Greece Soverign Debt Crisis, The Way Forward, if Any!

Economics / Global Debt Crisis Feb 11, 2010 - 07:46 AM GMTBy: Vishal_Damor

Morgan Stanley

did quick and extensive scenario analysis along with an update of the Greece situation. Presented below are key highlights and my read.

Morgan Stanley

did quick and extensive scenario analysis along with an update of the Greece situation. Presented below are key highlights and my read.

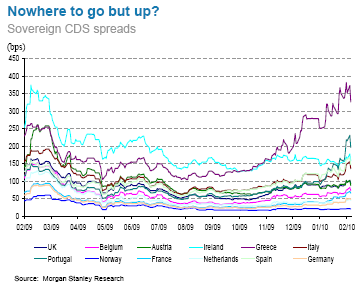

At present, the Greek CDS spread at 355bp is pricing in a 28% default probability over the next 5 years. This is up from a 9.5% cumulative default probability back in June 2009. While we take real issue regarding implied default probabilities on sovereign CDS, it is nonetheless a useful point of context. Although Greece’s inclusion in the EU complicates matters somewhat, we have yet to see a sovereign or credit “crisis” bankruptcy-averting restructuring deal at a meager price point of 355bp.

At present, the Greek CDS spread at 355bp is pricing in a 28% default probability over the next 5 years. This is up from a 9.5% cumulative default probability back in June 2009. While we take real issue regarding implied default probabilities on sovereign CDS, it is nonetheless a useful point of context. Although Greece’s inclusion in the EU complicates matters somewhat, we have yet to see a sovereign or credit “crisis” bankruptcy-averting restructuring deal at a meager price point of 355bp.

Morgan Stanley Quotes:

Markets are in the early stages of differentiating risks. In its simplest form, the negative market reaction around the sovereign debt concerns of peripheral Europe is a natural by-product of “the end of the

easing,” both real and perceived. From necessary fiscal tightening in Europe to monetary tightening in China, the markets are simply reacting to the withdrawal of liquidity. With respect to the peripheral Europe situation, the combination of fiscal austerity and contagion concerns, which, not surprisingly, are linked, will persist for some time to come, and thus so will volatility.

Greeks contagion effects: Morgan Stanley believes the effects from Greece are far more than what the government is pricing in.

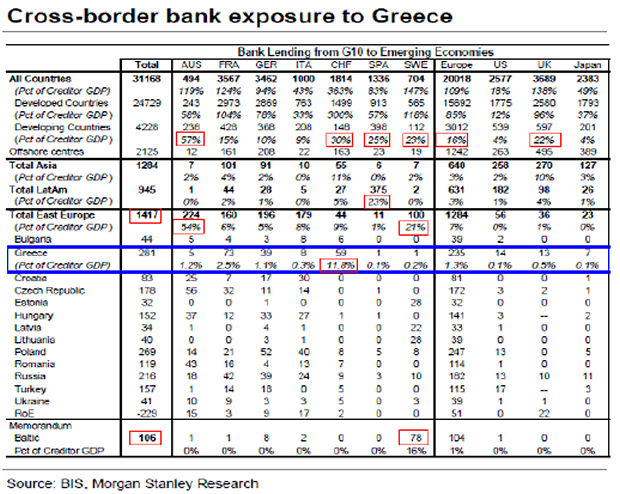

The lesson from the financial crisis of 2008 is that interrelationships across the global banking system correlate markets and allow contagion to spread. And that is the case for Europe today, where the banking system is a critically important provider of capital/credit (relative to the US), creating even more risk around contagion. For example, out of the $748B debt outstanding for Spain, 32% is owned by German banks and 25% by French banks. For Portugal’s $165B in debt, 51% is owned by Spain. These strong linkages could imply a lower tolerance by European authorities, causing them to act early, possibly too early. Lastly, in the extreme (low probability) bear case in which the markets systematically begin punishing countries based on their total indebtedness, the obvious spillover effects to the G3 become quite disturbing.

Greece crisis and it potential probable solution and consequences:

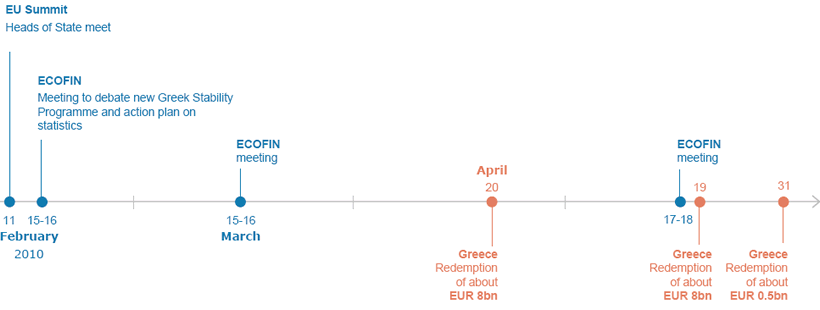

- Bailout by Germany/France consortium: Probablity of 70% and the best possible solution under the circumstances: A bi-lateral loan from EU countries—led by Germany and France—to Greece. Loan terms could be punitive to encourage Greece to take painful but necessary actions. In addition to the proposed European Commission requirement (to be voted on Feb 15/16) that Greece must report at least once a quarter on its fiscal progress, the loan terms may require additional steps beyond what Greece has already announced. Perceptions in Greece and the lender countries as to whether the terms are too strict or not strict enough will determine the speed and likelihood of a loan being completed prior to refinancing dates in April/May.

- Budget cuts and debt roll over: Probability of 20% and a more severe solution: Greece implements proposed fiscal austerity measures, including cuts in spending, a freeze in hiring and wages, and greater effort at fighting tax evasion. Investors view these measures as credible, allowing Greece to successfully roll-over debt and avoid near-term liquidity problems. But the fiscal measures lead to a severe recession, allowing longer-term solvency concerns to remain.

- IMF Package: (Probability 5%): An IMF loan is possible, but very unlikely because it would mean that the ECB and EU are relinquishing control of the situation, thereby creating a major credibility problem. A common feature of IMF-led bailouts—currency devaluation—is not an option for Greece.

- Default: (Probability 5%): Greece is unable to roll-over its debt in April/May and a bailout is not structured in time because either Greece fails to take the necessary actions or political support within the EU for a bailout is not there.

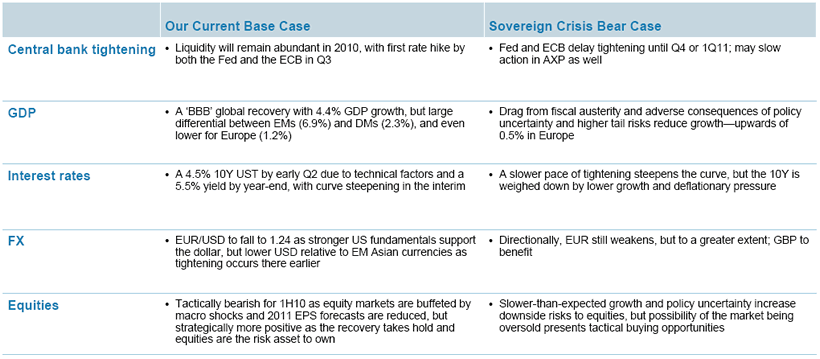

Morgan Stanley lays out different scenarios between a base case and a sovereign bear case.

Noteworthy:

- Equities to underperform in H1FY10 as it gets buffetted by a wave of macro shocks.

- EUR/USD to fall to 1.24. Now that is a big one.

Developments to track Greek public support for fiscal austerity measures is necessary for serious reforms. A strike planned for February 24th (by Greece’s main umbrella union) will be a gauge for sentiment towards announced plans. Greek government will release a draft bill of its tax plan this week. A vote could take place as early as end of February. Greece debt management office has indicated that it will come to market with a 10-year debt auction in late February (possibly the 22nd)—the auction is very important for sentiment and its subscription and financing rate will be closely scrutinized. A bailout is highly controversial in Germany and likely to be a main issue in key German regional elections for parliament if it’s viewed as not being tough enough. A loss by the ruling CDU/CSU/FDP coalition would put Merkel’s majority at risk.

Source: BIS, MS, GS Research

Source: http://investingcontrarian.com/global/soverign-debt-way-forward-if-any/

Vishal Damor

http://investingcontrarian.com/

Vishal Damor, works for an emerging market financial consulting firm and is the editor at INVESTING CONTRARIAN, a financial analysis and reporting site covering commodities, emerging markets and currencies.

© 2010 Copyright Vishal Damor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.