Freaky Thursday - Foreclosures and China GDP Hit Records

Stock-Markets / Financial Markets 2010 Apr 15, 2010 - 10:04 AM GMTBy: PhilStockWorld

"I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs." - Thomas Jefferson

"I believe that banking institutions are more dangerous to our liberties than standing armies. If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs." - Thomas Jefferson

Poor Jefferson must be rolling over in his grave today one in 138 American homes (932,234) received a default or auction notice, or were repossessed by banks in the firs quarter of this year. That is an annualized pace of 3% of all homes (i.e.. one in 33), which means THIS YEAR, someone on your block is having their home taken from them…

Poor Jefferson must be rolling over in his grave today one in 138 American homes (932,234) received a default or auction notice, or were repossessed by banks in the firs quarter of this year. That is an annualized pace of 3% of all homes (i.e.. one in 33), which means THIS YEAR, someone on your block is having their home taken from them…

Foreclosure filings in the U.S. rose 16 percent in the first quarter from a year earlier and bank seizures hit a record as lenders stepped up action against delinquent homeowners, according to RealtyTrac Inc. Unemployed and “underwater” homeowners, or those who owe more than their property is worth, are driving foreclosures. The U.S. jobless rate was 9.7 percent in March, unchanged for a third month, the Labor Department reported April 2. More than a fifth (20%!!!) of mortgaged homes were underwater in the fourth quarter, according to real estate data firm Zillow.com. Bank repossessions climbed to 257,944 in the quarter. Scheduled auctions totaled 369,491, also the most since RealtyTrac began releasing data.

Please read that again. 3% of the homes in America are being foreclosed on NOW. 20% of the homes in America are underwater, 10% of the population is unemployed, 25% of the population is "underemployed." These numbers will not just go away because the S&P hits 1,200!

Foreclosure prevention efforts such as the U.S. Treasury’s Making Home Affordable Program may have “slowed down the normal foreclosure timeline,” James J. Saccacio, RealtyTrac’s chief executive officer, said in today’s report. The number of homes seized by lenders rose 35 percent from a year earlier, RealtyTrac said. Auctions increased 21 percent from the same period in 2009. Nevada has the worst rate in the nation with 1 in 33 homes getting a notice in Q1 - an annual rate of 12% of all homes - PER YEAR! This is exactly what Jefferson was worried about over 200 years ago…

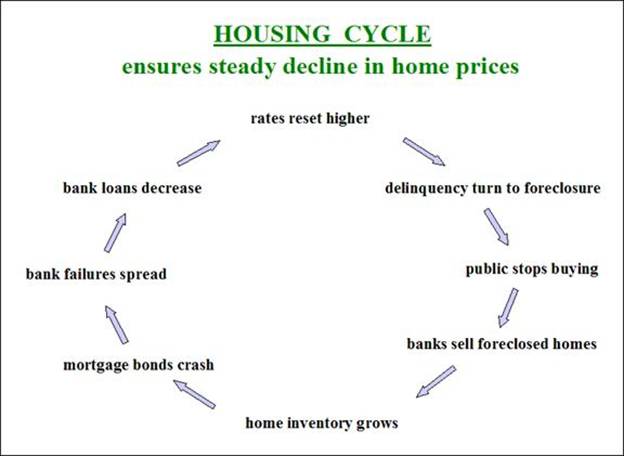

Note from the chart on the right and as we’ve discussed previously, there is a 10-month gap between missing your mortgage payment and losing your home. Right now, there are MILLIONS of Americans somewhere in this loop, effectively living rent-free for as long as it lasts. This is putting over $40Bn a month into the consumer spending pool that otherwise would be chewed up by mortgage payments so we are pretty much boosting retail spending at the banks’ expense but, of course, nothing really comes at the banks’ expense since they hide all their losses until the government papers it over so this is all just a part of the overall free money party being thrown by the Fed at the eventual expense of the taxpayers.

And who, ultimately, benefits from the confiscation of the people’s property? Who are the banks and the corporations that grow up around them that Jefferson warned us about? If you’ve been reading my columns, it’s an easy answer and I’m not going to get into it here because many of those companies will be appearing on this weekend’s new Buy List (which I just updated for Members this morning) as those who have money get to buy your old property for 50 cents on the dollar - maybe less. This is the game that’s been going on since long before Jefferson’s time, ever since 1215 when the English Barons (not the people) forced King John to grant them lasting property rights which they in turn used to turn their former serfs into wage slaves by dangling the carrot of property ownership in front of the working man.

It’s a simple method of buying low and selling high. The landowners play a long game since they start the game with money and can afford to be patient (like poker). They keep available land scarce and drive up the prices, and they drive up demand by lending money (to buy their own properties) until the value reaches a point at which they begin to dump land on the open market, which then decreases the price and drives the borrowers to default. At the same time they stop lending money, meaning no new buyers will come on the market at which point the peasants who need to sell their land are totally screwed and are forced to lose substantial amounts - often their life savings - in order to get out of the constant debt burden of home ownership. Once the properties crash back to very low levels, the Barons (who still won’t lend to others to keep out competition) begin to confiscate what properties they can and buy back the rest. Once they have their land back - they begin the cycle again. Isn’t capitalism great?!?

Speaking of Capitalists who have lots of money - China’s economy is growing at an 11.9% pace and that sort of news used to take down the markets as it indicated they would put on the brakes but China is doing a neat trick by keeping consumer price inflation way down at 2.4% while the manufactures eat the rest of the 5.9% increase in Producer Prices - isn’t that nice of them? Some investors, including hedge fund manager Jim Chanos, already see a property bubble in China that could reverberate around the world if it bursts. “The case for policy tightening remains intact given the risks of China’s economy overheating,” said Brian Jackson, a Hong Kong-based strategist at Royal Bank of Canada. “The additional measures announced today suggest policy makers remain reluctant to use the blunt instrument of higher interest rates, but it is unlikely that extra fine-tuning will be enough to slow down the property market. Residential and commercial real-estate prices in 70 cities climbed 11.7 percent in March from a year earlier, the most since data began in 2005. ”

The Hang Seng was pretty much flat on this news and, in fact, fell from 22,338 at the open to 22,158 at the close but that still counts at a +36 day so we put that in the win column for the Honorable Trade-Bot of China. Shanghai couldn’t hold it together but did run up 30 points into the close and finished down just 0.04% for the day - not too bad after spending most of the day falling 50 points (1.5%). The Nikkei celebrated the usual dollar spike back to 93.5 Yen which, as usual, reversed once the Nikkei closed in what is perhaps the biggest joke in all of investing (buy Yen at 9 pm, sell yen the next morning).

The Hang Seng was pretty much flat on this news and, in fact, fell from 22,338 at the open to 22,158 at the close but that still counts at a +36 day so we put that in the win column for the Honorable Trade-Bot of China. Shanghai couldn’t hold it together but did run up 30 points into the close and finished down just 0.04% for the day - not too bad after spending most of the day falling 50 points (1.5%). The Nikkei celebrated the usual dollar spike back to 93.5 Yen which, as usual, reversed once the Nikkei closed in what is perhaps the biggest joke in all of investing (buy Yen at 9 pm, sell yen the next morning).

Europe is flat this morning wondering what we are going to do and Greece is off again - scrapping their bond issue due to a seeming lack of demand. This is the kind of thing we would be worried about if we hadn’t switched our brains off and gone bullish and we will keep our brains switched off as long as we are over our levels.

Sure we dropped 484,000 jobs last week and sure that was 10% more than expected and sure continuing claims are up to 4,639,000, which is 59,000 more than expected and up 70,000 from last month. Who cares about that, Cramer says to ignore all those funnymentals and we’re sticking with Cramer! Capacity Utilization remains an anemic 73.2% but that makes sense as 25% of the population is underemployed and 10% have no jobs at all so why turn the machines on? See - we’re saving energy! Industrial Production was up 0.1% vs 0.5% expected but that’s just an 80% miss so we’re not going to worry about that are we?

The Empire Manufacturing Index was a legitimate bright spot at 31.86, up from 22.86 last month and blowing away expectations (and all logic) of 24. Do we believe that Manufacturing ramped up 25% in a single month? Sure, why not - we believe the economy is recovering, we believe inflation is under control and we believe housing is coming back so why the hell wouldn’t we believe this - don’t forget, we’re just 8 months away from our Santa rally too!

So ho-ho-ho we’re going to party like it’s 1999 for another day at least, the Nasdaq will punch through 2,500 today and the NYSE is over 7,700 and we’ll get our Russell 720 too. All that’s left now is SOX 400 and it’s the perfect top - oops, I mean mid-point… silly brain, must have had too much coffee this morning…

By Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2010 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.