U.S. Treasury Bonds, It's All The Same Trade!

Interest-Rates / US Bonds Mar 09, 2010 - 02:22 PM GMTBy: Guy_Lerner

One of the frustrating aspects about this market environment is that all assets look like the same trade. Betting on equities is a bet against bonds or vice a versa, betting on bonds is a bet against equities. It is that simple. Consequently, using a tactical asset allocation strategy makes it hard to diversify away my risk as I end up being all in on essentially what has become the same trade.

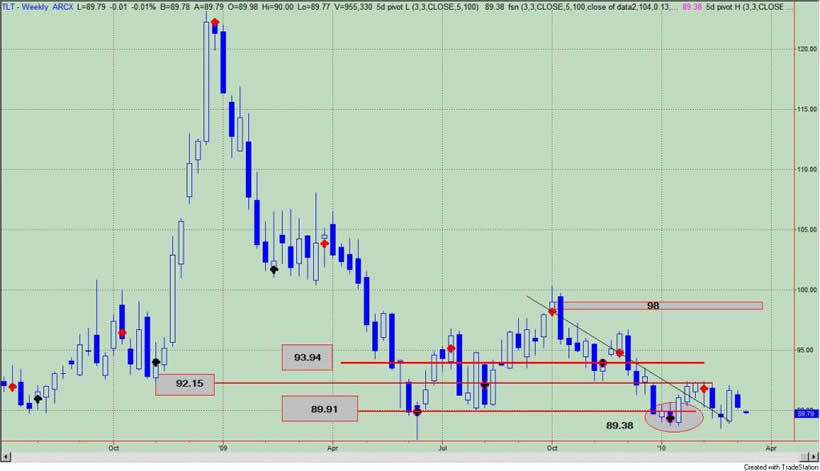

From my perspective, one of the best places to park my money would be in Treasury bonds as the reward to risk is greatest. This can be seen in figure 1 a weekly chart of the i-shares Lehman 20 + Year Treasury Bond Fund (symbol: TLT). The key pivot point at 89.38 is support, and a weekly close below this level would be lights out for TLT - expect much lower Treasury bond prices or higher yields. In addition to being close to support levels, the "smart money" or commercial traders from the Commitment of Traders data is bullish on bonds, and the "dumb money" or Market Vane Bullish Consensus is extremely bearish. It is within this context - low (and quantifiable) risk and betting with the "smart money" and against the "dumb money" - that I see this as the "better" trade. Despite the resistance overhead, I believe that TLT could make it to $98.

Figure 1. TLT/ weekly

The flip side to Treasury bond trade has become the equity trade. As we have chronicled over the past couple of weeks, this is the crowded trade. There are too many bulls. In addition, there are headwinds in the form of strong trends in 10 year Treasury yields, gold, and crude oil. In essence, to bet with the equity bulls, you have to ignore risks and jump into the market while holding your nose. You are buying high to sell higher. In my opinion, the best case scenario for the bulls would be a persistence of the trading range that we have been in for the past 5 months.

Only time will tell as the story unfolds, but from this perspective, the safer and better reward to risk trade is with Treasury bonds. We should have our answer soon enough.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2010 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.