BP Oil Disaster Could Hit Europe Via the Powerful Gulf Stream Current

Politics / Environmental Issues Jun 10, 2010 - 01:26 PM GMT The Obama Administration and senior BP officials are frantically working not to stop the world’s worst oil disaster, but to hide the true extent of the actual ecological catastrophe. Senior researchers tell us that the BP drilling hit one of the oil migration channels and that the leakage could continue for years unless decisive steps are undertaken, something that seems far from the present strategy.

The Obama Administration and senior BP officials are frantically working not to stop the world’s worst oil disaster, but to hide the true extent of the actual ecological catastrophe. Senior researchers tell us that the BP drilling hit one of the oil migration channels and that the leakage could continue for years unless decisive steps are undertaken, something that seems far from the present strategy.

In a recent discussion, Vladimir Kutcherov, Professor at the Royal Institute of Technology in Sweden and the Russian State University of Oil and Gas, predicted that the present oil spill flooding the Gulf Coast shores of the United States “could go on for years and years … many years.”

According to Kutcherov, a leading specialist in the theory of abiogenic deep origin of petroleum, “What BP drilled into was what we call a ‘migration channel,’ a deep fault on which hydrocarbons generated in the depth of our planet migrate to the crust and are accumulated in rocks, something like Ghawar in Saudi Arabia.” Ghawar, the world’s most prolific oilfield has been producing millions of barrels daily for almost 70 years with no end in sight. According to the abiotic science, Ghawar like all elephant and giant oil and gas deposits all over the world, is located on a migration channel similar to that in the oil-rich Gulf of Mexico.

As I wrote at the time of the January 2010 Haiti earthquake disaster, Haiti had been identified as having potentially huge hydrocasrbon reserves, as has neighboring Cuba. Kutcherov estimates that the entire Gulf of Mexico is one of the planet’s most abundant accessible locations to extract oil and gas, at least before the Deepwater Horizon event this April.

“In my view the heads of BP reacted with panic at the scale of the oil spewing out of the well,” Kutcherov adds. “What is inexplicable at this point is why they are trying one thing, failing, then trying a second, failing, then a third. Given the scale of the disaster they should try every conceivable option, even if it is ten, all at once in hope one works. Otherwise, this oil source could spew oil for years given the volumes coming to the surface already.”

He stresses, “It is difficult to estimate how big this leakage is. There is no objective information available.” But taking into consideration information about the last BP ‘giant’ discovery in the Gulf of Mexico, the Tiber field, some six miles deep, Kutcherov agrees with Ira Leifer a researcher in the Marine Science Institute at the University of California, Santa Barbara who says the oil may be gushing out at a rate of more than 100,000 barrels a day.

What the enormoity of the oil spill does is to also further discredit clearly the oil companies’ myth of “peak oil” which claims that the world is at or near the “peak” of economical oil extraction. That myth, which has been propagated in recent years by circles close to former oilman and Bush Vice President, Dick Cheney, has been effectively used by the giant oil majors to justify far higher oil prices than would be politically possible otherwise, by claiming a non-existent petroleum scarcity crisis.

Obama & BP Try to Hide

According to a report from Washington investigative journalist Wayne Madsen, “the Obama White House and British Petroleum are covering up the magnitude of the volcanic-level oil disaster in the Gulf of Mexico and working together to limit BP’s liability for damage caused by what can be called a ‘mega-disaster.’” Madsen cites sources within the US Army Corps of Engineers, FEMA, and Florida Department of Environmental Protection for his assertion.

Obama and his senior White House staff, as well as Interior Secretary Salazar, are working with BP’s chief executive officer Tony Hayward on legislation that would raise the cap on liability for damage claims from those affected by the oil disaster from $75 million to $10 billion. According to informed estimates cited by Madsen, however, the disaster has a real potential cost of at least $1,000 billion ($1 trillion). That estimate would support the pessimistic assessment of Kutcherov that the spill, if not rapidly controlled, “will destroy the entire coastline of the United States.”

According to the Washington report of Madsen, BP statements that one of the leaks has been contained, are “pure public relations disinformation designed to avoid panic and demands for greater action by the Obama administration., according to FEMA and Corps of Engineers sources.”

The White House has been resisting releasing any “damaging information” about the oil disaster. Coast Guard and Corps of Engineers experts estimate that if the ocean oil geyser is not stopped within 90 days, there will be irreversible damage to the marine eco-systems of the Gulf of Mexico, north Atlantic Ocean, and beyond. At best, some Corps of Engineers experts say it could take two years to cement the chasm on the floor of the Gulf of Mexico.

Only after the magnitude of the disaster became evident did Obama order Homeland Security Secretary Napolitano to declare the oil disaster a “national security issue.” Although the Coast Guard and FEMA are part of her department, Napolitano’s actual reasoning for invoking national security, according to Madsen, was merely to block media coverage of the immensity of the disaster that is unfolding for the Gulf of Mexico and Atlantic Ocean and their coastlines.

The Obama administration also conspired with BP to hide the extent of the oil leak, according to the cited federal and state sources. After the oil rig exploded and sank, the government stated that 42,000 gallons per day were gushing from the seabed chasm. Five days later, the federal government upped the leakage to 210,000 gallons a day. However, submersibles monitoring the escaping oil from the Gulf seabed are viewing television pictures of what they describe as a “volcanic-like” eruption of oil.

When the Army Corps of Engineers first attempted to obtain NASA imagery of the Gulf oil slick, which is larger than is being reported by the media, it was reportedly denied the access. By chance, National Geographic managed to obtain satellite imagery shots of the extent of the disaster and posted them on their web site. Other satellite imagery reportedly being withheld by the Obama administration, shows that what lies under the gaping chasm spewing oil at an ever-alarming rate is a cavern estimated to be the size of Mount Everest. This information has been given an almost national security-level classification to keep it from the public, according to Madsen’s sources.

The Corps of Engineers and FEMA are reported to be highly critical of the lack of support for quick action after the oil disaster by the Obama White House and the US Coast Guard. Only now has the Coast Guard understood the magnitude of the disaster, dispatching nearly 70 vessels to the affected area. Under the loose regulatory measures implemented by the Bush-Cheney Administration, the US Interior Department’s Minerals Management Service became a simple “rubber stamp,” approving whatever the oil companies wanted in terms of safety precautions that could have averted such a disaster. Madsen describes a state of “criminal collusion” between Cheney’s former firm, Halliburton, and the Interior Department’s MMS, and that the potential for similar disasters exists with the other 30,000 off-shore rigs that use the same shut-off valves.

Silence from Eco groups?... Follow the money

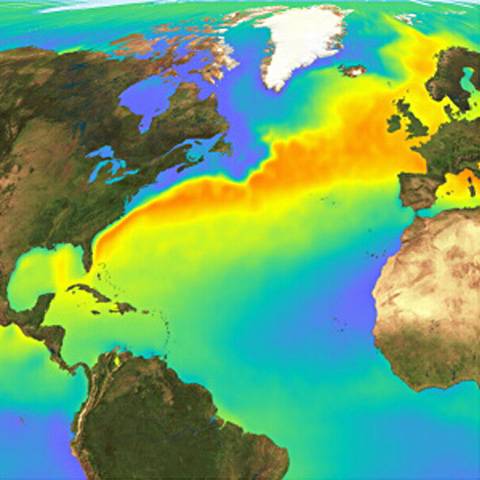

Without doubt at this point we are in the midst of what could be the greatest ecological catastrophe in history. The oil platform explosion took place almost within the current loop where the Gulf Stream originates. This has huge ecological and climatological consequences.

A cursory look at a map of the Gulf Stream shows that the oil is not just going to cover the beaches in the Gulf, it will spread to the Atlantic coasts up through North Carolina then on to the North Sea and Iceland. And beyond the damage to the beaches, sea life and water supplies, the Gulf stream has a very distinct chemistry, composition (marine organisms), density, temperature. What happens if the oil and the dispersants and all the toxic compounds they create actually change the nature of the Gulf Stream? No one can rule out potential changes including changes in the path of the Gulf Stream, and even small changes could have huge impacts. Europe, including England, is not an icy wasteland due to the warming from the Gulf Stream.

Yet there is a deafening silence from the very environmental organizations which ought to be at the barricades demanding that BP, the US Government and others act decisively.

That deafening silence of leading green or ecology organizations such as Greenpeace, Nature Conservancy, Sierra Club and others may well be tied to a money trail that leads right back to the oil industry, notably to BP. Leading environmental organizations have gotten significant financial payoffs in recent years from BP in order that the oil company could remake itself with an “environment-friendly face,” as in “beyond petroleum” the company’s new branding.

The Nature Conservancy, described as “the world’s most powerful environmental group,” has awarded BP a seat on its International Leadership Council after the oil company gave the organization more than $10 million in recent years.

Until recently, the Conservancy and other environmental groups worked with BP in a coalition that lobbied Congress on climate-change issues. An employee of BP Exploration serves as an unpaid Conservancy trustee in Alaska. In addition, according to a recent report published by the Washington Post, Conservation International, another environmental group, has accepted $2 million in donations from BP and worked with the company on a number of projects, including one examining oil-extraction methods. From 2000 to 2006, John Browne, then BP's chief executive, sat on the CI board.

Further, The Environmental Defense Fund, another influential ecologist organization, joined with BP, Shell and other major corporations to form a Partnership for Climate Action, to promote ‘market-based mechanisms’ (sic) to reduce greenhouse gas emissions.

Environmental non-profit groups that have accepted donations from or joined in projects with BP include Nature Conservancy, Conservation International, Environmental Defense Fund, Sierra Club and Audubon. That could explain why the political outcry to date for decisive action in the Gulf has been so muted.

Of course those organizations are not going to be the ones to solve this catastrophe. The central point at this point is who is prepared to put the urgently demanded federal and international scientific resources into solving this crisis. Further actions of the likes of that from the Obama White House to date or from BP can only lead to the conclusion that some very powerful people want this debacle to continue. The next weeks will be critical to that assessment.

By F. William Engdahl

www.engdahl.oilgeopolitics.net

*F. William Engdahl, author of Gods of Money: Wall Street and the Death of the American Century and Full Spectrum Dominance: Totalitarian Democracy in the New World Order (Third Millennium Press), may be reached via his website, www.engdahl.oilgeopolitics.net.

COPYRIGHT © 2010 F. William Engdahl. ALL RIGHTS RESERVED

F. William Engdahl Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.