Consumer Confidence is the Greatest Bubble of All!

Economics / US Economy Sep 08, 2007 - 08:57 PM GMTBy: Andy_Sutton

If you're like me, you have sat back over the past month or two and wondered what took so long. This is not to say that I am a gloomist by any means. There are a very small percentage of us that look at the economy and markets from a very different perspective. A perspective grounded in common sense. I can distill the difference down to a simple comparison: Most of the world believes there is a free lunch. We do not.

If you're like me, you have sat back over the past month or two and wondered what took so long. This is not to say that I am a gloomist by any means. There are a very small percentage of us that look at the economy and markets from a very different perspective. A perspective grounded in common sense. I can distill the difference down to a simple comparison: Most of the world believes there is a free lunch. We do not.

The ‘B' word has become standard mainstream media fare these days. Contrast with last year when the mouthpieces were adamant that there was no bubble, just a ‘prolonged period of unusual, but sustainable growth' (laughter mine). What was so sustainable about borrowing exorbitant amounts of money from foreigners to buy their products while producing precious little of our own I'll never know. What was so sustainable about giving away a greater and greater percentage of our monthly income to pay mortgages just because we thought someone else would come along with even more (borrowed) money to spend later? The answer eludes me. There is no free lunch.

The chickens set to flight during this latest bubble; the most excessive in the history of mankind are now coming home to roost. The government reaction has been feeble and sadly predictable. Even this humble publication wrote of a bailout back in March of this year. This statement certainly isn't meant to brag, but to make the point that this could be seen a mile away. However, we had seen a nasty trend creep into our bubbles more recently. They have become more severe, more dogmatic and more often, it seems as though the general consensus is that they will indeed go on forever. There is no free lunch.

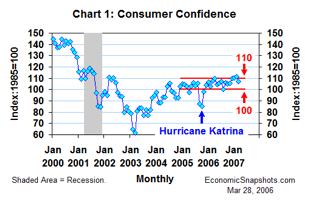

I want to talk about perhaps the biggest bubble of all though. I want to talk about the confidence bubble. In the chart below is it easy to track the confidence of consumers:

It is pretty easy to see from the above graphic that consumer confidence has been pretty steady well into the early part of this year. The next graphic is from the Conference Board and represents data since January:

I find this to be particularly amazing given the fact that during this time, the reality that home equity is disappearing has emerged. The reality that the housing market will indeed not go up forever has emerged. The reality that potentially millions of Americans are chained to mortgages for which they have little hope of paying has emerged. The dollar has dropped to historical lows against foreign currencies. There have already been two tremors in the capital markets. Compare the consumer confidence charts with the ISE Homebuilder's ($RUF) chart from March to present:

While these charts are not meant to create a quantitative comparison, it is pretty easy to see the divergence between reality and perception. The very firms that were building the ATM's of wood, nails and drywall have run into a brick wall. Yet the ones that rely on rising prices to fund various degrees of excess have paid precious little attention until now. Perhaps reality is finally setting in. There is no free lunch.

Don't let anyone kid you about what the problem really is here. We are not talking about a liquidity crisis. Sure, the Fed is spending a lot of time and sacrificing untold forests of trees in an attempt to print their way out of the corner. Sure the Treasury Secretary, President and others are now jawboning about bailouts for subprime (and prime) lenders and borrowers. The root cause of all of this is not the bursting of the credit bubble though. It is the bursting of the most important and largest of all bubbles that they want to prevent. They are trying to save the confidence bubble. We clearly have a confidence crisis right now. When it is finally admitted, I am sure that my favorite word (contained) will be used early and often. What happens though when consumers start to lose faith in the borrow and spend approach to easy living? What happens when servicing their borrowings becomes unmanageable? What happens when they realize that there is no such thing as a free lunch?

This is the reason myself and others like me are happy that we are finally seeing some signs that the cleansing effects of a recession are here (whether or not anyone is willing to admit it). We have binged. Now we need to purge. We have spent, now we need to produce. This is a lifestyle, however, that will not be given up easily and without much pumping by the media, politicians and Wall Street. I'll leave you with one final graphic and a thought:

This is the reason myself and others like me are happy that we are finally seeing some signs that the cleansing effects of a recession are here (whether or not anyone is willing to admit it). We have binged. Now we need to purge. We have spent, now we need to produce. This is a lifestyle, however, that will not be given up easily and without much pumping by the media, politicians and Wall Street. I'll leave you with one final graphic and a thought:

This paper was printed on October 22nd, 1929. It cost three cents at the time. Today's Wall Street Journal costs 50 times that much. This reality is one of the many costs of complacency and forgetting that there is no such thing as a free lunch.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. He currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.