Genuine Checkmark Economic Recovery Spotted - Guess Where?

Commodities / Gold and Silver 2010 Jun 05, 2010 - 06:11 AM GMTBy: Mike_Shedlock

In response to Disputing the Alleged "Checkmark Recovery" reader Dave Bellamy informed me that I missed one.

Dave writes ...

Dear Mish,

I read and heard you reports on the "checkmark recovery" - very good!

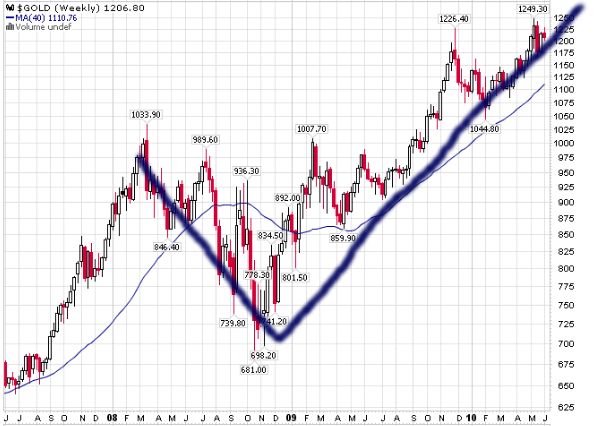

Anyway, I found a checkmark! The chart is below.

Keep up the great work. A dose of realism is so refreshing. It's strange, but whenever I hear you talking about the union workers in the USA it reminds me so much of the 1970s in Britain, all the same stuff, the 1978-79 'Winter of Discontent' culminating in the major election victory and reveral of policy in 1979 when Mrs. Thatcher came into power.

We got all the stories about British car workers in the nationalized car company talking their pillows to work so they could sleep on the nightshift and all that fun! The irony was also that, after these companies had been nationalized, their financial losses had ballooned. As you might expect with a blank cheque from the taxpayer via the Labour government. Now 30 years later, we are in similar position with rampant excess government again.

Dave

Gold Weekly

Thanks Dave!

There's no doubt about it. That is what a genuine checkmark recovery looks like.

By the way, gold has had quite a runup. If the stock market collapses again (and I think that is likely), I do not know if gold follows this time or not. No one else does either, although many pretend to.

Should a pullback happen, I do think the $975-1000 area would hold this time, noting that the last correction was to the $680 level.

Gold can easily be at the start of a blowoff stage, but I am more inclined to think there will be another pullback first.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.

Comments

|

Liam Slater

05 Jun 10, 12:39 |

Shedlock Gold

Mike's been wrong on gold for over a year. |