Seeing the Good and Bad in Latin America Investing

Stock-Markets / Emerging Markets Jul 28, 2010 - 10:31 AM GMTBy: Frank_Holmes

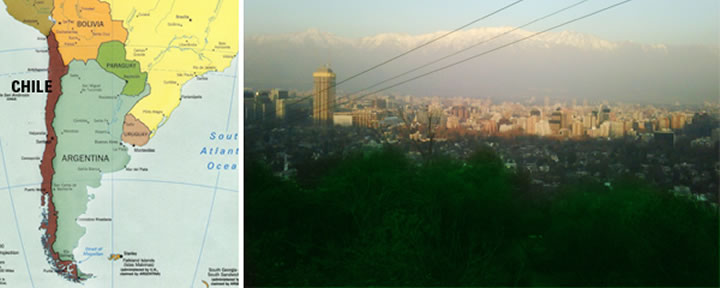

Global Strategist Jack Dzierwa is just back from an extensive research trip across Latin America. In addition to checking on agricultural prospects in Brazil (detailed here: Brazil Feeds the World), Jack traveled to Chile and Argentina. There he found two very different stories – one good, the other not.

Global Strategist Jack Dzierwa is just back from an extensive research trip across Latin America. In addition to checking on agricultural prospects in Brazil (detailed here: Brazil Feeds the World), Jack traveled to Chile and Argentina. There he found two very different stories – one good, the other not.

The Good: Chile

Compared to Western Europe and the U.S., which are dealing with massive sovereign debt burdens and growing default worries, Chile offers a fiscally prudent alternative.

Its public debt-to-GDP is a mere 7 percent, well below Latin American peers like Brazil (60 percent) and Colombia (46 percent), to say nothing of the developed nations near or above triple digits.

Chile’s devastating earthquake in February isn’t stopping the country’s economic growth – forecasters predict 5.5 percent growth this year and 6.5 percent in 2011 as resource exports to emerging markets in Asia accelerate.

The earthquake caused $32 billion in destruction and the government plans to lean on the corporate sector to help fix the damage. Corporate tax rates will be raised from 17 percent to 20 percent across the board this year and 18.5 percent in 2011. The plan is to return to a 17 percent rate by 2012.

Chile has high hopes for President Sebastian Pinera, who took office shortly after the quake. Pinera, a billionaire businessman, will look to improve Chile’s public service and education sectors by making labor laws more flexible.

Another suggestion for Pinera: privatize more of the state-run companies as a way to attract more investment. For example, the mining sector accounts for 40 percent of Chile’s GDP, but there is not a single mining company listed on the local stock exchange.

The Bad: Argentina

Argentina is looking at GDP growth in the 8 percent to 9 percent range, in part driven by a 50 percent jump in auto production. But this good news is largely offset by 25 percent annual inflation due to excessive money printing.

This has long been the story for Argentina, a resource-rich nation that is still struggling to recover from a 2002 crisis sparked by a sovereign debt default.

Over the past decade many foreign companies have left the country. The number of foreign banks has nearly been cut in half since 2001, and foreign direct investment was just under $5 billion in 2009 -- well below the annual average of $7 billion from 1995-2005.

Protectionist policies have also hurt economic growth. In April, the government imposed an import duty on goods from China, and China responded by refusing to purchase soybeans from Argentina (the country’s largest export) – instead Beijing took its business to neighboring Brazil.

Even the expectation of future taxes appears to be suppressing growth and investment. Private businesses seem afraid to invest in growth or expansion because they’re worried about the tax implications.

And the fear of another sovereign debt default remains. Five years ago, the credit default swap spreads for Argentina and Brazil were roughly the same at around 500 basis points. Today, Argentina’s CDS spread stands at 850 basis points, while Brazil’s has narrowed to 180 basis points.

Jack is sitting down with our video team to recap his Latin American findings, stay tuned to USFunds.com for the video update.

By Frank Holmes, CEO , U.S. Global Investors

Frank Holmes is CEO and chief investment officer at U.S. Global Investors , a Texas-based investment adviser that specializes in natural resources, emerging markets and global infrastructure. The company's 13 mutual funds include the Global Resources Fund (PSPFX) , Gold and Precious Metals Fund (USERX) and Global MegaTrends Fund (MEGAX) .

More timely commentary from Frank Holmes is available in his investment blog, “Frank Talk”: www.usfunds.com/franktalk .

Please consider carefully the fund's investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by visiting www.usfunds.com or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Distributed by U.S. Global Brokerage, Inc.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. Gold funds may be susceptible to adverse economic, political or regulatory developments due to concentrating in a single theme. The price of gold is subject to substantial price fluctuations over short periods of time and may be affected by unpredicted international monetary and political policies. We suggest investing no more than 5% to 10% of your portfolio in gold or gold stocks. The following securities mentioned in the article were held by one or more of U.S. Global Investors family of funds as of 12-31-07 : streetTRACKS Gold Trust.

Frank Holmes Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.