Gold, Investor Doubt And Uncertainty Are Commonplace

Commodities / Gold and Silver 2010 Apr 01, 2010 - 02:48 AM GMTBy: Aden_Forecast

Most people seem to be confused these days. This not only applies to investors, but to everyday folks across the spectrum. People hear one thing, but they see another. Doubt and uncertainty are, therefore, fairly common.

Most people seem to be confused these days. This not only applies to investors, but to everyday folks across the spectrum. People hear one thing, but they see another. Doubt and uncertainty are, therefore, fairly common.

This is not unusual. The times are uncertain. Unprecedented historical events are taking place. And even though many aren’t aware of the details, a majority of nearly 90% feel that the U.S. government is broken. They know things aren’t right, so this leads to confusion.

We know by your letters that’s how some of you are feeling and we totally understand why. This tells us that it’s a good time to stand back and review some basics…

TRADERS VS INVESTORS

Many of you, for instance, want to know when to buy or sell metals or gold stocks. That’s especially true now that the markets have been correcting. What to do, should I sell and so on. These questions can essentially be categorized as trading questions, so we’ll start with that.

The simple facts show that sooner or later, most traders end up losing money. Sure, there are some who follow the markets daily, they’re nimble and smart and they make money, but these are a very small minority.

Whatever happened to all of the hot shot day traders who were making bundles during the tech boom?

The reason you haven’t heard about them over the past 10 years is because there aren’t many. From what we’ve heard, most of them lost nearly everything. So was it worth it? No.

We know trading can be fun. If you know what you’re doing it can be profitable. Some investors are very good at it and they provide trading services, which are very worthwhile.

But for the majority of investors we advise investing based on the major trends. These are the trends that last at least a year and sometimes many years. That’s where the big moves take place and it’s where you’ll make the most money over the long haul.

To do this, however, you have to be patient. And you have to understand that there will be ups and downs (corrections) along the way. No market goes straight up, but if a major trend is up, you will profit. As legendary investor Warren Buffett has often said, you only need to make one or two good trades a year and that’s enough.

GOLD IS A GOOD EXAMPLE

Gold provides a good example of this. It started moving up in 2001 after bottoming near $250. It’s now above $1100 and it’s been the best investment of the decade. Does it really matter if you bought it at $350, $500, $800 or more? No it doesn’t. Was the price too high near $1000 when India bought gold from the IMF? No it wasn’t.

The main point is, the major trend is up, meaning it’s going higher probably for many more years to come. Ideally, you’d want to buy new positions during a downward correction, which is what we strive to do, but it’s really okay to buy at any time. That’s what we mean by taking a big picture view and it applies to all investments that are in major uptrends.

Remember, markets are always looking ahead. They’re not interested in what’s happening today or yesterday. That’s why it’s most important to let the markets tell you what’s likely coming up, which is what we focus on, and then go with it. All of the reasons why will always become obvious in time.

Of course, the news is important and at times it’s very important. There are also times, however, when it’s a non-event. But if you make investment decisions based solely on the news instead of the market action, you generally won’t do well.

To make our point, we’ll use the economy as an example since it’s currently the cause of a lot of this confusion…

IT’S A RECOVERY, AFTER ALL...

We know that many people don’t believe this but the economy is recovering. We also know that there are many things wrong with this recovery, but nevertheless it is a recovery.

The stock market has been rising for a year now. It’s been telling us that an economic recovery was coming. The stock market is still in a major uptrend and it’s now moving up again. So it’s telling us that the economic recovery is going to continue.

The index of leading economic indicators is reinforcing this. It’s been rising for 10 consecutive months. This indicates a strengthening recovery over the next six months or so. Other economic signs are pointing in the same direction.

This is one case of the market action and the news coinciding, which is ideal. But it doesn’t always happen that way. It also doesn’t tell us how long the recovery is going to last. But still, that’s the reality and we have to go with it for however long it does last.

... BUT HIGH PRICE TO PAY

We all know that this recovery is based on unsound fundamentals. Massive spending and excessive stimulus have been the primary driving factors boosting the economy, which grew at an annual rate of 5.9% in the last quarter of 2009, the largest quarterly gain in six years.

So there has been a high price to pay for this recovery. It has come about because an unthinkable amount of debt has been taken on. Consider this…

In the U.S., it took nearly 200 years for debt to reach the $1 trillion level. Last year alone the debt was almost twice that and it’s now near $13 trillion. This happened in a relatively short period of time and all U.S. debt now amounts to about $250,000 per person.

UNSUSTAINABLE SITUATION

Is this healthy? Of course not! Experts estimate that in about 10 years just the expenses for the interest payments on the debt and Social Security will take up about 80% of all of the government’s income.

The other 20% will have to pay for everything else. So obviously this means huge debts for as far as the eye can see. It also means that further efforts will be made to keep interest rates low for as long as possible to avoid exploding interest payments, which would rise along with rising interest rates.

In addition, inflation will eventually result due to the Fed’s aggressive monetary policies. In fact, this is already getting started since producer prices have had sporadic surges in recent months with a 17% annualized rise in January.

That’s why so many experts are pessimistic and/or uncertain about the economy’s future. The same goes for the public, and they’re right.

Nevertheless, the economy is still recovering. Even though it may not make sense or have a healthy foundation, it’s happening and as an investor that’s what we have to deal with.

CHANGE TAKES TIME

One important factor, which could partially explain why this discrepancy is currently taking place is because big changes usually end up taking much longer than you’d think.

In other words, sooner or later the negative economic fundamentals (debt) are going to catch up with reality. There will be severe consequences. But again, no one knows exactly when that’s going to happen.

The markets, however, will provide plenty of insight and we’ll take that, rather than the dozens of expert opinions out there.

Meanwhile, as an investor, try not to feel pressured. There really isn’t a hurry.

A DISCRETE BULL MARKET

Gold’s major trend has been up for nine consecutive years, yet the investing public has barely begun to invest. It’s not well known that this bull market even exists. This in itself is bullish because it means the 375% gain over the last almost decade will be pale compared to the potential this second phase of the bull market could have.

The markets are one big ball of mass emotions. And in many ways, the first nine years of the stock market’s mega bull market rise from the mid-1970s through the 1990s was similar to this bull market rise in gold.

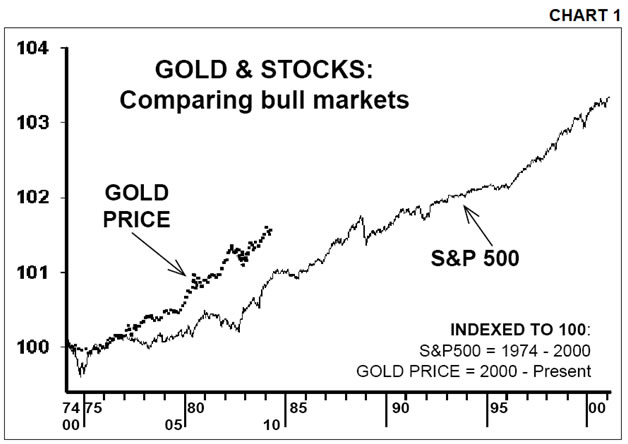

Chart 1 shows the S&P500 from the 1974 major low to the 2000 peak, compared to the gold market from its 2001 low to the present. Here you can see the similarities of the first nine years.

In both cases, the rise wasn’t generally noticeable because another overpowering market was the main focus. In 1974-1983 the gold market was the flurry, not the stock market. Since 2001, it’s been the stock market flurry, which carried over from the tech and global boom, that has had more attention.

This is not to say that gold today is where the stock market was in 1983, ready to embark upon a mega decade bull market, but it could. These similarities and many others suggest that gold’s bull market has much further to run.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.