Stock Market Investor Sentiment: The Great Unwind

Stock-Markets / Stock Market Sentiment May 09, 2010 - 05:02 AM GMTBy: Guy_Lerner

When you look at investor sentiment for the past week, you must understand that the majority of data was collected and disseminated prior to Thursday's downdraft. While the data may seem stale and not reflective of the end of week events, it should be appreciated how many investors were wrong on this market. We weren't just seeing excessive bullish sentiment prior to this week, we were seeing extreme and excessive bullish sentiment. For example, in the Investors Intelligence data, there were 3 times as many bulls as bears, a reading last seen in December, 2009 and October, 2007.

When you look at investor sentiment for the past week, you must understand that the majority of data was collected and disseminated prior to Thursday's downdraft. While the data may seem stale and not reflective of the end of week events, it should be appreciated how many investors were wrong on this market. We weren't just seeing excessive bullish sentiment prior to this week, we were seeing extreme and excessive bullish sentiment. For example, in the Investors Intelligence data, there were 3 times as many bulls as bears, a reading last seen in December, 2009 and October, 2007.

The Rydex market timers had twice as many assets in bullish funds versus bearish funds, which was the highest value since the December, 2004 top. The point is this: these kinds of extremes are going to take time to unwind. Sentiment remains bullish despite this week's drubbing for stocks. I doubt investors are hopeful or acting like deer caught in the headlights. If they are, a bounce should bring further selling. More likely, there are just a lot bulls hoping to get to the exits or wishing they had sold last Monday. The next great buying opportunity will be when the "dumb money" turns bearish, and the only way to make this happen is for prices to continue lower. This appears to be several weeks away (at least) as the excessive and extreme sentiment seen over the past 8 weeks is unwound.

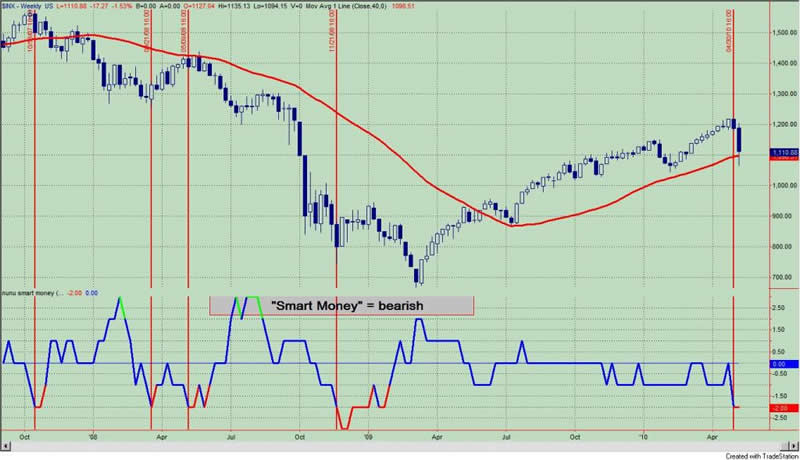

The "Dumb Money" indicator (see figure 1) looks for extremes in the data from 4 different groups of investors who historically have been wrong on the market: 1) Investor Intelligence; 2) Market Vane; 3) American Association of Individual Investors; and 4) the put call ratio. The "Dumb Money" indicator is bullish to an extreme degree. If you think this is good for higher prices, then read the article entitled, "This Is For All You Bull Market Geniuses".

Figure 1. "Dumb Money" Indicator/ weekly

The "Smart Money" indicator is shown in figure 2. The "smart money indicator is a composite of the following data: 1) public to specialist short ratio; 2) specialist short to total short ratio; 3) SP100 option traders. The "Smart Money" indicator is bearish for the second straight week.

Figure 2. "Smart Money" Indicator/ weekly

Figure 3 is a weekly chart of the S&P500 with the InsiderScore "entire market" value in the lower panel. From the InsiderScore weekly report we get the following: "The fact that so many buyers did so little to offset their selling peers is a sign that conviction lays with those taking money off the table....the Weekly Score for the Entire Market fell dramatically, settling at its eighth-worse level over the past three years."

Figure 3. InsiderScore/ weekly "entire market" value

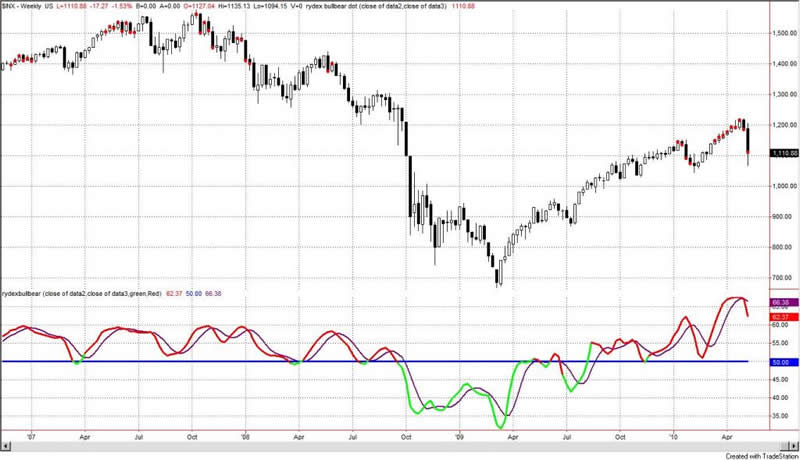

Figure 4 is a weekly chart of the S&P500. The indicator in the lower panel measures all the assets in the Rydex bullish oriented equity funds divided by the sum of assets in the bullish oriented equity funds plus the assets in the bearish oriented equity funds. When the indicator is green, the value is low and there is fear in the market; this is where market bottoms are forged. When the indicator is red, there is complacency in the market. There are too many bulls and this is when market advances stall.

Currently, the value of the indicator is 62.37%. Values greater than 58% (arbitrarily chosen) are associated with market tops, and the red dots over the price bars indicate such.

Figure 4. Rydex Total Bull v. Total Bear/ weekly

Shorter term Rydex measures continue to suggest excessive bullishness. This data, which has proved to be very actionable, is available as Premium Content. This service should help you improve your market timing.

By Guy Lerner

http://thetechnicaltakedotcom.blogspot.com/

Guy M. Lerner, MD is the founder of ARL Advisers, LLC and managing partner of ARL Investment Partners, L.P. Dr. Lerner utilizes a research driven approach to determine those factors which lead to sustainable moves in the markets. He has developed many proprietary tools and trading models in his quest to outperform. Over the past four years, Lerner has shared his innovative approach with the readers of RealMoney.com and TheStreet.com as a featured columnist. He has been a regular guest on the Money Man Radio Show, DEX-TV, routinely published in the some of the most widely-read financial publications and has been a marquee speaker at financial seminars around the world.

© 2010 Copyright Guy Lerner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Guy Lerner Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.