New Record Low Two Year Treasuries Yield, Is This Start Of U.S. Dollar Rally?

Interest-Rates / US Interest Rates Nov 27, 2009 - 05:30 AM GMTBy: Mike_Shedlock

In the wake of the Dubai default (please see Dubai Defaults - Deflation In Action - Watched Pot Theory Revisited for details), I am up watching treasury yields.

In the wake of the Dubai default (please see Dubai Defaults - Deflation In Action - Watched Pot Theory Revisited for details), I am up watching treasury yields.

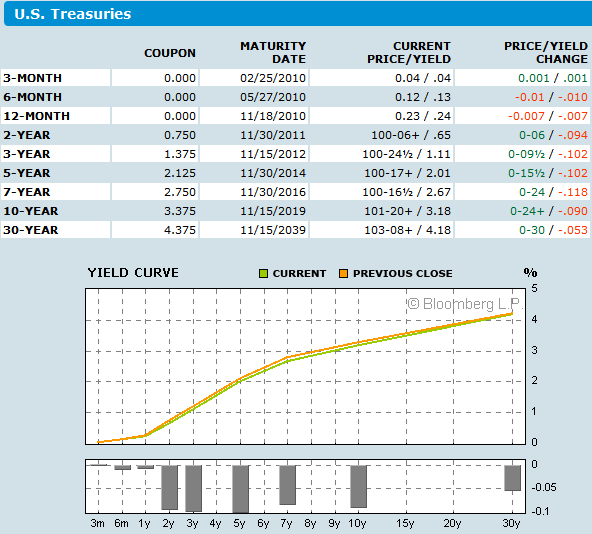

Two year treasury yields plunged to an new all-time record low as the following Bloomberg table shows.

Yield Curve as of 2009-11-27 12:22 AM

On Monday Bloomberg reported Treasury Sells Two-Year Notes at Record Low Yield

The Treasury sold $44 billion of two-year notes at a yield of 0.802 percent, the lowest on record, as demand for the safety of U.S. government securities surges going into year-end.

The last auction, a $44 billion offering on Oct. 27, drew a yield of 1.02 percent. Indirect bidders, a class of investors that includes foreign central banks, purchased 44.5 percent of the notes today, the same as at the October sale.

The previous low was 0.922 percent on the auction held. Dec. 26, 2008.

For the first time in seven decades, Treasury bills are paying no interest while stocks continue to appreciate -- a divergence that might be perilous if Federal Reserve Chairman Ben S. Bernanke didn’t know all about 1938.Notice the misguided faith the author has in Bernanke's ability to do something intelligent. The fact of the matter is we would not be in this mess if the Fed had been acting intelligently instead of openly promoting housing and credit bubbles that have now crashed.

As for the divergence, yes, it's there. I commented on it Tuesday in Nearly 1 in 4 Borrowers Is Underwater; Case Shiller Prices Rise 4th Consecutive Month; Treasury Yields Sink

While the stock market is saying one thing, the treasury market says another. I know who I believe, and it's not the stock market.

Hyperinflation In Reverse

So here we are with two year treasuries down from Tuesday's record low yield of 0.802 percent to a mere .65 percent this morning. Also note that five year treasuries are at 2.01 percent, and three month treasuries yield zero percent.

This must be a symptom of the hyperinflation everyone seems to be predicting.... except in reverse.

Thanksgiving morning at about 5:00 AM (before any news reports were out on Dubai) I was trying to figure out what was going on with the futures and I penned in Yen Hits 14 Year High vs US Dollar; Nikkei Sinks ...

Dollar Sinks S&P Futures Down

One thing of note is that S&P 500 futures are down 14 points and commodities are down as well even though the dollar is sinking. This is a dramatically different change from the norm.

Of course this is a holiday and we must see if there is follow through. This could be a one day wonder.

The important point is that if this sticks, or if equities sink while the Yen and/or Dollar rally, the reflation trade is finally over.

Can it be that the much despised treasuries are the only thing that will rally while everything else sinks? Yes, that is entirely possible given how lopsided anti-dollar sentiment is vs. everything else.It may or may not play out that way. After all, Friday has barely begun. We have seen these kind of starts to the day actually close up. However, at this hour, commodities are getting whacked while the dollar has reversed hard to the upside.

Given the US markets were closed yesterday, I have the same question floating in my mind as a day ago, wondering if this is another one day wonder rally in the dollar (and another one day wonder selloff in equities) or if this is the start of a long awaited correction in both the dollar and equities.

Time will tell, but it will not be pretty for dollar bears or equity bulls if it is.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.