Gold And The Myth Of Free Markets

Commodities / Gold and Silver 2010 May 11, 2010 - 05:53 AM GMTBy: Darryl_R_Schoon

Some conspire to take power; others conspire to keep it

Some conspire to take power; others conspire to keep it

What we don’t know explains what we don’t understand. This is why the work of the Gold Anti-Trust Action committee, GATA, is to be admired. Much of the exposure of the US government’s hidden hand in the manipulation of the gold markets is due to GATA’s work. What most still do not understand is the extent of that hidden hand and its effect on America, a nation many believe to be free.

The sewers of influence that course through America’s financial system are hidden from the public eye and for good reason. If Americans understood the intent and motives of those who control the nation’s finances, they would realize they’re the patsies in an on-going suckers game with political parties the hired hacks who work on behalf of those who run the country; but, of course, Americans don’t understand and the game goes on.

.

Voting: A sucker’s bet in a fixed game

On GATA’s Board of Directors is Catherine Austin-Fitts, a person not known to many. She should be. From 1978 to 1989, she was at Dillon Read, a powerful and prestigious New York investment bank (later merged with S.G. Warburg and then UBS) where she was both Managing Director and a Member of its Board of Directors.

It was at Dillon Read where Catherine Austin-Fitts witnessed America’s heavily denied transformation, a transformation where America’s elites and Wall Street conspired with the Clinton Administration to turn Nixon’s “War on Drugs” into profit-driven genocide.

…I decided to write “Dillon Read & Co Inc. and the Aristocracy of Stock Profits” as a case study designed to help illuminate the deeper system… Dillon Read…and the Clinton Administration with the full support of a bipartisan Congress ..[colluded to profit] by ensnaring our youth in a pincer movement of drugs and prisons and wins middle class support for these policies through a steady and growing stream of government funding and contracts for War on Drugs activities at federal, state and local levels… This is genocide — a much more subtle and lethal version than ever before perpetrated by the scoundrels of our history texts.

Catherine Austin-Fitts, US Assistant Secretary of Housing (HUD) Bush Administration 1989-1990, Managing Director and Member Board of Directors, Dillon Read, 1986-1989

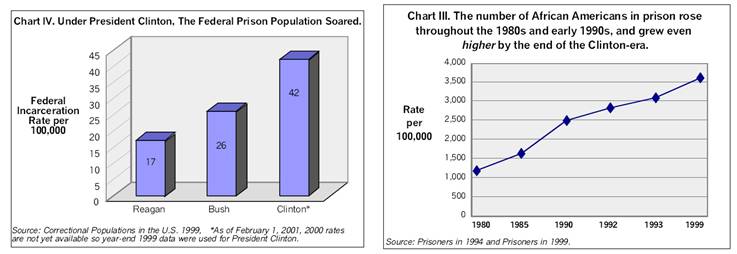

Because of Wall Street’s participation in America’s War on Drugs, large amounts of money were involved; and to start the money flowing, more Americans would have to go jail and they did. It’s no coincidence that the US is now the world’s number one jailor with the highest percentage of its citizens behind bars.

Under President William Jefferson No, I did not inhale Clinton, America’s prison population began to significantly rise, surpassing the numbers arrested under President Ronald Reagan. Thus began the diaspora of America’s underclass, especially black Americans into increasingly private prison cells in larger and larger numbers.

http://www.justicepolicy.org/images/upload/01-02_REP_TooLittleTooLate_AC.pdf

America’s genocide as told by Wall Street and Washington insider and GATA board member, Catherine Austin-Fitts, involves the US government, banks, powerful elites, both political parties and the Rothschilds. To read her story, see http://www.dunwalke.com/1_Brady_Bush_Bechtel.htm

GATA, MARTIN ARMSTRONG AND FREE MARKETS

GATA was incorporated by Bill Murphy in January 1999 to advocate and undertake litigation against illegal collusion to control the price and supply of gold and related financial securities. Exactly one year later in January 2000, Bill Murphy was to become personally acquainted with Martin Armstrong of Princeton Economics.

At the time gold was $280/oz , silver was $5.18 and GATA’s Bill Murphy was hearing rumors that Martin Armstrong was heavily involved in shorting gold. Then, on January 5, 2000 the following article, a revelatory bombshell, was posted on Kitco.

Date: Wed Jan 05 2000 04:24

GoldBird1 ( Armstrong-Republic-manipulations ) ID#396247:

Copyright © 1999 GoldBird1/Kitco Inc. All rights reserved

***** EDITED *****

EVEN EVIL RUNS OUT OF LUCK

The governments and bankers behind the manipulation of gold are running out of options. Their supplies of physical gold are dwindling as demand is rising. Their attempts to force down the price of gold has lasted almost 30 years but even evil runs out of luck.

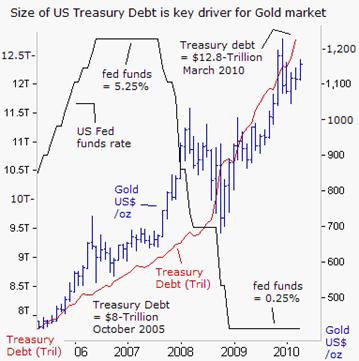

Their attempts to re-liquefy the markets are backfiring as Gary Dorsch, editor of Global Money Trends, points out that when central banks now pump in new debt, it forces the price of gold higher: The Fed has monetized trillions of dollars of new debt, through its QE scheme, and many investors have lost all faith in the value of paper money. In fact, the ballooning size of the US Treasury’s debt, which hit a record $12.8-trillion last month, has been a steady linchpin supporting the historic rally in the gold market over the past decade. As a general rule of thumb, every $1-trillion of fresh debt issued by the Treasury equates with a $125 /ounce increase in the price of gold. As long as the Fed and G-20 central banks continue to peg ultra-low interest rates, - and G-20 governments continue to flood the debt markets with huge quantities of IOU’s, - it translates into monetization, and the trajectory for the gold market would stay bullish. http://www.sirchartsalot.com/

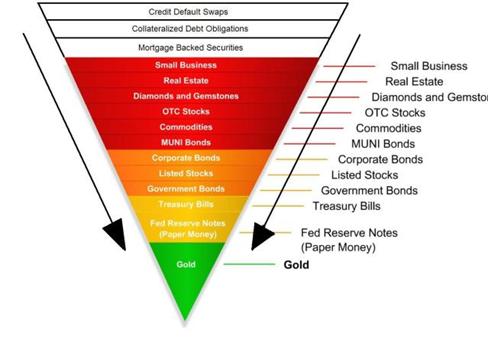

Gold has now again broken above the $1200.mark. The price of gold has quadrupled since GATA was incorporated in January 1999. It will even go higher as central bankers continue to fight in vain to maintain capitalism’s crumbling fiefdom of paper money. John Exter’s inverse pyramid denoting the deflationary flight to safety has now reached government bonds, i.e. sovereign debt. Gold is the ultimate destination of deflating wealth. www.marketoracle.co.uk/Article13848.html

FREE MARKETS AND CAPITALISM

There is a controversy regarding capitalism that should be addressed. Rather than defining capitalism in contradistinction to communism, i.e. free versus managed markets, it is more useful to define what capitalism actually is:

Capitalism’s distinguishing feature is the nature of money used in capital markets

In his book, Capitalism (Polity Press 2008), Geoffrey Ingham writes: It might seem unnecessary to draw attention to the fact that money is an essential component of the capitalist system…Capitalist societies…share certain fundamental features: (i) the private credit and the banking system ‘money multiplier’: (ii) state debt as the ultimate foundation of credit-money; (iii) the pivotal role of the central bank: and, (iv) the three cornered struggle between state, money market and taxpayer.

Capitalist economies came into existence when the Bank of England was established in 1694, a central bank which issued money in the form of debt, a monetary phenomena that had never before occurred in history. In capitalist economies, money is debt.

The substitution of debt for savings as money led to the acceleration of Gresham’s Law where bad (debt-based) money drives out good (savings-based). This explains much about our present circumstances. The issue of free versus managed markets came only after the appearance of communism.

The rise of communism shifted the focus away from capitalism’s shortcomings (debt) and advantages (credit) to communism’s egregious, obvious and brutal oppression, a phenomenon that occurs whenever and wherever power is centralized.

The greater the centralization of power the greater the opportunity for oppression

It should be understood, especially today, that capitalism is no more a protector against oppression than is democracy (see Democracy in America by Alexis de Tocqueville) and, if capitalist/democratic societies, e.g. the US, the UK, the EU, etc, continue their present trajectory; their end will be but another iteration of state tyranny.

… democratic societies which are not free may well be prosperous, cultured, pleasing to the eye, and even magnificent, such is the sense of power implicit in their massive uniformity; in them may flourish many private virtues, good fathers, honest merchants, exemplary landowners, and good Christians too…But, I make bold to say, never shall we find under such conditions a great citizen, still less than a great nation

Democracy in America, Alexis de Toqueville, 1835

Today in America, under the guise of protecting the nation, long-standing constitutionally guaranteed freedoms are being dismissed and dismantled in the US at an accelerating pace. The dispersion of power that the Founding Father embedded in the Constitution in 1776 has now been replaced by a highly centralized government.

In America, markets aren’t free and neither are Americans

The US Patriot Act—Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001—is the blueprint for the new America. Written by legal hacks, foisted on the nation by the Republican Party in the darkly contrived shadow of 9/11 and extended by the Democrats, the right of the US government to intrude and override America’s civil liberties is now the law of the land.

MARTIN ARMSTRONG AND THE US GOVERNMENT

I am not sure what is going on. I have been told that the receiver is now going to try a contempt charge for my not handing in my keys despite the fact that the locks and security codes have been changed… It appears that a contempt-of- court can land you in jail for about one year. After that, higher courts deem it to be cruel and unusual punishment.

Martin Armstrong

The above was excerpted from an email sent to GATA’s Chris Powell from Martin Armstrong in early January 2000. The court receiver who accused Mr. Armstrong of contempt was Alan Cohen, a lawyer at the powerful and prestigious firm, O’Melveny & Myers. On January 14, 2000, Martin Armstrong was arrested based on Mr. Cohen’s allegations.

For the next seven years, Armstrong would be held without trial. Appellate courts would dismiss Armstrong’s appeals that such an unprecedented incarceration on contempt charges constituted cruel and unusual punishment; the courts instead found that cruel and unusual rulings apply only to persons, not to corporations or corporate officers such as Mr. Armstrong.

This is legal parsing at its most scurrilous, equal to those written by John Yoo, the Bush Administration lawyer who provided cover for America’s legalization of torture; cover, that if extended, could exonerate those convicted at Nuremberg.

Such is the current state of American jurisprudence, a country based on the rule of law—or, so it proclaims. If so, the question must then be asked: Whose rule? Whose law? And, most importantly, whose country? If you haven’t asked those questions, you don’t know the answers.

As would be expected, those who serve power, e.g. John Yoo, Alan Cohen, Bill Clinton et. al., are well-rewarded in a country as wealthy and powerful as America. Yoo is a professor at Boalt Hall School of Law at UC Berkeley, Cohen is Executive Vice President and Global Head of Compliance at Goldman Sachs and Clinton receives $5-$8 million annually in speaking fees as a respected former US president.

Currently, Martin Armstrong is serving a five-year sentence at Fort Dix federal prison; as his time served on contempt charges—seven years (a record)—was not credited against his sentence. For Armstrong’s case and information on his incarceration, see http://princetoneconomics.blogspot.com/

Martin Armstrong’s Pi Cycle Economic Confidence Model which predicted the exact top of the Japanese stock market is a noteworthy achievement in matters of economic theory. While incarcerated Armstrong continues to write, even when in solitary confinement; and when he’s not allowed access to a typewriter, he will use a pen, see http://armstrongeconomics.com/writings/.

Martin Armstrong in prison at Fort Dix Federal Penitentiary and Catherine Austin-Fitts, Bill Murphy and Chris Powell at GATA deserve our support in these consequential times. John Yoo, Alan Cohen, Bill Clinton and the many others who serve power and wealth do not.

In America, real power is held by those who pay Yoo, Cohen, and Clinton to do their bidding; coalescing power, control and wealth in a nation that still believes itself free—while those who are governed remain oblivious and unconcerned as to their true state.

Sleep, America, sleep

Dream, America, dream

For only in your sleep and dreams

Are you free and awake

America, however, is about to wake up. Its awakening will not be pleasant. The pain has only just begun.

Buy gold, buy silver, have faith.

By Darryl Robert Schoon

www.survivethecrisis.com

www.drschoon.com

blog www.posdev.net

About Darryl Robert Schoon

In college, I majored in political science with a focus on East Asia (B.A. University of California at Davis, 1966). My in-depth study of economics did not occur until much later.

In the 1990s, I became curious about the Great Depression and in the course of my study, I realized that most of my preconceptions about money and the economy were just that - preconceptions. I, like most others, did not really understand the nature of money and the economy. Now, I have some insights and answers about these critical matters.

In October 2005, Marshall Thurber, a close friend from law school convened The Positive Deviant Network (the PDN), a group of individuals whom Marshall believed to be "out-of-the-box" thinkers and I was asked to join. The PDN became a major catalyst in my writings on economic issues.

When I discovered others in the PDN shared my concerns about the US economy, I began writing down my thoughts. In March 2007 I presented my findings to the Positive Deviant Network in the form of an in-depth 148- page analysis, " How to Survive the Crisis and Prosper In The Process. "

The reception to my presentation, though controversial, generated a significant amount of interest; and in May 2007, "How To Survive The Crisis And Prosper In The Process" was made available at www.survivethecrisis.com and I began writing articles on economic issues.

The interest in the book and my writings has been gratifying. During its first two months, www.survivethecrisis.com was accessed by over 10,000 viewers from 93 countries. Clearly, we had struck a chord and www.drschoon.com , has been created to address this interest.

Darryl R Schoon Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.