Time Magazine's Kiss of Death to You!

Politics / Central Banks Dec 17, 2009 - 01:17 AM GMTBy: Mike_Shedlock

Bernanke is probably pleased to be name Time Magazine Person of the Year 2009.

Bernanke is probably pleased to be name Time Magazine Person of the Year 2009.

The story of the year was a weak economy that could have been much, much weaker. How the mild-mannered man who runs the Federal Reserve prevented an economic catastrophe.

Professor Bernanke of Princeton was a leading scholar of the Great Depression. He knew how the passive Fed of the 1930s helped create the calamity — through its stubborn refusal to expand the money supply and its tragic lack of imagination and experimentation. Chairman Bernanke of Washington was determined not to be the Fed chairman who presided over Depression 2.0.

So when turbulence in U.S. housing markets metastasized into the worst global financial crisis in more than 75 years, he conjured up trillions of new dollars and blasted them into the economy; engineered massive public rescues of failing private companies; ratcheted down interest rates to zero; lent to mutual funds, hedge funds, foreign banks, investment banks, manufacturers, insurers and other borrowers who had never dreamed of receiving Fed cash; jump-started stalled credit markets in everything from car loans to corporate paper; revolutionized housing finance with a breathtaking shopping spree for mortgage bonds; blew up the Fed's balance sheet to three times its previous size; and generally transformed the staid arena of central banking into a stage for desperate improvisation.

He didn't just reshape U.S. monetary policy; he led an effort to save the world economy.

Time Magazine Nonsense

Time Magazine is wrong of course. Bernanke did not save the world. Moreover Bernanke is a poor student of the great depression. He understands neither the cause nor the cure of depressions. It is equally clear Time Magazine doesn't either.

One does not cure a depression by throwing more money at it it, when the cause was the runup of money supply and credit in the first place.

In Praise Of Time

Bernanke is no doubt pleased to be on the cover, and I am pleased he is there as well. Bernanke is a fitting choice in a long line of fitting choices at Time.

I openly praise Time Magazine as a useful contrarian indicator.

That Bernanke is on the cover of Time Magazine means one thing "Bernanke's Time Is Limited" He is on his way out. And that is good news.

Ringing The Bell

My friend "HB" writes:

Appearing on the cover of Time as person of the year is like a bell ringing. It almost always is akin to a figurative death sentence for the person involved, and sometimes even a literal one.

- Jeff Bezos made the cover in 1999 - the year the internet portion of the tech stock bubble topped out.

- GW Bush made the cover as his popularity rating had just begun to slide, ending at the worst such rating since Nixon, concurrent with a stock market crash.

- Hitler made the cover in 1938.

- General Chiang Kai Chek in 1937. It turned out to be an ill omen, career-wise.

- Stalin made the cover in 1939 and again in 1942.

- Kennedy made the cover the year before he was assassinated, as did Martin Luther King - a literal death sentence in both cases.

- Lyndon B. Johnson made the cover in 1964 - he was about to lead the country into the Vietnam catastrophe.

- Nixon and Kissinger made it in 1972.

- It was Yury Andropov's turn in 1983 - he died shortly thereafter.

- Gorbachov became 'man of the decade' half a year before being forced to step down.

- Obama's turn was last year.

- Most worrisome however, in 2006 Time decided to write on its person-of-the-year cover 'You!'.

It is amazing in hindsight how Stalin and his brutal murderous regime of forcible collectivization was actually widely admired in the West during his lifetime.

Time is these days only a hair to the right of Marx, which is in marked contrast to the stance the magazine espoused vis-a-vis FDR and the new deal in the 1930's.

Back then Time was quite conscious of the failure of these policies - something its modern day editors seem to have completely forgotten and replaced with some post facto glorification of FDR.

YOU!

"Most worrisome however, in 2006 Time decided to write on its person-of-the-year cover 'You!'"

Indeed what a warning: "You!" In retrospect it should have been perfectly clear. Boomers were heading into retirement, flush with cash, jobs plentiful, feelin' good ... well you know the rest.

Today it is widely known that "You" is not generally in good shape.

Yet, the warning was right there on the cover. "You" was headed for deep, deep trouble. Few heeded the warning.

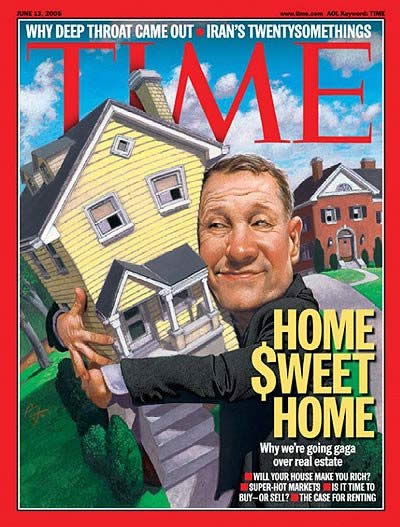

Gaga Over Real Estate

Although not a "person of the year" edition, please consider the June 2005 Time cover.

Not only did Time Magazine proclaim right on the cover "Why we're going gaga over real estate", Time followed it up with the even more ominous "You!".

I used the "Home $weet Home" cover to proclaim a top in housing. I hit it on the nose.

Flashback Monday, April 10, 2006: US vs. Japan Land Prices Pictorial Update.

Please see Collapse Of The "Ownership Society" for where we are now.

The Peak of Central Banking?

Kevin Depew was right on time as usual in Time on Bernanke: The Peak of Central Banking?

“This probably represents a peak in the importance of central banking. If you scan the list of Time magazine’s "Person of the Year" awards and pay attention to the timing, they almost universally represent a culminating event in the lives of the people or abstract ideas selected. This isn't because there is something flawed with Time's selection process; it's simply the case that by the time something is deemed universally important enough to be selected it has reached a natural point of exhaustion.”

A Good Omen

Bernanke being on the cover of Time Magazine is arguably a good omen, a time for hope.

Once again please consider my final thoughts in Fed's Exit Strategy: Stephen Roach vs. Mish

We need a plan and a timeline to put the world on a sound economic system because the current Bretton Woods II, fractional reserve, US dollar reserve currency hegemony is about to blow sky high.

The quicker this blows up, the quicker we can recover. And knowing what we know about Time Magazine, Central Banking will blow up sooner rather than later. Moreover, Bernanke will not be part of the solution, and that is a good thing.

I thank Time Magazine for the information and their kiss of death warning. However, I must also remind readers that Stalin made the cover twice, so immediate results just might be expecting too much.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2009 Mike Shedlock, All Rights Reserved

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.