Dow to Gold Ratio Update

Commodities / Gold & Silver 2009 Oct 09, 2009 - 12:55 PM GMTBy: Adam_Brochert

The Dow to Gold ratio is something I harp on again and again. Why? Well, two reasons. The second I'll mention later. The first reason is that it is a very big step for stockbugs to step away from their addiction with all things Wall Street. The long term chart of the Dow to Gold ratio tends to induce cognitive dissonance in stockbugs and may help them get to rehab. In other words, to change their thoughts on investing "for the long haul." Most Americans of investing age right now are bred to be stockbugs and are saturated with messages about investing in stocks that are, quite simply, ridiculous and biased.

The Dow to Gold ratio is something I harp on again and again. Why? Well, two reasons. The second I'll mention later. The first reason is that it is a very big step for stockbugs to step away from their addiction with all things Wall Street. The long term chart of the Dow to Gold ratio tends to induce cognitive dissonance in stockbugs and may help them get to rehab. In other words, to change their thoughts on investing "for the long haul." Most Americans of investing age right now are bred to be stockbugs and are saturated with messages about investing in stocks that are, quite simply, ridiculous and biased.

A piece of metal has vastly outperformed the stock market and holding cash since 1999. And it's going to continue for a while longer. It is up to you to do something about it if you haven't already.

Yes, 401(k) plans are restrictive and screw the average guy or gal. Yes, it's true that most plans won't let you invest in Gold or Gold mining stocks. Yes, it's true that nobody cares about you or your savings and you will get screwed if you leave your money in one of the lousy, overpriced stock mutual funds in a typical retirement plan. And U.S. short-term bonds are holding up nicely but leave you at risk for a currency crisis or one-time currency debasement in the future, which is now an almost certainty for U.S. investors as the international monetary system deteriorates and global capital races in and out of paper currencies looking for safety (the current intermediate bear market rally aside). As the greatest debtor nation on earth, the United States is not in a great position to dictate terms to the rest of the world any longer now that the secular credit contraction has begun in earnest.

But rather than give up and leave what's left of your money to the wolves, there's a shiny piece of metal available to you that can protect your savings from the further destruction in financial assets that is inevitable. The Dow to Gold ratio will reach 2 and may well go below 1 this cycle. The ratio is currently around 9. Do the math. When it's a choice of stocks or no stocks, the choice is "no stocks" for now, assuming you are not a good trader who can play the swings both ways. But if it's "no stocks" and if corporate bonds and real estate are in the same price collapse boat, what are your options? The oil bubble has popped and dragged most commodities with it.

Gold stands above the rubble looking down with disinterest. The value of Gold is that it has a stable value while the things around it fluctuate in value. After all, it's just a hunk of freakin' metal - how can its true value change? Right now, financial assets and asset prices that rose due to heavy leverage (i.e. real estate) are falling in value as the leverage is taken away by the credit contraction. This is one of the reasons that Gold is rising relative to stocks and has been since 1999.

Cash is king during a secular credit market contraction because other asset classes are declining in value so that cash can buy more of these assets at a later date. But you'd better be holding the right form of cash during a Kondratieff Winter to come out ahead! The best form of cash is Gold. It cannot be debased by apparatchiks, while every paper currency on the planet is being mismanaged right now by bankstas and bureaucrats trying to borrow their way back to prosperity. Never mind that impossible-to-service debt cannot be cured by taking on more debt when there is not enough underlying productive capacity to make good use of the new debt. Officials are not in the business of making sense or being prudent - why bother when the money you are spending and debts you are taking on are not yours?

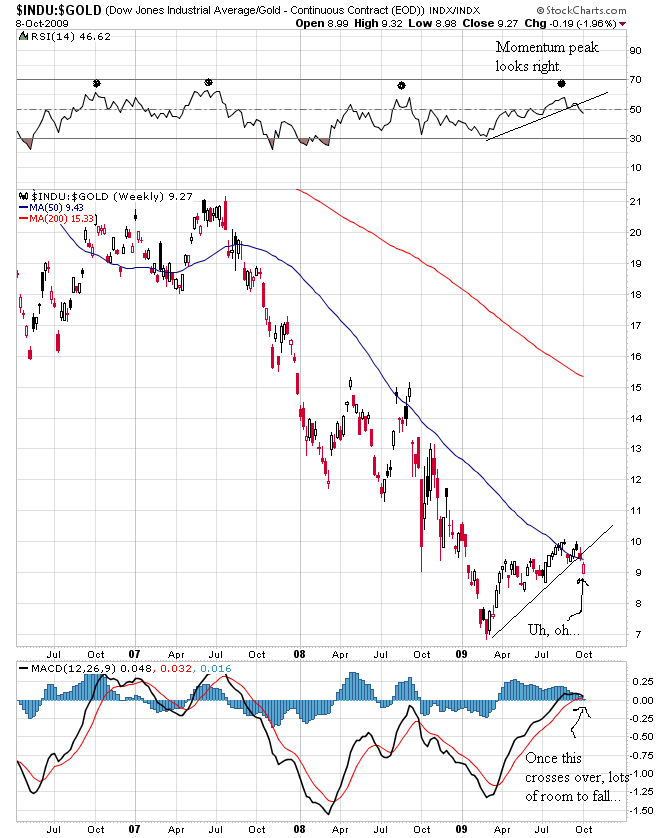

The Dow to Gold ratio simply reflects this decline of confidence in financial assets. Now that we have reached the point of recognition in the minds of institutional funds and many retail investors, the Gold and Gold stock mania can begin. The current breakout of Gold to all-time new nominal highs in U.S. Dollar terms corresponds with a breakdown in the Dow to Gold ratio that looks very good technically. Here's a 3.5 year weekly chart of the ratio up thru yesterday's close:

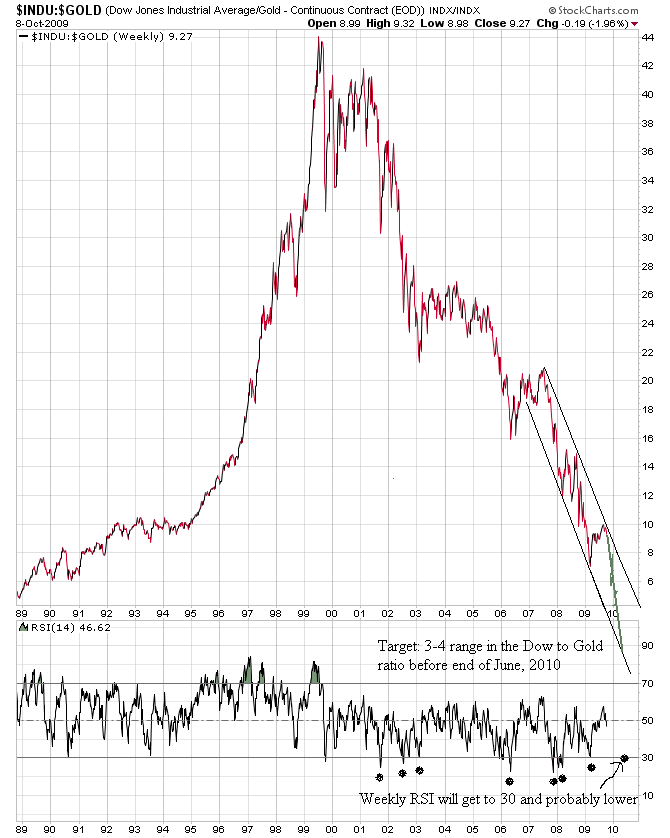

And here's a long-term 20 year chart of the Dow to Gold ratio with a prediction on where and when this ratio will next bottom based on the channel in this ratio chart that has formed:

This should be a big move and since it's a ratio chart, the move can be accomplished many ways. What I believe will happen is that Gold will rise significantly (30-75%)and the Dow will fall significantly (40-75%). This intermediate-term move will not be a straight line but I think it will be mostly over before the end of June based on Gold's seasonal price run patterns that tend to start in the late-summer to early-fall and complete in the spring.

Oh, and that second reason I keep harping on the Dow to Gold rato? Because I am using it as my long-term road map for knowing when it is time to sell my Gold and get back into general stocks, corporate bonds and/or real estate. I'll probably keep a few Krugerrands as a souvenir once this cycle is over, though...

Visit Adam Brochert’s blog: http://goldversuspaper.blogspot.com/

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2009 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.