo, I'm Chris Vermeulen founder of TheGoldAndOilGuy and NOW is YOUR Opportunity to start trading GOLD, SILVER & OIL for BIG PROFITS. Let me help you get started.

If you would like more information on my trading model or to receive my Free Weekly Trading Reports - Click Here

If you have any questions please feel free to send me an email. My passion is to help others and for us all to make money together with little down side risk.

To Your Financial Success,

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.