Euro-Zone Debt Default Risk Crisis, "UR ALL PIGS FROM HELL!”

Economics / Global Debt Crisis Feb 09, 2010 - 04:45 AM GMTBy: Gordon_T_Long

Whether you’re in Central Europe, such as Ukraine or Romania, the Med countries such as Portugal, Italy, Greece, Spain, or from Hungary to the Baltic States of Estonia, Latvia or Lithuania, you all have one common problem ---The hell that is the Euro!

Whether you’re in Central Europe, such as Ukraine or Romania, the Med countries such as Portugal, Italy, Greece, Spain, or from Hungary to the Baltic States of Estonia, Latvia or Lithuania, you all have one common problem ---The hell that is the Euro!

“Euro members drew down their benefits in advance – ‘ex ante’ -- when they joined EMU and enjoyed "very easy financing" for their current account deficits. They cannot expect ‘ex post’ help if they get into trouble later. These are the rules of the club” (1)

Jean-Claude Trichet, President, European Central Bank

The Euro is still an experiment. Like any experiment it needs to withstand the results of testing under stress conditions. The present stresses within the PIGS have pushed the Euro and the viability of the EMU onto the global stage with all the attention of “The Emperor has no Clothes”!

Whether the Euro is your domestic currency; or you peg your currency to the Euro; or you are significantly influenced economically by the Euro, you are now infected by the possibility of contagion.

EURO - EMU EXPERIMENT (E3)

“At the heart of the problem is Europe’s unwillingness more than a decade ago to choose either unification or separation. It wanted economic unification and continued political independence of nation states. In short, it wanted the best of both worlds, and for a time it seemed to have succeeded in that goal. The success amazed many economists, most of them from Britain and the United States, who had argued that a single currency would require much more political unification.” (1)

The experiment was launched and founded on ‘half measures’. If everything worked over time there was the possibility of political unification. If things failed there was the return to independent monetary policy. Everyone agreed that time would tell.

THE TEST of TIME (T3)

The central premise of the experiment which is now under test conditions is whether:

When sovereign countries are placed under economic pressures, due to governments’ historically inevitable inability to reign in fiscal spending and election entitlement promise, Can they then implement unpopular policy reforms without resorting to currency debasement and the governments’ stealth tax of inflation?

The whole basis of the EMU and Euro currency rests on the outcome of the highly visible public tests underway. Users of the Euro surrendered their option of sovereign monetary policy with their EMU membership which has been historically the escape route for trapped political regimes.

The whole basis of the EMU and Euro currency rests on the outcome of the highly visible public tests underway. Users of the Euro surrendered their option of sovereign monetary policy with their EMU membership which has been historically the escape route for trapped political regimes.

Preliminary indications are not encouraging as the US dollar versus the Euro spike is clearly signaling. “Traders and hedge funds have bet nearly $8bn against the Euro, amassing the biggest ever short position in the single currency on fears of a eurozone debt crisis. Figures from the Chicago Mercantile Exchange, which are often used as a proxy of hedge fund activity, showed investors had increased their positions against the Euro to record levels in the week to February 2. The build-up in net short positions represents more than 40,000 contracts traded against the Euro, equivalent to $7.6bn. It suggests investors are losing confidence in the single currency’s ability to withstand any contagion from Greece’s budget problems to other European countries” (2)

HELL THAT IS THE EURO: Europe’s Sub-Prime Problem

The global financial media and markets are presently riveted on the PIGS! Though there appears every reason for this, due to the dramatic rise in CDS prices, the real looming problem is much more frightening. We have felt strongly since the US Sub-Prime problems unfolded, leading the world to nearly the financial abyss, that Central & Eastern Europe was actually the ultimate “sub-prime” problem. From Hungary to the Baltic States of Estonia, Lithuania and Latvia, financial problems are prevalent and tied in some way to the hell that is the Euro.

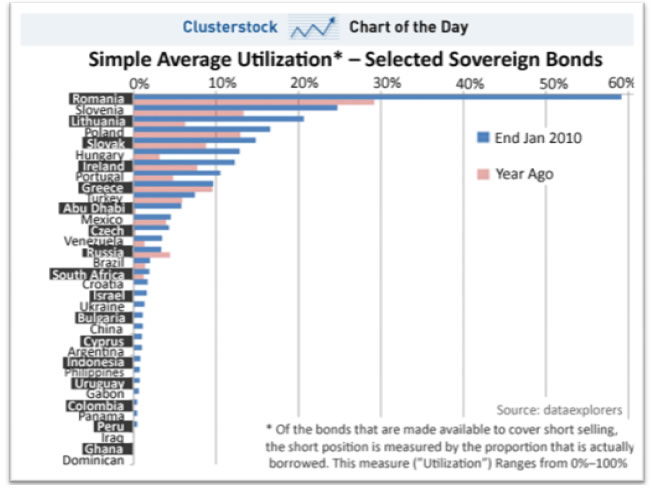

The chart from a February report by Dataexplorers (3) showing bond shorting activity confirms the bigger problem is being viewed by investors to be in fact in Central & Eastern Europe.

Romania, Slovenia, Lithuania, Poland, Slovak and Hungary are all above Portugal & Greece in investor decisions to actually take action and put their money on the line by shorting these countries’ sovereign debt.

Global investors continue to see headline stories from the WSJ 01-28-10: Latvian Annual CPI Falls Further Amid Deep Recession, and ABC News 02-08-10: Lithuanian Economy Shrinks 15 Pct in 2009 that are worrisome. What may yet not be fully appreciated is that these problems are becoming even more serious due to potential European banking stability concerns, every day the PIGS problem is allowed to fester by ECB dithering.

“The massive expansion of Sovereign balance sheets has been essential to compensate for the complete collapse of the Libor market, but it has left investors increasingly nervous. If the Government is lender of last resort, then what happens when they cannot meet their obligations …… Some market discussion and sell side research has investigated the linkages between these countries – for example, the Greek banks are said to have lent heavily to Romania and Bulgaria; most of the Eastern European countries have focused their borrowing in Austria. Patterns like these will determine whether isolated defaults become falling dominoes.”

Sovereign Debt:Tracking the Short Sellers

Dataexplorers - - February 2010 Report

But is it dithering that is really occurring or the fatal flaw of the whole Euro experiment?

Is the Euro not fundamentally based on an assumption that democratically elected governments (even those with left leaning policies) and huge legacy entitlements can actually ‘Walk-the-Talk’ and implement tough choices when they are required by EMU charter requirements? We mean specifically the tough choices spelled with a capital “T”; like those testing Greece’s newly mandated socialist party or Portugal’s also recently elected government with a 10 percent Maoist-Trotskyist Bloco vote.

“Portuguese debt surged (02-04-10) to a record 222 on reports that Jose Socrates was about to resign as prime minister after failing to secure enough votes in parliament to carry out austerity measures. Parliament minister Jorge Lacao said the political dispute has raised fears that the country is no longer governable. “What is at stake is the credibility of the Portuguese state,” he said. Portugal has been in political crisis since the Maoist-Trotskyist Bloco won 10pc of the vote last year”

Fears of 'Lehman-style' tsunami as crisis hits Spain and Portugal

Ambrose Evans-Prichard - Telegraph.co.uk

“In 2009, downgrades and debt auction failures in countries like the UK, Greece, Ireland and Spain were a stark reminder that unless advanced economies begin to put their fiscal houses in order, investors and rating agencies will likely turn from friends to foes. The severe recession, combined with a financial crisis during 2008-09, worsened the fiscal positions of developed countries due to stimulus spending, lower tax revenues and support to the financial sector. The impact was greater in countries that had a history of structural fiscal problems, maintained loose fiscal policies and ignored fiscal reforms during the boom years.”

The Coming Sovereign Debt Crisis

Nouriel Roubini and Arpitha Bykere – Forbes.com

THE CORE ISSUE:

Under close examination, the one striking similarity of all the countries with heavy bond shorting is that they also all have an electorate that has a history of socialist legacy expectations. This is not a political statement but rather an observation of the likely resistance to the implementation of tougher austerity measures that are certainly ahead.

“As growth slows and debt rises in these countries, government largess for university fees, secure government jobs and lifetime pensions will come under increasing pressure. On a continent where the culture and legitimacy of the mother state are so deeply ingrained - and now in some cases unaffordable - a question remains: can the European Commission say ''no more'' to prodigal nations like Greece and, to a lesser extent, Spain and Portugal? And how will the countries themselves confront the political fallout of economic distress? ''People view these welfare polices as acquired rights,'' said Jordi Gal, an economist who leads the Centre for Research in International Economics in Barcelona. ''If the Spanish government were to stop paying the fees for students at universities or any move in that direction, there would be a major social uprising.''

For decades, both conservative and socialist governments in Greece have rewarded the demands of public sector unions with higher pay and more jobs. In 2009, striking farmers were paid €400 million by the government - and this year they are back again, having briefly closed Greece's border with Bulgaria. Protesting dockworkers extracted big payouts from the government in November. And the country's tax collectors went on strike on Thursday, even though their services are needed more than ever. Striking is a bit of a national sport in Greece. Last month, the country's unionized prostitutes took to the streets, protesting unlicensed competition from Russian and Eastern European immigrants. The pressing question now is whether the new Prime Minister, socialist George Papandreou, can break this cycle of appeasing constituencies. (5)

Employment

Employment

When the electorate is facing historical unemployment, how exactly do you stimulate the economy while making massive fiscal adjustments to fiscal budgets to meet EMU debt level governance? This is historically when a country resorts to loosening monetary policies, ‘money printing’ or other forms of currency depreciation.

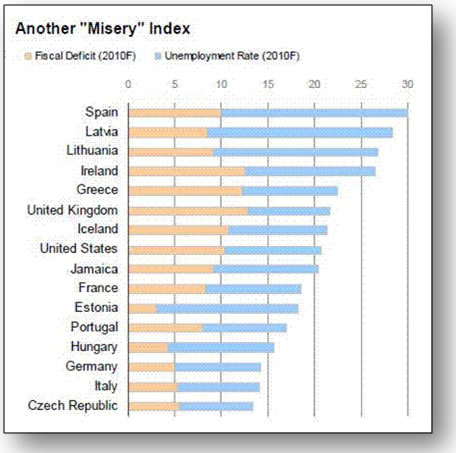

The Misery Index chart shows a significant correlation between the countries being shorted and those also with: failing fiscal policies, fiscal deficits, high unemployment and a disgruntled electorate! Serious social unrest is the obvious consequence that will eventually be blamed on the EMU and the Euro.

Productivity

“The euro has strengthened by more in real terms since its launch in 1999 than any other leading currency. To add insult to injury, Greece and the other peripheral countries have lost competitiveness within the zone. On one measure, Greek unit labor costs rose by 23 per cent against Germany’s between early 2000 and the second quarter of 2009. This is in line with the experience of other peripheral members.” (6)

Is it realistic to expect Greece to fulfill its promise to reduce its fiscal deficit from approximately 12.7 per cent of gross domestic product to 3 per cent by 2012? This has less likelihood of happening then a successful accounting audit of the Greek government financial books!

“The euro zone’s manufacturing sector is growing at its fastest pace in two years. However, there are dramatic differences in how manufacturing is faring within the eurozone which point to the currency as a major source for the loss of competitiveness in Greece, Spain and Ireland. The eurozone manufacturing purchasing manager’s index came in at 52.4 for January, which is the fourth monthly rise and indicates that the manufacturing sector is expanding in the eurozone as a whole. But expansion is not a uniform condition. At Europe’s old 1957 core, things are looking bright.

“The euro zone’s manufacturing sector is growing at its fastest pace in two years. However, there are dramatic differences in how manufacturing is faring within the eurozone which point to the currency as a major source for the loss of competitiveness in Greece, Spain and Ireland. The eurozone manufacturing purchasing manager’s index came in at 52.4 for January, which is the fourth monthly rise and indicates that the manufacturing sector is expanding in the eurozone as a whole. But expansion is not a uniform condition. At Europe’s old 1957 core, things are looking bright.

France is expanding at the fastest pace in nearly a decade, while the Benelux countries, Germany and Italy are also expanding. However, in Spain, Ireland and Greece, the manufacturing contraction continues apace. The fact is weaker manufacturing nations are steadily losing competitiveness and this is hurting their ability to compete. In a recent piece on the tensions these differences are creating, Ambrose Evans-Pritchard notes: German goods are flooding the South. In the 12 months to November, Germany-Benelux had a current account surplus of $211bn: Spain had a deficit of $82bn, Italy $74bn, France $57bn, and Greece $37bn. So the Germans and the Benelux nations have an enormous eurozone internal market surplus. Yes, German or Dutch workers are still more expensive than Spanish or Greek ones. However, when looking at German productivity, the cost differences vanish. The problem? The euro”. (7)

SYMPTOMS:

What the press is following with such interest are the symptoms - symptoms of a possible failed experiment based on an unproven assumption. Whatever the outcome or actions taken to remedy the problems, we can be fairly confident it will not be part of the original EMU governing body of laws and regulations.

Julian Callow from Barclays Capital said the EU may need to invoke emergency treaty powers under Article 122 to halt the contagion, issuing an EU guarantee for Greek debt. “If not contained, this could result in a `Lehman-style’ tsunami spreading across much of the EU.”

Fears of 'Lehman-style' tsunami as crisis hits Spain and Portugal

Ambrose Evans-Prichard - Telegraph.co.uk

THE CONSEQUENCES:

The chances are good that the present standoff between the ECB and PIGS will end with either 1) the ECB creating a massive new moral hazard situation, 2) an IMF bailout, 3) an EC member countries defaulting or 4) the splintering of the union itself. None of the alternatives are particularly appealing and have consequences.

“Most of the time having an independent currency is nothing but a nuisance. But every so often and quite unpredictably, countries desperately need a safety valve. The 1930s were a time when such relief was needed. Our own era is posing what look like similar challenges. Stuff does, indeed, happen. Having willed the creation of the euro, its members must overcome the difficulties that arise when, as now, stuff happens”.

The Greek tragedy deserves a global audience

Martin Wolf, Financial Times

What may be an even bigger concern for the global economy overall, is that the consequences of these resolution activities will likely slow the unwinding of the EU financial actions implemented to stem the financial crisis. This will stealthily seal the case for very high levels of inflation to quietly appear on the horizon as we are all distracted.

EXPERIMENTAL RESULTS:

E3 => T3 => HELL = INSTABILITY = PHASE Shift

Gordon T Long gtlong@comcast.net Web: Tipping Points

Mr. Long is a former executive with IBM & Motorola, a principle in a high tech start-up and founder of a private Venture Capital fund. He is presently involved in Private Equity Placements Internationally in addition to proprietary trading that involves the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, we encourage you confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.