What’s So Special About This Nasdaq Stock Index Chart?

Stock-Markets / Stock Markets 2010 Feb 25, 2010 - 01:15 AM GMTBy: David_Grandey

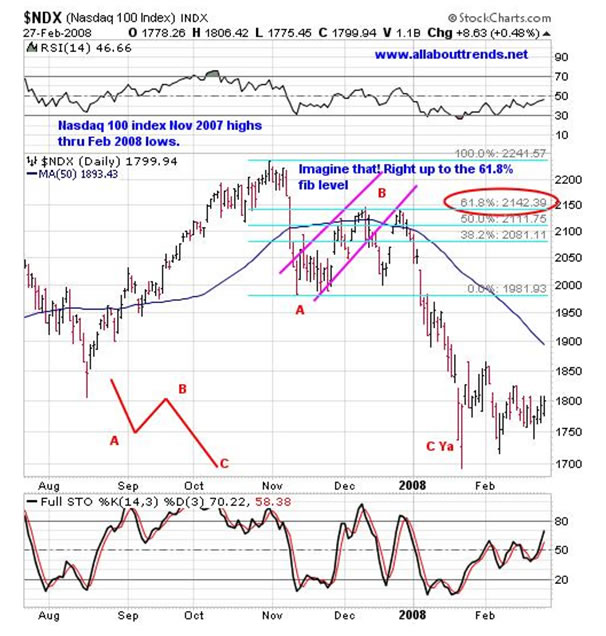

It's the NDX 100 Index off the 2007 peak. Does anything jump out at you? It should

It's the NDX 100 Index off the 2007 peak. Does anything jump out at you? It should

Take a good look:

We've talked about ABC's.

We've talked about Fibonacci levels.

We've talked about trend channels.

That's a big picture chart. Now let's zoom in and look a little closer at the chart above.

We've talked about ABC's.

We've talked about Fibonacci levels.

We've talked about trend channels.

We've talked about the 50 day average.

Now Take a look at the chart below, see anything?

If the similarities of the two charts above don't make you go whoa? We don't know what will. Those who are long only? You better be prepared!

Those who are wise enough to take control of their own destiny vs. allowing a traditional wall streeter to do so? Better start think about hedging the long side of your account. Those who have 401k plans investing heavily into equities, you might want to think about raising some cash. Those who have IRAs and can't short? Better be looking at inverse ETFs.

Those who see it for what it really is? Yep get ready to have some fun on the short side.

Look at the current chart of the S&P 500. Look familiar? It should, its' setting up the same way the NDX 100 did back in 2007 JUST

BEFORE The Markets gave back 10+ years worth of gains. You don't want to potentially have to go through that again do you? After all those who fail to learn from history are doomed to repeat it right?

Right now there are two things missing.

1. The C Wave of the ABC down we've been talking about for weeks here. By the time that wave is clear the damage will already have been underway and as we've always said you're late to the party

2. And of course YOU!

So the big question at this point is? If this breaks are you going to be prepared to take action or be a deer in the headlights?

We've got a list of short sell set ups that have been triggering every day for the last few days.

Hopefully you have been paying attention.

Want to know when the market is going to turn? We know, and it has nothing to do with the stock market and everything to do with psychology.

Week after week we've been laying out the most likely outcome here based upon Technical Analysis and it's ALL been in advance of it happening too. Now we are not saying that what happens next is exactly what is going to happen as we are not one to tell the market what it should do because the market doesnt care what you or us think -- it does what IT wants to do.

NOTE: Those who rode the whole market all the way down off the 2007 highs via a traditional Wall St. style of account PLEASE PAY

EXTRA ATTENTION.

If you continue to think the way you've always thought you are going to get the results you've always got. If you are getting the results you want? Just keep thinking the way you've always thought. If you haven't been getting the results you want? Then you need to change your thinking.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

27 Feb 10, 15:22 |

analysis

You are so naive with this analysis.... |