Gold Rises to New Record Nominal Euro High over €817/oz

Commodities / Gold and Silver 2010 Feb 16, 2010 - 08:05 AM GMTBy: GoldCore

Gold built on last week’s gains and rose nearly 1% yesterday, closing at $1,099.50/oz and gold also rose in other major currencies. Gold has risen in Asian trading and again in early European trade and is currently trading at $1,113.20/oz and in euro and GBP terms €816/oz and £710/oz respectively. As expected the crisis in the Eurozone has seen gold surge in Euro terms to new record (nominal) highs over €817/oz – thus surpassing the previous record high seen in December 2009 at €813/oz.

Gold is well supported by oil steady near $75 a barrel (NYMEX March 10) and the dollar having weakened to 80.17 on the US dollar index. Markets continue to focus on sovereign debt issues in the Eurozone and Dubai’s debt woes are have also resurfaced (see News below). The meeting of finance ministers of the full 27-nation European Union with Greece expected to be top of the agenda may give guidance to markets. Investors fear a Greek default could spark a wider European debt crisis, threatening the ability of governments internationally to borrow money.

International financial contagion remains a risk and the cost of insuring sovereign debt is rising for all countries internationally. As long as there remains the risk of the ignition of what is being called the global debt time bomb, it is hard to see how gold will not remain in strong demand, particularly with investors and central banks internationally. The notion that other major economies such as the UK and US are not challenged by similar challenging fiscal risks is erroneous and it seems likely that it is only a matter of time before markets begin to focus on the risks facing all western economies.

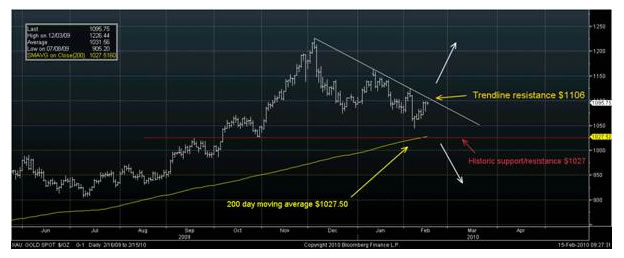

Technically gold is looking better after the recent vicious selloff (see Bloomberg chart). A close today over trend line resistance at $1,106/oz could quickly see us challenge the next level of resistance at the $1,150/oz level.

Silver

Silver rose 0.5% yesterday and has had a strong morning in Asia moving from $15.70/oz to as high as $15.85/oz. Silver is currently trading at $15.80/oz, €11.57/oz and £10.07/oz.

Platinum Group Metals

The PGMs have also caught a bid and risen. Platinum is trading at $1,536/oz and palladium is currently trading at $430/oz. While rhodium is at $2,500/oz.

News

· Greece has been told that it must make further spending cuts or face sanctions, the eurozone chief has said. Jean-Claude Juncker told German radio that Greece must understand that other eurozone members are not prepared to pay for its mistakes. After the European Union vowed to helped Greece last week, the tone has turned harsher this week as talk of a bail-out proves unpopular. Greece's woes have sent the euro down to a nine-month low recently.

· Crude oil rose after gains in Asian equities and growth in Japan’s economy increased confidence that a global economic recovery will lead to higher fuel demand. The MSCI Asia Pacific Index rose 0.5 percent to 116.5 in Tokyo as banks reported higher profits. Japan, the world’s third-biggest oil consuming country, yesterday reported 4.6 percent growth in gross domestic product for the three months ended Dec. 31, surpassing the 3.5 percent median estimate of economists surveyed. “Japan had better-than-expected growth in the fourth quarter of 2009 and Japan is the second-biggest economy in the world and the third-biggest oil consumer,” said Thina Saltvedt, a commodities analyst at Nordea Bank AB in Oslo. “That’s given some support to the oil.” Crude oil for March delivery rose as much as $1.10, or 1.5 percent, to $75.23 a barrel in electronic trading on the New York Mercantile Exchange today. It was trading at $74.91 a barrel at 8:44 a.m. London time.

· Consumer price inflation in the UK rose even further above its 2 percent target in January as expected, though the Bank of England is likely to say this will be temporary when it is forced to explain itself to the government later on Tuesday. Bank of England Governor Mervyn King will send a letter of explanation to the Chancellor today. Economists are forecasting that the rise is temporary and is due to a return to the 17.5% VAT rate and higher petrol costs taking effect.

· The Dubai debt talks may again cause jitters in markets following news that Dubai World may offer creditors just 60% of the money they are owed as part of a deal to reschedule $22 billion in debt. This will result in significant added exposure for many western banks.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.