Why The Fed's Interest Rate Cut Did Not Come As A Surprise

Interest-Rates / US Interest Rates Aug 21, 2007 - 12:32 AM GMTBy: John_Mauldin

This week's Outside the Box is from good friend and South African partner Dr. Prieur du Plessis of Plexus Asset Management. Prieur suggests that we should not be surprised at last week's rate cut, as it is consistent with past rate cut cycles when viewed from the fact that banks are tightening up on their lending standards to both consumer and commercial borrowers. There are a number of very original graphs here with some very interesting analysis that is truly Outside the Box.

This week's Outside the Box is from good friend and South African partner Dr. Prieur du Plessis of Plexus Asset Management. Prieur suggests that we should not be surprised at last week's rate cut, as it is consistent with past rate cut cycles when viewed from the fact that banks are tightening up on their lending standards to both consumer and commercial borrowers. There are a number of very original graphs here with some very interesting analysis that is truly Outside the Box.

John Mauldin, Editor

Why The Fed's Rate Cut Did Not Come As A Surprise

by Dr. Prieur du Plessis

Since hitting a peak on July 16, the meltdown in global stock markets has taken place with lightning speed. Given the fact that more than 10% (using the Dow Jones World Index as a proxy for global stocks) has already been wiped off investors' scoreboards, the question invariably is how low can we go.

Has the Fed come to the rescue of markets with today's cut of the discount window rate from 6.25% to 5.75%? Before getting stuck in analysis, let's take a look at a very useful diagram devised by my colleague Ryk de Klerk, strategy consultant of Plexus Asset Management. The chart below summarizes the cause of the current global liquidity crisis and the eventual intervention by major central banks in an easy-to-understand manner.

Source: Plexus Asset Management

In the midst of the current crisis one should concentrate on what is happening and what can be expected by central banks, especially the Federal Reserve. The major concern of the Fed is undoubtedly the potential impact of the crisis on the US economy, especially with banks having been forced to tighten their lending standards due to deteriorating balance sheets.

The Fed's July Senior Loan Officer Opinion Survey for the second quarter revealed that banks have tightened their lending standards for consumer loans in the second quarter and as a result of the severity of the crisis are currently making their standards even more onerous.

Source: Federal Reserve Board

*Est. = estimate by Plexus Asset Management

The same is probably happening with corporate clients.

Source: Federal Reserve Board

*Est. = estimate by Plexus Asset Management

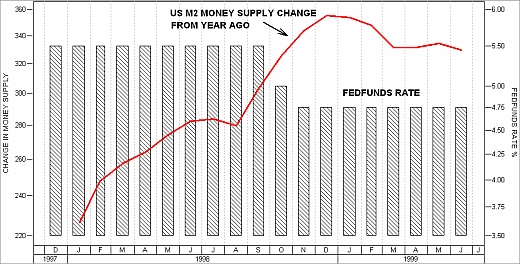

In recent history, whenever banks tightened their lending standards for corporate clients for whatever reason at the time when the Fed pursued an accommodative monetary policy, the Fed intervened.

At the end of January 1996 banks started to increase their lending standards. The Fed cut the Fed funds rate to "... keep the stance of monetary policy from becoming effectively more restrictive ..." (see 1 on chart below).

The Fed cut the Fed funds rate in September 1998 as the Fed organized the rescue of Long-Term Capital Management, a very large and prominent hedge fund on the brink of collapse (see 2 on chart below).

In 2001 the Fed cut the Fed funds rate aggressively as it was very accommodative in its monetary policy, but the banks kept their lending standards extremely tight at a time when massive corporate scandals unfolded (see 3 on chart below).

This brings us to August 2007 (see 4 on chart below), explaining the Fed's rate cut of earlier today.

Sources: Federal Reserve Board, I-Net Bridge

Also, when the Fed cut rates in 1996, 1998 and 2001 the real Fed funds rate was not dissimilar to the current real Fed funds rate.

Sources: Federal Reserve Board, I-Net Bridge

But the real Fed funds rate is currently more restrictive than in 1998 given the state of the US economy.

Sources: Plexus Asset Management, I-Net Bridge

Tightening of lending standards is of major concern to the Fed regarding future economic growth and it will not come as a surprise to see the US ISM Non-manufacturing Purchasing Managers' Index (PMI) declining significantly.

Sources: ISM, Federal Reserve Board

And keep in mind that the non-manufacturing component accounts for more than 80% of the US economy.

Sources: ISM, I-Net Bridge

The Fed has always provided liquidity (as measured by zero maturity money growth) when banks tightened lending standards excessively and was probably acutely aware of the imminent credit crisis by significantly adding liquidity since the first quarter of this year - as it did in 1998 before lowering the Fed funds rate.

Sources: Federal Reserve Bank of St. Louis, Federal Reserve Board

The level of inflation is of no concern to the Fed in the decision to intervene. On all occasions of Fed intervention the inflation rate (CPI) was higher than it is currently, except in 1998.

Sources: Federal Reserve Bank of St. Louis, I-Net Bridge

It is not inconceivable that rate cuts could follow the same pattern as in 1998, with two or three cuts in quick succession.

Source: I-Net Bridge

Without the Fed providing liquidity, the economy could be in deep trouble, making a recession almost inevitable.

Sources: Plexus Asset Management, I-Net Bridge

What is the typical reaction of markets following a cut in rates? Let's consider what happened in 1998.

Equity prices soared ...

Source: I-Net Bridge

and metal prices started to recover only a quarter later, but the gold price kept drifting lower.

Source: I-Net Bridge

Comparing the markets now with 1998 provides some guidance.

Equities ...

Source: I-Net Bridge

Metals ...

Source: I-Net Bridge

In conclusion, the recent events have brought forward the roll-over of the US economy and it is likely to remain weak for at least another two quarters. After today's rate cut the action of the Fed has now firmly moved to centre stage as far as mapping out the direction of stock markets is concerned. It is not clear at all, however, to what extent the US will be able to avert a significant economic slowdown and whether stock markets will manage to stay on the rails.

As far as investment strategy is concerned, the conclusion remains rather to err on the conservative side with whatever you do and not to frown upon holding cash. Suffice to say, the current market environment reminds me of the saying that "in these days the focus should be on the return OF capital rather than the return ON capital". (Also see my article on " Where to hide from jittery financial markets ".)

Source: Unknown

Dr Prieur du Plessis is managing director of Plexus Asset Management. The address of his blog, Investment Postcards from Cape Town , is: www.investmentpostcards.com (subscribe to blog in top right-hand corner to receive automatic e-mail updates of new postings).

Your thinking that things take at least a few months to get back to normal analyst,

By John Mauldin

http://www.investorsinsight.com

To subscribe to John Mauldin's E-Letter please click here: http://www.frontlinethoughts.com/subscribe.asp

Copyright 2007 John Mauldin. All Rights Reserved

John Mauldin is president of Millennium Wave Advisors, LLC, a registered investment advisor. All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors before making any investment decisions. Opinions expressed in these reports may change without prior notice. John Mauldin and/or the staff at Millennium Wave Advisors, LLC may or may not have investments in any funds cited above. Mauldin can be reached at 800-829-7273.

Disclaimer PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.