Financial and Commodity Bubbles Everywhere?

Commodities / Gold & Silver 2009 Dec 13, 2009 - 10:34 AM GMTBy: Charles_Maley

The financial markets are generally unpredictable, so one has to have different scenarios. The idea that you can actually predict what’s going to happen contradicts my way of looking at the market – GEORGE SOROS

The financial markets are generally unpredictable, so one has to have different scenarios. The idea that you can actually predict what’s going to happen contradicts my way of looking at the market – GEORGE SOROS

I realize there are legitimate bubbles in the financial markets, but somehow we are seeing bubbles lurking in every dark doorway. The latest seems to be gold. Granted, gold has had a nice move up recently, and is vulnerable to a short term correction, but I personally cannot see where this constitutes a bubble.

So, let’s take a look at another scenario.

From a longer term perspective gold has compounded at about 4.75% from the 1933 lows when it traded at $32.00 per ounce, underperforming most other asset classes. If you care to look at it shorter term, say over the last year or so, there are many other markets that have risen faster. So, why aren’t these markets in bubbles?

Bespoke Investment Group pointed this out in a recent post on their website.

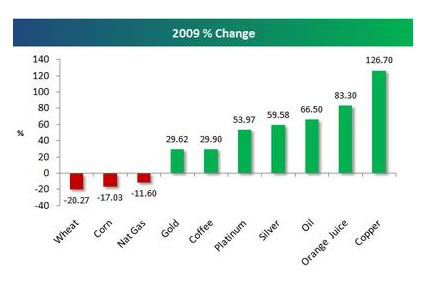

“Below we highlight the year-to-date performance of ten major commodities. While gold is currently grabbing the headlines, it’s actually up the least out of the seven major commodities that are in the black this year. As shown, Copper is up the most with a gain of 126.7%. Orange juice is up the second most with a gain of 83.3%, while oil, silver, and platinum are all up more than 50%. Coffee and gold are both up about 30%. Three commodities are down in price in 2009 — wheat (-20.27%), corn (-17%), and natural gas (-11.6%).”

So, why isn’t copper or orange juice in a bubble? I wonder how many people are aware that copper is up over 4 times what gold is up this year, and oil over 2 times. Even silver is up more than gold this year.

Another worthwhile observation was made by Chris Mayer of the Daily Reckoning.

“Then there is this chart of the Shadow Gold Price. In the old days of the Bretton Woods Agreement, countries had to maintain certain ratios of gold against their currencies. The Shadow Gold Price aims to replicate this discipline. So for the US, the Shadow Gold Price is Federal Reserve Bank liabilities (bank reserves) plus money in circulation divided by US gold holdings. Also on the chart, you can see the spot price of gold.”

Chris further notes where Paul Brodsky and Lee Quaintance of the hedge fund QB Partners wrote:

“If one allows for even a small probability of a future monetary system that reflects more honest/tangible money, then a quick glance at the graph above makes it easy to conclude that spot gold is fundamentally cheap. Even if this is too far a stretch for market participants skeptical of such a radical change in monetary policy, it is reasonable to conclude that the prices of spot gold and the Shadow Gold Price should converge somewhat over time.”

They note that the spot gold price has never been so cheap compared with the Shadow Gold Price. For parity to set in, gold would have to trade for $16,000 per ounce. No one is predicting $16,000 per ounce gold. In any case, it shows you the risk of holding paper – and bonds – on the eve of a massive devaluation of the dollar. Maybe the central bankers of Russia, Venezuela and Ecuador understand all of this better than they let on and that’s why they are buyers of gold.

Wikipedia reports that there has been roughly 158,000 tons of gold over all history. At $1000 / oz and 33.1 grams / troy oz that is 4.8 billion oz and 4.8 trillion dollars.

According to World of Wall Street site “A key observation here is that even a dramatic increase in gold mining (say a 50% increase) would not significantly change the amount of gold in the world. A gold bubble, unlike the Internet and Real-Estate bubbles, cannot be extinguished by a dramatic increase in supply. The European and USA central banks, with their allies, have been suppressing the price of gold for years by selling their stores of gold into the market. Should that Cartel be broken, either by various members getting cold feet and refusing to sell (as seems to be the case with European central banks) or by members running out of gold to sell or by investor demand, from a flight to safety, simply overwhelming this central bank selling a genuine gold bubble could begin.”

“The western investor psychology is momentum investing. So, if the price of gold should rise, western investors will not want to sell their gold while it is rising. If we model gold price as existing holders not selling and a fraction of GDP or US household financial assets moving into gold (say 1%) we have roughly 480 billion dollars chasing 110 million oz of new gold and a price of gold of $4,400.”

“Similarly if we see 5% of financial assets moving into gold (in a mania or panic) with our model we see a price of gold of 22,000$. That would be a genuine gold bubble as all the gold in the world would then be valued at roughly twice global GDP (110 trillion $). This is not sustainable, but a shift of a significant fraction of financial assets into gold could definitely kick off a gold mania pushing prices to extravagantly high levels.”

Enjoy this article? Like to receive more like it each day? Simply click here and enter your email address in the box below to join them.

Email addresses are only used for mailing articles, and you may unsubscribe any time by clicking the link provided in the footer of each email.

Charles Maley

www.viewpointsofacommoditytrader.com

Charles has been in the financial arena since 1980. Charles is a Partner of Angus Jackson Partners, Inc. where he is currently building a track record trading the concepts that has taken thirty years to learn. He uses multiple trading systems to trade over 65 markets with multiple risk management strategies. More importantly he manages the programs in the “Real World”, adjusting for the surprises of inevitable change and random events. Charles keeps a Blog on the concepts, observations, and intuitions that can help all traders become better traders.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.