Gold and Silver Forecast Update

Commodities / Gold & Silver 2009 Dec 26, 2009 - 02:30 PM GMTBy: G_Abraham

What a month for gold and silver as they peaked and crashed by over 10% this month. But instead of being disspointed, I think this is the perfect fodder and stage for the next super fast bull rally. In fact the next move will be among the powerful and sustainable rallies in 7 year bull run of Gold as it will suck in even the most conservative of funds as Gold takes out levels like $1200, $1300 as if they were fig leaves.

What a month for gold and silver as they peaked and crashed by over 10% this month. But instead of being disspointed, I think this is the perfect fodder and stage for the next super fast bull rally. In fact the next move will be among the powerful and sustainable rallies in 7 year bull run of Gold as it will suck in even the most conservative of funds as Gold takes out levels like $1200, $1300 as if they were fig leaves.

The perfect instrument to play Gold and Silver for the next wave are:

- Physical Gold: There is no better way to play the rally than hold the physical asset. The risk/reward for such instrument is far greater than any other. It requires planning, tremendus effort on your part but in the medium run they will pay off. Trust me on this!

- Stocks( Novagold is a must as I have a target of $10): If you cannot hold the physical asset, then you must own the companies that produce Gold. Novagold is the among the finest but there are many others esp chinese producers.

- ETF (GLD and others): Gold ETFs can be an effective way to play gold but you must do your research on the custodians of GOLD ETF. If you see names like JP Morgan or Morgan Stnaley, my suggestion: Stay away.

- Naked futures: This is the most dangerous way to play Gold but it offers reward like no other as the leverage can multiply your gains many fold.

The following is the Gold chart and my thoughts:

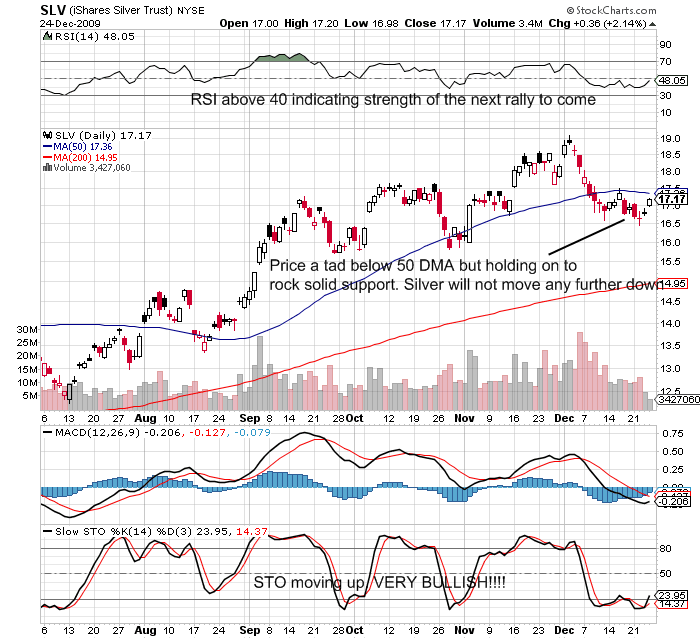

The following is the Silver chart and my thoughts:

Silver will lead Gold in the next move. I also believe Silver will take out $20 early 2010 and after a brief dip back below $20, Silver will explode to $24-25 levels.

INVESTING CONTRARIAN Targets for Gold and Silver:

1. Gold: $1300 in Q1 2010

2. Silver: $23 in Q1 2010

Remember our targets. We will update these if there are any changes in economic news and assumptions. Once again to reitrate we are not making a target for dollar as of now as dollar may technically move around levels but the trend in Gold and Silver are definitely up!!!

Godly Abraham

http://investingcontrarian.com/

Formerly a hedge fund analyst for India's largest fund house and currently a Private Equity fund analyst with a swiss firm, Godly Abraham is an active writer at INVESTING CONTRARIAN which is a daily online publishing house, covering investing ideas and economic analysis on wide ranging topics but mainly specialized to covering US,UK, EU and BRIC countries and their political ramifications.

© 2009 Copyright Janet Tavakoli- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.