When Gold Fundamentals Don’t Matter

Commodities / Gold and Silver 2010 Apr 25, 2010 - 01:24 AM GMTBy: Kevin_George

One of the biggest talking points in the financial world is the direction of Gold. The internet is awash with predictions of price, mostly based on some combination of inflation, money-printing excesses and Chinese demand.

One of the biggest talking points in the financial world is the direction of Gold. The internet is awash with predictions of price, mostly based on some combination of inflation, money-printing excesses and Chinese demand.

Those who believe that gold is a one-way bet, are failing to account for the potential of an unseen event, such as the sub-prime fallout or the Lehman Brothers collapse and the effect they had on the financial markets. This despite the recent problems in Dubai and Greece, with many more debt-ridden countries close behind. The reflation of all risk assets created from the March 2009 low, is once again a serious risk to the markets and any unwind would likely be more severe than the 2008 collapse.

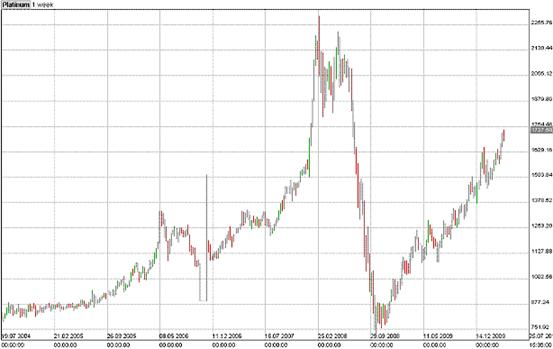

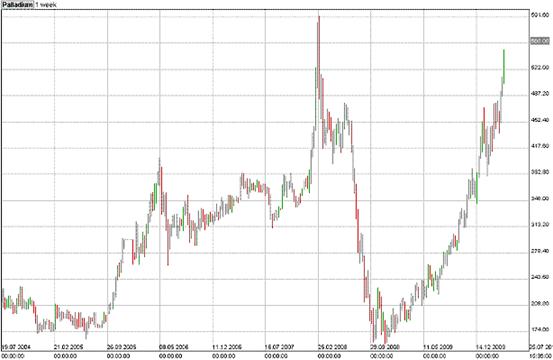

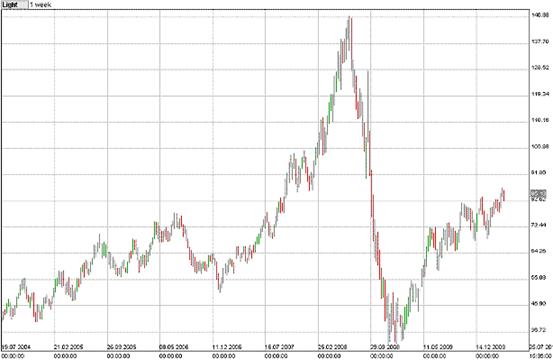

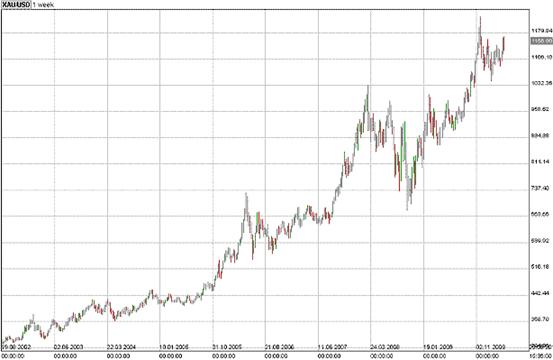

As the following charts show, markets in all commodities collapsed in tandem regardless of the supply and demand picture, Chinese consumption etc. This is the point where the fundamentals don’t matter and the market will find its own price for precious metals and commodities, as it did in 2008.

The collapse in commodities also had a big effect on gold, with the price falling from around $1015 to $695. The key point to note here, is that this move happened before the mainstream media, retail investors, ETFs and Hedge Funds “doubled up” the speculative risk on gold. As was seen during the collapse of 2008, China wasn’t there to support the market on the way down and neither were Hedge Funds or Institutions who were caught up in the fear of the moment or exacerbating the move down with margin calls or short selling.

What would happen if another credit/carry trade de-leveraging scare occured? What would happen if China was once again affected and had to halt its recent stockpiling of commodities at the same time? What would happen if once again, margin calls across the world created forced sellers in the trillion dollar markets?

The drive in the Gold price since 2008 has been helped by huge Chinese stockpiling and diversification, Hedge Funds investing billions to speculate and hedge against inflation and by the rush of retail investors who believe that price is on a one-way trip to $5000. How many will have the stomach to stick to their guns in the event of an unwind.

Gold will almost certainly form the basis of a new financial system if the recent experiment in endless money creation fails but before this happened, a very brisk and very painful shakeout of speculative positions would be first on the agenda. Therefore, Gold longs only have one hope in today’s climate- that the recovery is real and inflation rears its head from the reflation exercises. If a second deflationary scare appears first, the fundamentals won’t matter.

By Kevin George

kg-publishing@hotmail.co.uk

I am an independent financial analyst and trader.

© 2009 Copyright Kevin George - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.