Winds of Economic and Geopolitical Change

Economics / Emerging Markets Nov 13, 2009 - 02:02 AM GMTBy: Puru_Saxena

The 19th century belonged to Britain, the 20th century belonged to America and in the 21st century, China will rule the business world. Whether you like it or not, this transition is already underway and it will intensify over the coming decades.

The 19th century belonged to Britain, the 20th century belonged to America and in the 21st century, China will rule the business world. Whether you like it or not, this transition is already underway and it will intensify over the coming decades.

It is our observation that throughout history, no empire has managed to rule forever. If you look back in time, you will realise that various empires rose to power, they prospered and spread their influence. Thereafter, they over-extended themselves and then decayed. In fact, all the glorious empires had one thing in common – the spectacular collapse.

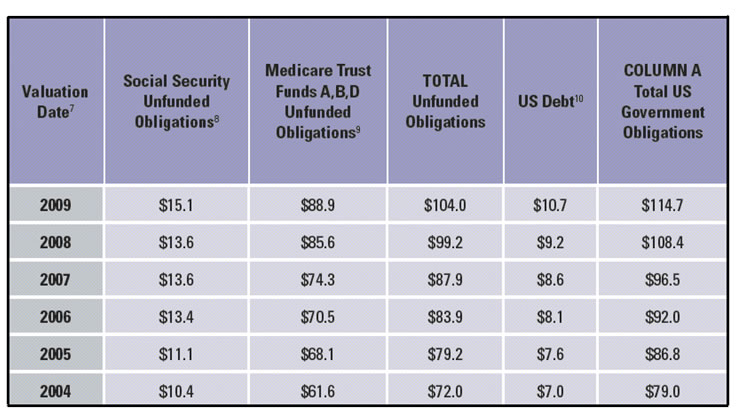

Now, there can be no doubt that America ruled the economic world for the better part of the previous century, however it has now entered a terminal decline. The recent credit crisis and the failure of some of the largest American financial corporations is proof that the world’s largest economy is well past its prime. Today, America finds itself heavily in debt and to make matters worse, its demographics are also worsening. Unfortunately, the American leaders are attempting to postpone the day of reckoning by taking on even more debt! It is noteworthy that over the past year alone, America’s federal debt increased by approximately US$2.1 trillion and its projected budget deficit over the next decade is now slated to be almost US$9 trillion! If this does not shock you, then consider Figure 1 which shows the total obligations of the US government.

Figure 1: US Government Obligations (trillions of US dollars)

Source: Sprott Asset Management

As you can observe from Figure 1, over the past six years, American unfunded obligations increased by almost 50% from US$79 trillion to US$114.7 trillion! Alarmingly, over the same period, American government revenue rose by only 12%! Now, you do not have to be a genius to figure out that no entity can continue to increase its liabilities by more than four times the rate of its revenue. If this spending frenzy continues, commonsense dictates that at some point in the future, the solvency of the American government will come into question. When that happens, foreign capital will flee America, interest-rates will sky-rocket and we will witness an epic currency crisis.

Furthermore, it is worth noting that apart from the American government, the Federal Deposit Insurance Corporation (FDIC) is also in serious trouble. In an ironic twist of fate, the FDIC’s Deposit Insurance Fund has spent so much money covering bank failures over the past three months that it has completely run out of money! This implies that there is no capital available now to insure bank deposits held at American banks.

Given the horrendous deficits and ugly debt obligations, the American government is now left with the following options:

- Raise taxes (not sufficient to meet obligations)

- Cut back on spending (highly unlikely)

- Default (unimaginable)

- Print money (only viable option)

Remember, America is the largest debtor nation the world has ever seen and the only way it can repay its obligations is through a process known as quantitative easing (euphemism for printing money). In fact, this stealth confiscation of savings is already well underway. A recent report published by the Federal Reserve revealed that the American central bank purchased half of the newly issued US Treasuries in the second quarter of this year. Needless to say, the Federal Reserve financed these purchases by creating dollars out of thin air – a short-term fix but a long-term disaster.

Let us put it bluntly; the days of American hegemony are drawing to a close and within the next two decades, China will become the world’s most dominant economy.

If you are sceptical about our claim, you may want to note that twenty years ago, China’s economy was worth only US$342 billion and as of last year, its GDP had grown to US$4.4 trillion; representing an annual growth rate of 13.62%. Now, if China succeeds in growing its economy by roughly 8% per annum over the next two decades, its GDP will grow to US$20.5 trillion by 2029. At that point, China may well replace America as the world’s largest economy.

It is worth keeping in mind that whereas American households are up to their eyeballs in debt, their Chinese counterparts have a savings rate of almost 40%! Furthermore, at a time when America and other nations in the West are struggling to stay afloat, China’s foreign exchange reserves have surged to US$2.27 trillion!

Now, we are aware that many commentators are criticising China for the sheer size of the stimulus unleashed by its leaders. In our view, this ridicule is baseless because instead of spending printed or borrowed money, at least the Chinese are spending their savings.

In any event, the stimulus applied by the Chinese policymakers seems to be working. Over the past seven months, money-supply growth in China has risen by 26% and loans have surged by 32%. In turn, this inflationary orgy is creating a residential construction boom (Figure 2). All this economic activity is in stark contrast to America, where despite all the policy-actions, private-sector credit is contracting.

Figure 2: China’s stimulus is working

Source: China National Bureau of Statistics

Look. China is the future and you can be rest assured that over the following years, the Chinese will raise their standard of living and domestic consumption will explode. Already, roughly 900,000 cars are sold each month in China and by the end of this year, the Asian powerhouse will replace America as the world’s largest market for automobiles. Interestingly, similar trends of rising consumption can be observed in various household items such as refrigerators, motorbikes, mobile phones and so forth.

So, as an investor, you have a choice. Either you can continue to listen to the ‘China bashers’ or you can hop on the Orient Express and make a small fortune. It goes without saying, we have allocated capital to superb businesses in China and the ongoing correction in Chinese stocks is a great opportunity to accumulate more positions in this exciting economy. Apart from China, we have also allocated capital to India and Vietnam. It seems to us that in this low-growth world, investors will flock to these fast-growing economies; thereby pushing up asset prices. In fact, we will be bold enough to state that the next asset bubble will probably form in the developing nations of Asia and we have every intention of participating in the festivities. In summary, if you have not done so already, we suggest that you take advantage of the ongoing market correction by investing in China, India and Vietnam.

Puru Saxena publishes Money Matters, a monthly economic report, which highlights extraordinary investment opportunities in all major markets. In addition to the monthly report, subscribers also receive “Weekly Updates” covering the recent market action. Money Matters is available by subscription from www.purusaxena.com.

Puru Saxena

Website – www.purusaxena.com

Puru Saxena is the founder of Puru Saxena Wealth Management, his Hong Kong based firm which manages investment portfolios for individuals and corporate clients. He is a highly showcased investment manager and a regular guest on CNN, BBC World, CNBC, Bloomberg, NDTV and various radio programs.

Copyright © 2005-2009 Puru Saxena Limited. All rights reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.