Stocks, Gold and Commodity Markets Major Update

Stock-Markets / Financial Markets 2010 Feb 05, 2010 - 01:20 AM GMTBy: Steven_Vincent

It's been a while since I gave an update. This one comes at what may be a turning point as significant as the one in March '09. Is the bear market beginning its next leg? Quite possibly. It’s important to note that I have been bullish since the March ‘09 bottom and I do not qualify as a permabear.

It's been a while since I gave an update. This one comes at what may be a turning point as significant as the one in March '09. Is the bear market beginning its next leg? Quite possibly. It’s important to note that I have been bullish since the March ‘09 bottom and I do not qualify as a permabear.

Comment here.

So far my outlook has been borne out very well. It’s worth noting that the markets did not achieve the bounce targets or even the 50 EMA before failing miserably. The 20 EMA has crossed the 50 EMA.

I think a fairly immediate test of the 200 EMA is in order and should produce a short to intermediate term bottom after some churning. If we get a sharp V bottom that may be bearish since it would mark a short covering rally rather than patient buying. The zone between SPX 1032 and 1017 should provide some support.

I would add that it is possible that a top is forming it may be a complex process that will still take months to unfold, and may include a retest of the recent highs. It will depend on the quality of the rally we see off the indicated support zone. I would also add that we may be witnessing another full fledged financial panic and there may be some extreme risk that needs to be discounted. The sovereign debt crisis, the US state and municipal debt crisis, commercial real estate and further residential real estate defaults are all very real components of a potential deflationary spiral.

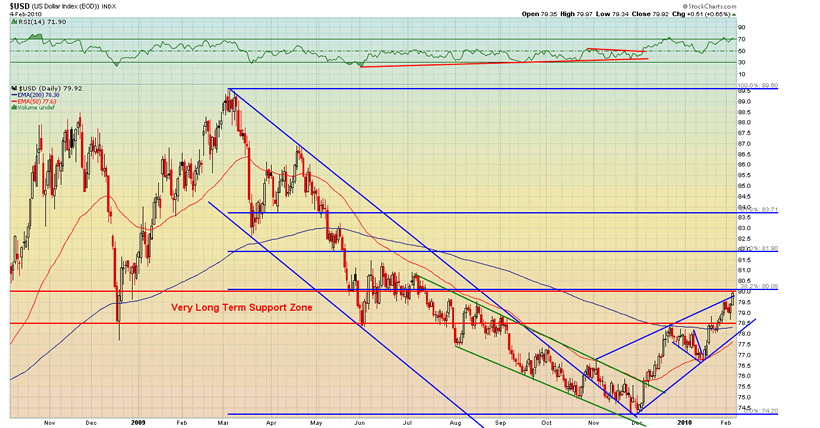

The US dollar pushed through to the 80 level with little effort. This may be an indication that a deflationary tsunami is in process. I suspect that it will be penetrated along with the 38.2% fibonacci retracement level from the March 2009 high as stocks put in a temporary bottom. We also have a channel buster here which almost always occasions a top. A retest of the rising 200 EMA, which is soon to be crossed by the 50 EMA, may provide a good long entry on the dollar.

Gold rallied to the resistance area that I had indicated and then tanked as predicted. It’s got a date with the 200 EMA in the 1031 area. A rally from there should provide a good short entry for the real move back to the $650 zone.

Good Trading!

Subscribe to my free BullBear Trading Service to get all the details of my trades as they develop.

The BullBear Market Report is live every Monday and Thursday after the closing bell. Call in with your questions, thoughts and observations.

Disclosure: No current positions.

By Steve Vincent

The BullBear is the social network for market traders and investors. Here you will find a wide range of tools to discuss, debate, blog, post, chat and otherwise communicate with others who share your interest in the markets.

© 2010 Copyright Steven Vincent - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.