Fed Publishing Mathematical Gibberish to Hide Balance Sheet Secrets

Politics / Central Banks Jan 13, 2010 - 11:17 AM GMTBy: Mike_Shedlock

The Fed is pulling out all stops to defend its secrets, including publishing self-serving mathematical gibberish. Please consider the St. Louis Fed article on the Social Cost of Transparency.

The Fed is pulling out all stops to defend its secrets, including publishing self-serving mathematical gibberish. Please consider the St. Louis Fed article on the Social Cost of Transparency.

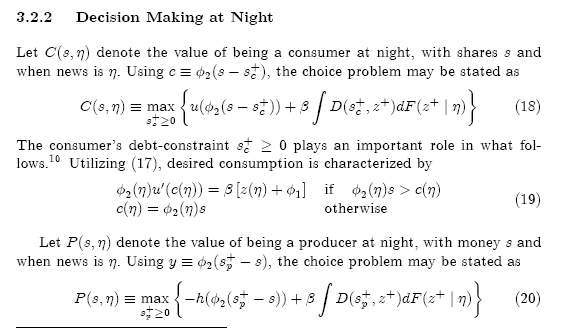

Unless you are an academic wonk, you will be stymied by pages that look like this ...

There are 24 pages of such nonsense with titles like

- 2.2 Private Information and Full Commitment

- 2.3 Private Information and Limited Commitment

- 3.2.1 Decision Making in the Day

- 3.2.2 Decision Making at Night

- 3.2.4 A No-News Economy

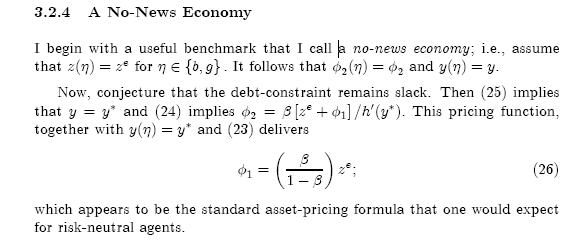

Just for good measure here is the page describing 3.2.4 A No-News Economy

The article culminates with ...

For an asset economy then, the prescription of “full transparency” is not generally warranted.

Approaching the problem under the premise that fuller transparency is always desirable may not be the right place to start.

Hiding Behind Empirical Formulas

The problem is Bernanke places his complete faith in such gibberish, so much so that he has lost all sense of real world action by real people. The result is that in spite of his PhD, he could not see a housing bubble that was obvious to anyone using a single ounce of common sense.

Moreover, had Bernanke simply opened his eyes instead of relying on a poor interpretation of an already fatally flawed Taylor Rule, the credit/housing bubble would not have gotten as big as it did, and we might not be discussing the above ridiculous mathematical formulas that supposedly show us the Fed needs to be secretive.

For more on Bernanke's love affair with the Taylor Rule (even though Taylor Disputes Bernanke on its usage), please see Taylor, NY Times, Dean Baker Call Out Bernanke.

Appeals Court To Hear Bloomberg's Freedom of Information Suit

Bloomberg has been in a battle with the Fed for two years over the Fed's “unprecedented and highly controversial use” of public money. In August it "won" the lawsuit but the Fed has appealed.

Please consider Federal Reserve Seeks to Protect U.S. Bailout Secrets.

The U.S. Court of Appeals in Manhattan will decide whether the Fed must release records of the unprecedented $2 trillion U.S. loan program launched after the 2008 collapse of Lehman Brothers Holdings Inc. In August, a federal judge ordered that the information be released, responding to a request by Bloomberg LP, the parent of Bloomberg News.

Bloomberg argues that the public has the right to know basic information about the “unprecedented and highly controversial use” of public money. Banks and the Fed warn that bailed-out lenders may be hurt if the documents are made public, causing a run or a sell-off by investors. Disclosure may hamstring the Fed’s ability to deal with another crisis, they also argued. The lower court agreed with Bloomberg.

The ruling by the three-judge appeals panel may not come for months and is unlikely to be the final word. The loser may seek a rehearing or appeal to the full appeals court and eventually petition the U.S. Supreme Court, said Anne Weismann, chief lawyer for Citizens for Responsibility and Ethics, a Washington advocacy group that supports Bloomberg’s lawsuit.

In her Aug. 24 ruling, U.S. District Judge Loretta Preska in New York said loan records are covered by FOIA and rejected the Fed’s claim that their disclosure might harm banks and shareholders. An exception to the statute that protects trade secrets and privileged or confidential financial data didn’t apply because there’s no proof banks would suffer, she said.

The central bank “speculates on how a borrower might enter a downward spiral of financial instability if its participation in the Federal Reserve lending programs were to be disclosed,” Preska, the chief judge of the Manhattan federal court, said in her 47-page ruling. “Conjecture, without evidence of imminent harm, simply fails to meet the board’s burden” of proof.

By the time the documents are released, the information may be useless, or not. Regardless, the battle is worth fighting just over the principles of the matter.

Fed Faces Subpoena Over AIG bailout

On Tuesday I commented on House Plans To Subpoena Geithner Over AIG Decisions

AP

Rep. Edolphus Towns, D-N.Y., said Tuesday he will subpoena the New York Fed for documents related to the bailout of failed insurer American International Group Inc.

Towns chairs the House Oversight and Government Reform Committee. The committee is investigating deals that diverted billions of AIG bailout dollars to banks including Goldman Sachs Group Inc.

The committee has been investigating e-mails from New York Fed lawyers telling AIG not to disclose details about the deal. The e-mails were released last week by California Rep. Darrell Issa., the committee's top Republican.

Issa asked Towns to subpoena the New York Fed after the Fed blocked a separate request for documents.Audit The Fed

Of course we cannot forget Ron Paul's Audit The Fed measure that has passed the house. These measures show just how angry everyone is over the Fed.

The Fed has increased that anger and resentment by pointing the finger at everyone else. For details, please see Ben Bernanke Looks In Mirror, Sees Barney Frank.

Three Front Attack

- Appeals Court To Hear Bloomberg's Freedom of Information Suit

- Fed Faces Subpoena Over AIG bailout

- Audit The Fed

What's On The Fed's Balance Sheet?

The Fed's balance sheet (better thought of as a diaper or a garbage dump), is not only smelly, it is bulging bigger by the day.

We have a right to know what the Fed is doing, what the assets it is holding are worth, and what arrangements it might have illegally made with AIG or others.

Yesterday the Washington Post reported Federal Reserve earned $45 billion in 2009.

I have a few questions.

Really?!

- Does that count the $185 billion the NY Fed crammed down taxpayers throats over AIG?

- Does that count the real cost of any of its other inane off-balance-sheet recommendations approved by Congress at taxpayer expense?

- Does that include a marked-to-market accounting of Mortgage Backed Securities on its balance sheet?

- Does that include a marked-to-market accounting of anything other than specific items the Fed wanted marked-to-market?

The Fed conveniently ignores all of its recommendations that cost taxpayers hundreds of billions of dollars, some done illegally, and then has the self-serving, selective-myopia gall to talk about "gains".

Bloomberg argues that the public has the right to know basic information about the “unprecedented and highly controversial use” of public money. Anyone thinking clearly has to agree.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.