How Low Will Silver Go?

Commodities / Gold and Silver 2010 May 24, 2010 - 12:49 PM GMTBy: Jeff_Clark

Jeff Clark, Casey’s Gold & Resource Report :

We released our 2010 Silver Buying Guide last week and the silver price promptly cratered. So does this change our view of gold’s shiny cousin? Hardly.

Jeff Clark, Casey’s Gold & Resource Report :

We released our 2010 Silver Buying Guide last week and the silver price promptly cratered. So does this change our view of gold’s shiny cousin? Hardly.

While industrial uses comprise about half (53%, according to GFMS) of silver’s demand, making it susceptible to bigger falls than gold in a weak economy, it is equally clear silver also responds well to inflation, as well as serious financial “dislocations” (to put it nicely).

There are many examples of this, perhaps the best being the late 1970s. The economy in the middle of that decade was going nowhere, so some investors dumped their silver holdings because demand would supposedly be weak. A big mistake, as we now know, because silver’s greatest advance occurred at a time industrial demand was, at best, flat. Instead, silver rose due to monetary concerns and rampant inflation, giving investors 500%+ returns in the latter part of that decade, with an easy chance for even higher gains.

So if you’re buying silver to protect yourself against inflation and out-of-control government spending, then – as Doug Casey is fond of saying – sit tight and be right.

Still, it might be useful to contemplate how far silver could fall, particularly if you don’t own enough and are looking to add to your holdings.

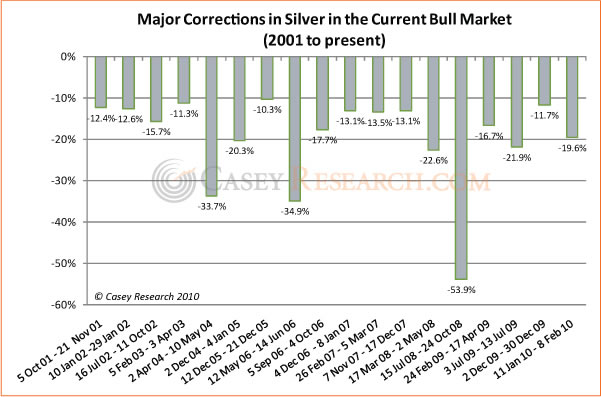

The following chart examines all the major corrections in the price of silver in the current bull market (2001 to present). I only included corrections greater than 10%, many of which were big and sudden, much like we’re experiencing now.

You can easily see how volatile silver has been. Yet amidst all that volatility, the price has risen 334% from its 11-21-01 low (as of May 21).

Based on this data, we can make some projections. Our recent high in silver was $19.64. Therefore...

• The average correction in the chart is 19.7%. You’ll notice this is almost exactly what we experienced earlier this year. An average correction from the May 20 high would give us a silver price of $15.77.

• The two nasty corrections of 33.7% and 34.9%, when averaged together, would give us a price of $12.90.

• The 53.9% cliff drop would take us as low as $9.05.

Diagnosis? Normal.

2) If you agree with our analysis that says inflation is inevitable and that fiat currencies will sooner or later be taken off life support, then scary drops become great buying opportunities. Imagine if you had bought during that waterfall decline in 2008; you could’ve paid less than $9 for an ounce of silver. That would make the current correction less worrisome. By extension, buying during today’s big downdrafts will give you peace of mind tomorrow when we see another correction at higher levels.

Treatment regimen? Buy the big corrections.

3) Adjusted for inflation, silver’s peak in 1980 would exceed $100 today (and that’s based on distorted government CPI numbers).

Prognosis? Excellent.

Since we don’t know where the next bottom is, one effective way to handle purchases is to buy in tranches. You could place limit orders at a couple different levels.

But we might save the Big Purchase for a true fire-sale price, something greater than the average sell-off. There won’t be a big flashing light that says “Buy Now!” when the bottom forms, but the bigger the drop, the easier it will become to ease into the market.

Easy? Yes, if you have lots of cash (we currently recommend in Casey’s Gold & Resource Report that one-third of assets be in cash). That big stash is going to give you the ability to load up on the cheap.

If you don’t have a significant amount of Federal Reserve notes saved, it’s not too late to start. And I’ll bet you a six-pack on a Tahitian beach you’ll feel differently about this sell-off if you have a big pile of cash waiting to deploy.

The big SALE! may very well be on its way. I hope you’re getting ready for it.

What silver investments are we buying on the corrections? Check out our 2010 Silver Buying Guide, which includes a list of the dealers with the cheapest prices on all forms of physical silver, a brand new silver ETF recommendation, and the two best silver stocks in the world. You’ve got nothing to lose – a one-year subscription to Casey’s Gold & Resource Report is only $39, and you can try it risk-free for 3 months here.

© 2010 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.