It’s A Market Of Stocks, Not Just A Stock Market

Stock-Markets / Stock Markets 2010 Apr 29, 2010 - 04:09 PM GMTBy: David_Grandey

It’s A Market Of Stocks Not Just A Stock Market

It’s A Market Of Stocks Not Just A Stock Market

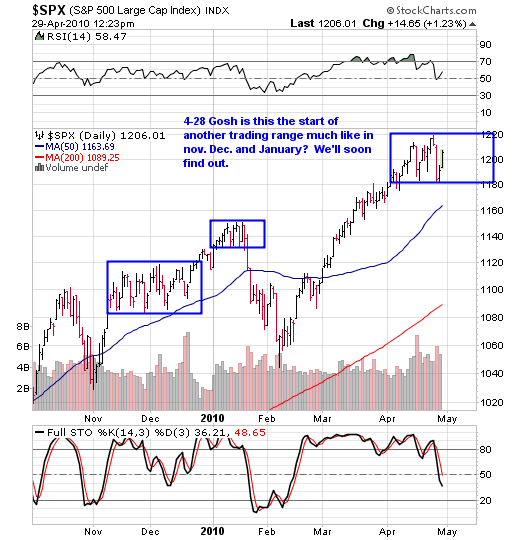

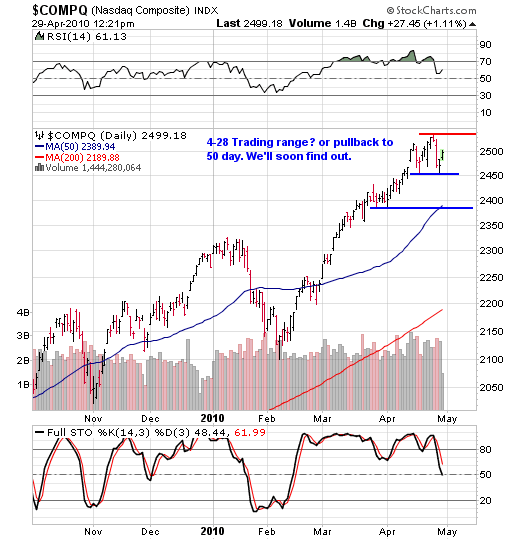

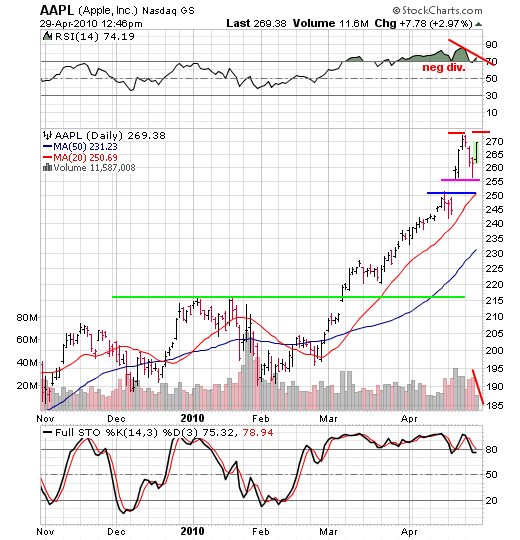

Right now the markets are retesting their highs. Should the retest fail and leading stocks like AAPL, CREE, CMG and NFLX form double tops, then we’ll really want to pay attention to that.

Take a look at AAPL:

So currently where is resistance? The red line. Let’s see what happens there. Surely no low risk entry point to be had. The most recent entry was when it was in the $256 level and you blinked your eye you missed it. We even said something to that effect recently and that was something like – It means we’ll be buying them on bad days in the market. This is the information age and things are real fast — get used to it.

Tomorrow is 1st QTR GDP and that’s a market moving number. Which means we could go either way. Volatile to say the least.

But for now, it’s a market of stocks and it’s all about chart recognition and doing what the charts tell you to do.

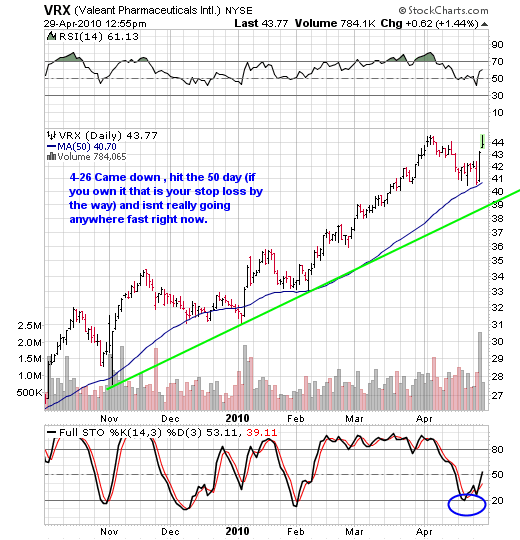

Case #1 — VRX

VRX is a leading stock that pulled back to the 50-day average. When it did so, POW ZOOM right to a retest of the recent highs.

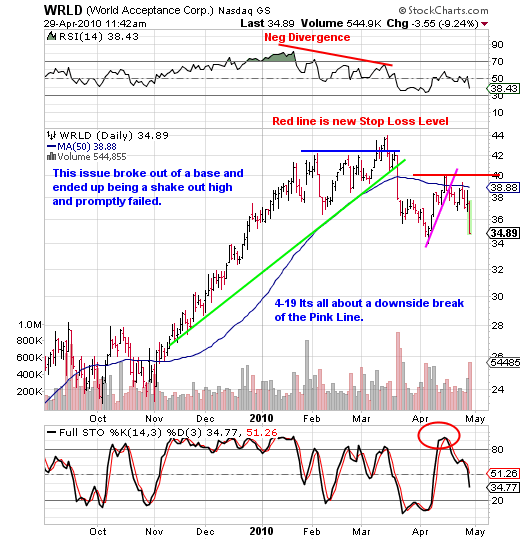

Case #2 — WRLD

A clear case of range bound trading. The resistance of the red line is where to place your short-sell trade and you cover at prior lows near $34.

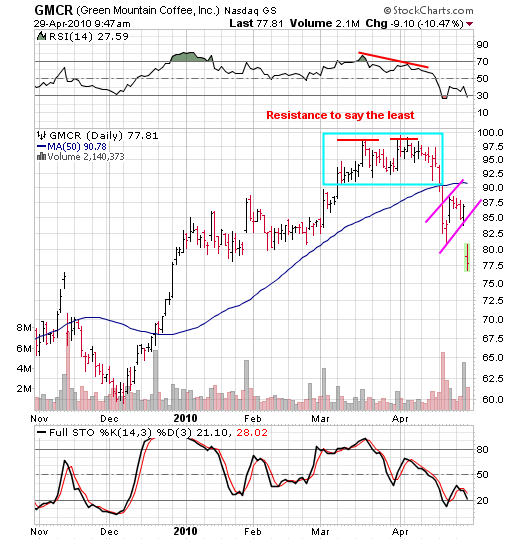

Case #3 — GMCR

Eventually all stocks in an uptrend change their trend from up to down. The best early warning sign is the presence of a double top which GMCR formed as shown by the red lines.

The blue box outlines a sideways consolidation. But GMCR broke out of that to the downside on very heavy volume. We call this the “First Thrust Down.” From there GMCR tried to rally back as shown by the pink lines. This rally attempt is called a “Snap Back Rally.”

When we see a Snap Back Rally following a First Thrust Down, we put the stock on our short-sell watch list. A short-sell trade is triggered upon a break of the bottom pink line to the downside.

In our newsletter Monday we said– “One could actually take a short sell right here set a 10% stop and one of 3 things are going to happen to you — make a gain, wash, or get stopped out at a loss.”

Sure enough, GMCR reported earnings Wednesday after the close and promptly sold off close to 10%.

But that sell-off should come as no surprise to those that know how to identify bearish chart patterns — GMCR’s chart told you all you needed to know about the likely reaction to their earnings report.

Success in the market is all about chart recognition — identifying patterns and knowing how to trade them.

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2010 Copyright David Grandey- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.