Economy Forecast 2010 the Uncertain Statistical Economic Recovery

Economics / Economic Recovery Jan 09, 2010 - 01:13 AM GMTBy: John_Mauldin

2010: A Year of Uncertainty

2010: A Year of Uncertainty

"Rocking Even Me"

Prisoners of Our Preconceptions

The Statistical Recovery

The Great Experiment

Whither the Fed?

"Lying here, during all this time after my own small fall, it has become my conviction that things mean pretty much what we want them to mean. We'll pluck significance from the least consequential happenstance if it suits us and happily ignore the most flagrantly obvious symmetry between separate aspects of our lives if it threatens some cherished prejudice or cosily comforting belief; we are blindest to precisely whatever might be most illuminating." - from Transition, by Iain M. Banks

Still a man hears what he wants to hear

And disregards the rest

-- The Boxer, by Paul Simon

"They Are Rocking Even Me"

This will be my tenth annual forecast issue. Time has flown by, and I enter a new decade of writing Thoughts from the Frontline. And even as I write about the high level of uncertainty of the current times, I am optimistic that at the opening of the next decade we will look back and realize that there has been an enormous amount of progress made. None of us will want to revisit the pleasures of the past ten years in some nostalgic dream. I am so ready for a new decade. And speaking of Paul Simon (above), reading the lyrics of The Boxer, one of my favorite songs from my youth, another few words seemed to hit home:

...Now the years are rolling by me, they are rockin' even me

...I am older than I once was, and younger than I'll be, that's not unusual

...No it isn't strange, after changes upon changes, we are more or less the same

At the end of the letter I announce the dates for our annual Strategic Investment Conference, tell you about an important conference I will be attending next month for 9 days (a rather large chunk of time for me!), and drop a hint about why I am going to actually buy some stocks this decade.

For new readers (and a lot of you have joined us this last year), let me quickly tell you what it is that I really do. I basically read and think for a living. I read a lot - hundreds of newsletters, articles, papers, magazines, books, essays, emails etc., almost every week. Each Friday I sit down and write about what seems to me to be the most important ideas I have come across, often tying together concepts from multiple sources into what becomes this letter, hoping to piece together a few parts of the puzzle, to help us see the bigger picture. On Mondays I send readers Outside the Box, which is an article by some other writer that I find interesting, and I try to make sure that I disagree with more than a few of them. We need to think, and that is one way of helping us do so.

The letter started out ten years ago as a way for me to put into writing my ideas and thoughts on what I had read, and I sent it out to just 2,000 people. It has grown to where today it goes to around 1.5 million people and is posted on dozens of web sites. The letter is free. You can subscribe at www.investorsinsight.com simply by giving me your email address. And feel free to forward the letter to friends or put a link to it on your web site. And there are Chinese and Spanish translations of the letter each week as well.

2010: A Year of Uncertainty

I read and research more for the annual forecast issue than any other letter during the year. And having had the luxury of not writing for the last two Fridays, I've had even more time. It seemed to me that the volume of forecasts out this year was greater than ever. But even I was amazed when Birinyi Associates, Inc. showed a picture of annual forecasts they had come across and printed out. It was a stack almost two feet tall and comprising over 3,500 pages. They helpfully summarized the projections for the major investment banks and compared them.

Their work confirmed my own reading. The projections they cited and those I have read were all over the board and more divergent than I can ever remember. But as I read the tea leaves, there is a lot of uncertainty and caveats with these forecasts. And too many are based on assumptions that the future will turn out largely looking like the past. It has been my contention for a long time that we are in a period that looks nothing like the past, and to use backward-looking data to project the immediate future carries the risk of being very misleading.

Thus, before we get into my projections, I think we need to take a survey of where we are. That means this annual issue may turn into a two-week project (I generally try to stop writing at eight pages); but if you don't know where you are, how can you figure out where you're going?

This is a challenging time, and I am going to challenge a lot of people's ideas over the next two weeks. So, as we start, let's look at why we need to very carefully assess our belief systems. The two quotes at the start of the letter point out how difficult it is for us to accept an idea that challenges our belief system, or would have negative consequences for our lives. If we are long some investment, we look for good news that tells us our investments are going up, and gloss over the negatives.

Last month, I found out I was just a few thousand miles from becoming executive platinum on American Airlines. I have never attained that level, and there are some major benefits. So, the flight which was the least expensive and gave me the required miles was a two-hour hop to Tampa, where ironically I had been the week before. I flew back on the same plane 30 minutes later.

However, the time was put to very good use. I read a pre-publication manuscript of a book by my good friend James Montier, called The Little Book of Behavioral Investing. I was asked to write the preface. I have to say that this book will become one of those that I read at least once a year, as it just so pointedly reminds me of all the ways we make investment (and life!) mistakes because of the ways our brains are hard-wired.

One of the real problems is that we "hear what we want to hear." Our beliefs or personal interests lead us to conclusions or actions that may or may not be helpful. Let's take a page excerpt from James' book:

Prisoners of Our Preconceptions

"For instance, a group of people were asked to read randomly selected studies on the deterrent efficacy of the death sentence (and criticisms of those studies). Subjects were also asked to rate the studies in terms of the impact they had had on their views on capital punishment and deterrence. Half of the people were pro-death penalty and half were anti-death penalty.

"Those who started with a pro-death sentence stance thought the studies that supported capital punishment were well argued, sound and important. They also thought that the studies that argued against the death penalty were all deeply flawed. Those who held the opposite point of view at the outset reached exactly the opposite conclusion.

"As the psychologists concluded: ‘Asked for their final attitudes relative to the experiment's start, proponents reported they were more in favor of capital punishment, whereas opponents reported that they were less in favor of capital punishment.' In effect each participant's views polarized, becoming much more extreme than before the experiment.

"In another study of biased assimilation (accepting all evidence as supporting your case) participants were told a soldier at Abu Ghraib prison was charged with torturing prisoners. He wanted the right to subpoena senior administration officials. He claimed he'd been informed that the administration had suspended the Geneva Convention.

"The psychologists gave different people different amounts of evidence supporting the soldier's claims. For some, the evidence was minimal; for others, it was overwhelming. Unfortunately the amount of evidence was essentially irrelevant in assessing people's behavior. For 84% of the time, it was possible to predict whether people believed the evidence was sufficient to subpoena Donald Rumsfeld based on just three things:

1. The extent to which they liked Republicans

2. The extent to which they liked the US military

3. The extent to which they liked human rights groups like Amnesty International.

"Adding the evidence into the equation allowed the researchers to increase the prediction accuracy from 84% to 85%. Time and time again, psychologists have found that confidence and biased assimilation perform a strange tango. It appears the more sure people were that they have the correct view, the more they distorted new evidence to suit their existing preference, which in turns made them even more confident!"

"We'll pluck significance from the least consequential happenstance if it suits us and happily ignore the most flagrantly obvious symmetry between separate aspects of our lives if it threatens some cherished prejudice or cozily comforting belief; we are blindest to precisely whatever might be most illuminating," wrote Ian Banks, of the protagonist in the science fiction novel Transition I am currently reading.

(By the way, if you are a sci-fi reader and have not yet become addicted to the writing of Banks, start with his early work and move through the decades. He is one of the best hard sci-fi writers alive.)

Those who are invested in the idea of a "V"-shaped recovery became excited over the jobs report last month. Unemployment rose by only 11,000 jobs, if you did not look at the underlying numbers or ignored the household survey. And the consumer confidence surveys have begun to rise. The Index of Leading Economic Indicators has now risen for six months in a row. Productivity is up. And surveys indicate that consumer spending is up. GDP growth in the fourth quarter looks to be in the 3%-plus range.

All reasons to be bullish, if you are looking for a reason to be bullish. If you don't examine the underlying data, you can feel good. The problem is that when we look deeper into the data than just the headlines, there are concerns.

For instance, take the contention that consumer spending is rising. I called Philippa Dunne at The Liscio Report. They survey the various states about taxes, among other things. "Sales taxes are not up and the current survey we are doing is pretty bad." She used the word "horrified" when commenting on some of the respondees' replies at the various state tax offices. Further, today we find that credit card lending dropped $17 billion last month, the largest drop in history. And this was during Christmas!

Savings are up. Credit is down. Where did the rise in consumer spending come from? Remember, these are mostly surveys and/or comparisons with a disastrous 2008. And they compare same-store sales for chains like Best Buy, which no longer competes with the bankrupt Circuit City, or for chains that closed stores, forcing buyers to the remaining stores. The key to watch is sales taxes. When they are rising, consumer spending is rising.

Consumer confidence is rising, but from truly awful levels. The levels are still well below any level in previous recessions and certainly do not indicate a robust economic rebound.

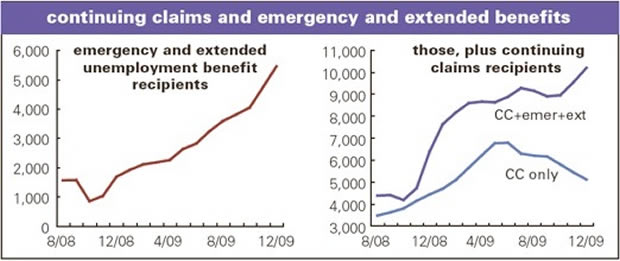

A challenged consumer confidence survey is not surprising, given the fact that roughly 8% of the working population is getting some form of unemployment assisance. One in eight children in this country is living on food stamps. By the way, the total number of people on unemployment is about 300,000 worse than most media accounts report. The Extended (and Emergency) unemployment claims for those out of work more than 26 weeks are not seasonally adjusted. To get the total number of people on unemployment insurance of all kinds, you have to add the non-seasonally adjusted number of continuing claims, which is currently about 300,000 higher than the seasonal adjustment. Here is a chart from Philippa, at www.theliscioreport.com.

She explained, "For the week ended 12/19, 10.42 million Americans were receiving unemployment benefits, With 5.44 million Extended claims (week ended 12/19) and 4.98 million Continuing claims.

"But NSA jobless claims show a far different story. The advance number of actual initial claims under state programs, unadjusted, totaled 645,571 in the week ending Jan. 2, an increase of 88,000 from the previous week. There were 731,958 Initial claims in the comparable week in 2009... The advance unadjusted number for persons claiming UI benefits in state programs totaled 5,479,110, an increase of 388,729 from the preceding week. A year earlier, the rate was 4.0 percent and the volume was 5,317,388.

"So the actual, the real benefits paid (Initial, Continuing, and EUC claims) hit another record of 11.268 million." (source: The Big Picture)

Today's employment report was just terrible. The headline said we lost 85,000 jobs. That is from the establishment survey, where they call up larger businesses and ask them about their employment. They also do a household survey, where they survey about 400,000 households. That report reveals a much worse situation.

Last month, single women who are heads of households saw their unemployment ranks rise by a massive 127,000. The number of employed men fell by 214,000. The total number of unemployed in the survey rose by an enormous 589,000. Those classified as not in the work force (due to the fact that they did not look for jobs) rose by 843,000! That now means that in 2009 3.5 million people were dropped from the potential labor force count because they were discouraged.

If you add those to the 15.3 million who are unemployed, you get a much higher unemployment number than 10%. Getting that exact number is tricky, because if you are back in school (as some of my friends are) you are not looking for a job but are going to want one soon. And if the economy does rebound and jobs start to become available, then it is likely a large number of the discouraged 3.5 million will start looking for jobs and therefore be listed in the work force. Ironically, a recovering economy could see the unemployment number rise. During the recovery, it will be important to look at the total number of employed and not just at the unemployment rate.

Sidebar: As noted above, a large number of people were dropped from the official labor force. What that means is that even though the number of employed people fell, the unemployment rate did not. It will be interesting to see if a lot of those people just decided that December was not a good time to be looking, spent time with families, or decided it was too cold to get out. How many will start looking as we get into the new year? We could see a rise in the unemployment rate next month if a large number do look for work.

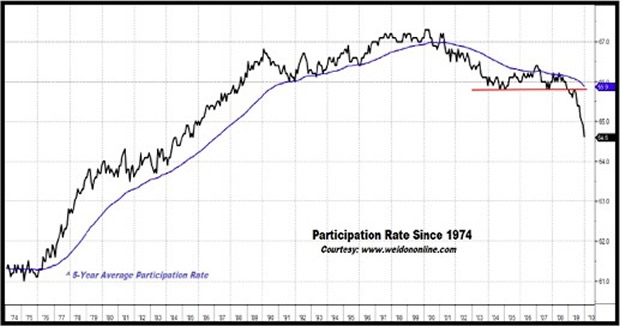

Look at the chart below from my friend Greg Weldon. (It just hit my inbox.) It shows the percentage of people who are participating in the work force. (www.weldononline.com) It is sadly dropping, which means that incomes to families are dropping. The number of people I know who are looking for work or are struggling increases each week. It truly saddens me.

The Statistical Recovery

So why, if the employment picture looks so bad, are we getting positive GDP numbers? I coined the term "Statistical Recovery" last summer to describe an economy where the statistics are positive but it certainly doesn't "feel" like a recovery. So, how is it that we see a rise in the statistics?

First, year-over-year comparisons are looking better, since 2008 was horrific. Second, inventory levels are about as low as they will go. In the way GDP is figured, a reduction in inventory reduces GDP. That was a negative figure for most of this recession. Simply because inventories not falling any more, it is easier to get a positive GDP.

Second, as I have written, there are one-time benefits for GDP from the federal stimulus. Roughly 90% of the 2.2% growth in GDP in the third quarter was attributable to the stimulus, and we will see a similar affect in the 4th-quarter numbers and at least through the first half of next year.

A reduction in imports is also a positive for GDP. We are buying less "stuff" from abroad, so that helps statistically.

Martin Feldstein, one of the great economists of our time, was quoted last week as saying that the recession is not over. Indeed, it you look at past recessions, it is not all that unusual (8 out of 11 times) for there to be positive GDP quarters in the midst of an ongoing recession.

The Great Experiment

So this is the backdrop as we look into the future. Unemployment is rising and is likely to remain stubbornly high (over 10%) for some time, except for the few months this coming summer when the Labor Department will hire hundreds of thousands of temporary census workers. The savings rate is rising, and consumer spending is at the very least challenged. The stimulus starts to drop sharply in the latter half of the year. States, counties, and cities are short about $260 billion and will either have to cut services (and thus jobs) or increase taxes. Housing is likely to get weaker, as there are large numbers of defaults coming because of mortgage-rate resets this year and next (more on that in a few weeks). Valuations on stocks are in the high range, and do not portend well for long-term returns.

Further - and this is the most important item to me - Congress is likely to allow the Bush tax cuts to expire and to add insult to injury with some form of large tax increase for heath care. Between the local, state, and federal tax increases, we could see a massive increase in taxes of perhaps $500 billion in a $13-trillion economy, or about 4% of GDP.

Think about that for a moment. It is likely we will begin 2011 with close to 10% unemployment, if not higher. Christina Romer's work shows that tax cuts have a three-times benefit to GDP. Tax increases presumably have a similar negative effect. (Ms. Romer, by the way, is President Obama's Chairwoman of the Council of Economic Advisors. This is not a partisan idea.)

This is the great experiment to which we are going to be subjected. There are those who agree with Art Laffer and company that tax cuts are a positive for the economy (that would include your humble analyst). And there are those who contend that the economy did just fine in the Clinton years before the Bush tax cuts and that we will do just as well if we take them away. And further, taxing the rich a little more is not really going to change their behavior.

My contention is that if such a tax increase is enacted all at once, the economy will at a minimum dip back into a nasty recession. If I am wrong, then I will have to abandon one of my long-cherished beliefs. I will have to stop arguing that tax cuts are as important as I think. Right now, when I read the data and studies, they confirm my tax-cutting bias. But I have to be willing to change my mind if The Great Experiment proves me wrong.

But if you think unemployment is high now, you will really not like what happens if we dip back into recession. It could go a lot higher. They are truly risking a great deal if they decide to pursue this experiment.

Thus, I am faced with a great deal of uncertainty as I look into the future with my forecasts - and we will get into the bulk of the actual forecasts next week. I almost titled this letter "The Year of Waiting," because there are so many important developments we are waiting on. Will they actually raise taxes in such a soft economy, or will cooler heads prevail and the increases be postponed, or at least phased in over 4-5 years? What will the health-care bill look like? There are so many things that could significantly change any predictions.

As I have written for years, the stock market drops an average of over 40% during a recession. If we go into a recession in 2011, it is highly unlikely that there will be an exception to the bear market rule. But this market seemingly wants to go higher. Smart people like my partner Steve Blumenthal argue with me that the technicals say we could go a lot higher in the short term. And he may very well be (and probably is) right.

This is a trader's market. It is not time to buy and hold large indexes or high-beta stocks and expect to be made whole over the next ten years. Hope is not a strategy. But waiting for the "shoe to drop" is frustrating, I know. However, that is the situation we find ourselves in.

We will go into this next week, but the current environment is quite different than 1982, when the last bull market started. Rates were falling; they are now likely to rise over time. Taxes were going down. Valuations were at historical lows, not high and rising. Inflation was coming down. And on and on. The current environment is not one in which bull markets are born.

Whither the Fed?

The futures market is pricing in rate hikes from the Fed beginning this fall. I highly doubt a politicized Fed will hike rates with unemployment over 10%, ahead of a November election. We are going to have a very easy monetary policy for longer than most observers think.

The Fed has painted itself into a very tough corner. Raising rates in a high-unemployment environment is risky. Bernanke knows what happened in 1937 and does not want a repeat. But by keeping rates too low for too long, they risk an asset bubble or two. And the federal fiscal deficit of over $1.5 trillion is not making their situation any easier.

The Fed has announced it is ending many of their various and sundry programs in the first quarter. They have essentially been the mortgage market. What will happen to rates? I think that is one of the reasons why Geithner has essentially lifted any limit on explicit guarantees for Fannie and Freddie. It will be seen as higher-paying government debt. It will also cost you, Mr. and Ms. Taxpayer, hundreds of billions in increased deficits, as they are telling those entities to eat the losses from large numbers of loan modifications. This is outrageous on so many levels. Congress should at least have to approve this.

It's getting close to my eight pages, so let me end by saying that, as we face the next crisis - and we will (there is always another crisis) - we will find we have not fixed the causes of the last one. We still have banks too big to fail, we have not put the credit default swaps on an exchange, we have not reinstated Glass-Steagall, Barney Frank's bill (which was not the one that came out of committee) now makes it exceedingly more difficult to short stocks, we keep in power the same people who missed the problems the last time, and the list of bad policies bought (typo intended) to you by bank lobbyists grows ever longer. If the current bill looks like it was written by the bank lobby, that's because it was. But it means we will have to face the same problems all over again. But that is another story for another day. Next week we look at the dollar and other currencies, gold, commodities, bonds, emerging markets, and more.

London, Monte Carlo, Zurich, and Stocks

Tomorrow I head to Santa Barbara for the annual business planning session with my partners at Altegris Investments. Let me quickly note that our annual Strategic Investment Conference will be April 22-24 in La Jolla. The speaker lineup is powerful. Already committed are David Rosenberg, Dr. Lacy Hunt, Dr. Niall Ferguson, and George Friedman, as well as your humble analyst. We are talking with several other equally exciting speakers. This conference sells out every year, and you do not want to miss it. We will have an announcement soon.

Secondly, I am going to go to the Singularity University's 9-day Executive Program from February 26 through March 6. As for how I feel about it, the fact that I would devote nine days to it basically says it all. They have a very powerful faculty brief a rather small group about how the future of a variety of technologies will impact all aspects of business and the economy. It is not cheap, at $15,000, but I think it will be worth my time. They have had more applications than they have slots, but they have said they will give my readers special preference (as far as possible). You can go to www.singularityu.org and click on the link to the conference to find out more. I have been told who some of my fellow attendees will be, and let me say that the list is impressive. I am really looking forward to it. Hope to see some of you there.

I will be in London January 20-23, then a few days in Monte Carlo, and then Zurich and Geneva mid-week. I do have some times open, and will be speaking in London with my European partners, Absolute Return Partners. Drop me a note if you would like to meet, and I will see what we can do.

Finally, next Monday's Outside the Box will be very unusual. I have not bought a stock for over ten years, preferring managers and funds. But starting in the next few weeks, I am going to begin buying stocks in a particular asset class, and intend to accumulate a portfolio over the next five years. Even in the face of what I think will be a recession. If you are interested in my thinking on this, be sure and read the letter.

I am so ready for 2010 and the next decade! As I look back, every decade has been better for me, and I think this decade will keep that trend intact. As Tiffani comes back from maternity leave (kind of), we have a lot of ideas for ways to serve you better. And we are going to be looking for suggestions. We are excited.

I am going to the Cowboys game tomorrow night, and hope we can beat our post-season jinx. This is going to be a very busy year for me, but I have to admit I am having more fun than I ever had. Thank you for being a part of it all.

Your more optimistic than this letter sounds analyst,

By John Mauldin

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

To subscribe to John Mauldin's E-Letter please click here:http://www.frontlinethoughts.com/subscribe.asp

Copyright 2009 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.