Self Sustaining U.S. Housing Market Recovery?

Housing-Market / US Housing Aug 02, 2010 - 12:08 AM GMTBy: James_Quinn

John Paulson Will Be Wrong This Time - We have arrived at critical juncture in the ongoing financial crisis. Have the government actions of the last year successfully spurred the animal spirits of Americans, resulting in a self-sustaining recovery?

John Paulson Will Be Wrong This Time - We have arrived at critical juncture in the ongoing financial crisis. Have the government actions of the last year successfully spurred the animal spirits of Americans, resulting in a self-sustaining recovery?

The Obama administration and most of the mainstream media would answer yes. GDP has been positive for the last four quarters. Consumer spending has increased in five consecutive months. Corporate profits have been relatively strong. The country has stopped losing jobs. The missing piece has been a housing recovery.

No need to worry. Famous or infamous (depending on your point of view) $15 billion man John Paulson has assured the world that house prices will rise 8% to 10% in 2011. His basis for this forecast is that California prices have rebounded 8% to 10% in the last year, and this recovery will spread to the rest of the nation.

Maybe Paulson has teamed up with his buddies at Goldman Sachs to develop a product that guarantees a housing recovery. I tend to not believe anything that comes out of the mouth of anyone associated with Wall Street, but let’s assess the facts and see if they point to an impressive housing recovery in 2011.

The man who has been right on housing for the last ten years has been Yale Professor Robert Shiller. His analysis of U.S. housing prices from 1890 until present, which he first published in 2005, unequivocally proved that we were in the midst of the greatest housing bubble in history. At the same time, David Lereah, the chief economist (shill) for the National Association of Realtors, was pronouncing it was the best time to buy. He published his masterpiece of market tops, Are You Missing the Real Estate Boom? at the 2005 housing peak. He called a bottom in January 2007, and the NAR has continued to tell Americans it is the best time to buy for the last five years as prices have dropped 36% nationally.

Dr. Shiller continues to be the voice of reason when it comes to the housing market. He is doubtful that the recent “recovery” will continue:

“Recent polls show that economic forecasters are largely bullish about the housing market for the next year or two. But one wonders about the basis for such a positive forecast. Momentum may be on the forecasts’ side. But until there is evidence that the fundamental thinking about housing has shifted in an optimistic direction, we cannot trust that momentum to continue.”

Whom do you believe? The paid mouthpiece for the National Association of Realtors, the Wall Street shill, or an impartial economics professor who has done rigorous analysis using 120 years of housing data?

Government Manipulation and Failure

The Obama administration has taken unprecedented actions using taxpayer money to keep housing from reaching its natural equilibrium level. The Keynesians who inhabit the White House decided that a first-time home buyer credit of $8,000 would boost home sales and have a multiplier effect by spurring home furnishing sales. It is obvious these people have not spent much time in the real world. No one decides to purchase a home because of a tax credit. They may accelerate a home purchase in order to take advantage of free money, but an incremental purchase will not be generated.

The tax credit was set to expire in November 2009, and the bean counters at CBO projected it would cost taxpayers $8 billion. The NAR estimated that 1.9 million first-time home buyers took advantage of the government handout, resulting in 350,000 additional sales over that time frame. Therefore, the total cost to the taxpayer was $15 billion, and each additional home sale cost you $43,000. Dean Baker of the Center for Economic and Policy Research called the credit “a questionable redistributive policy” from renters to home buyers, but said that he used it himself when he bought a house. He wrote on his blog: “Thank you very much, suckers!”

Congress deemed a 100% over-budget program that dispensed $8,000 to people for doing something they were going to do anyway such a raging success, they extended it and expanded it to all home sales. The new and improved program extended the $8,000 credit for first-time home buyers and added a $6,500 credit for any home purchase. It was restricted to “poor” folks who made less than $225,000. The credits run out on April 30, 2010. The mainstream media was positively ecstatic over the home sales “surge” in March. They will be astonished again next month as these handouts have pushed forward demand from later in the year.

Economists have estimated phase two of this program will cost taxpayers $100,000 for each additional home sold. The following chart unmistakably shows a surge in home sales from the government giveaways and then a plunge immediately thereafter.

The Home Affordable Modification Program (HAMP) makes the home tax credit program look like an astonishing success. The Obamanistas took $75 billion of taxpayer funds and have been distributing it to millions of reckless homeowners in order to keep them in homes they can’t afford. The administration sold this plan as keeping 4 million people in their homes. A veteran in the mortgage industry recently noted that a HAMP application he reviewed showed that these poor people needed a reduction in their $1,880 mortgage payment while incurring the following expenses in the prior month:

- Visits to the tanning salon

- Visits to the nail spa

- Purchases at a gourmet produce market

- Various liquor store purchases

- A DirecTV bill that must involve some serious premium programming or pay-per-view events

- And over $1,700 in retail purchases, including: Best Buy, Baby Gap, Brookstone, Old Navy, Bed, Bath & Beyond, Home Depot, Macy’s, Pac Sun, Urban Behavior, Sears, Staples, and Footlocker.

The conception behind this plan was that these homeowners were just down on their luck and needed a little help. The facts have proven otherwise. Despite threats and tremendous pressure from the administration on the banks, the program has been a miserable failure. After one year, only 228,000 permanent loan modifications have been completed. Modifications made by banks in 2008 have re-defaulted at a rate of 60%. If this program results in 500,000 modifications, the cost to taxpayers per modification will be $150,000.

The truth is that millions of irrationally exuberant people bought houses they couldn’t afford, using “creative” mortgage products, and then borrowed against the inflated value of these houses so they could live the good life. They rolled craps and now need to accept the consequences. These worthless government programs have cost taxpayers $100 billion and just postponed the ultimate bottom for housing.

Law of Supply and Demand

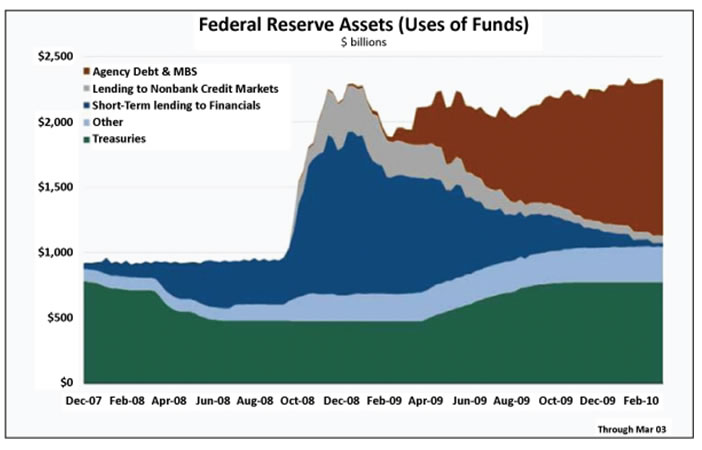

The Federal Reserve also did their part in the last year. They printed enough dollars to load their balance sheet with $1.25 trillion of mortgage-backed securities of highly questionable value. These purchases, which artificially reduced mortgage rates by at least 0.5%, concluded on March 31, 2010. Mortgage rates have already risen 0.25% in three weeks.

Considering the pile of tax dollars thrown at the housing market in the last year by our leaders, you would think new home sales would be above the level sold in 1963. New home sales in 1963 reached 600,000 when the U.S. population was 189 million. Today, new home sales are trending at 400,000 and the population is 310 million. At the peak in 2005, the total of existing and new home sales reached 9.2 million, with inventory for sale of 2.8 million homes. Total home sales are now trending at 5.4 million, a 40% decrease, while inventory for sale is 3.7 million, a 30% increase.

According to the Census Bureau, the real median price of homes in the U.S. peaked at $261,000 in the first quarter of 2006. The median price bottomed at $168,000 in the first quarter of 2009, a 36% drop. After throwing $100 billion at the problem and artificially depressing mortgage rates, the government has achieved an increase in prices to $173,000, a 3% surge. Based on this data, the market appears to have stabilized. An eight-month supply of inventory with prices up slightly sounds like a fledgling recovery. Nothing could be farther from the truth.

Foreclose This House

Believers in the fledgling recovery are ignoring some key facts. There are already 11 million homeowners underwater on their mortgages. As of March, banks had an inventory of about 1.1 million foreclosed homes, up 20% from a year earlier. Another 4.8 million mortgage holders were at least 60 days behind on their payments or in the foreclosure process. This “shadow inventory” was up 30% from a year earlier.

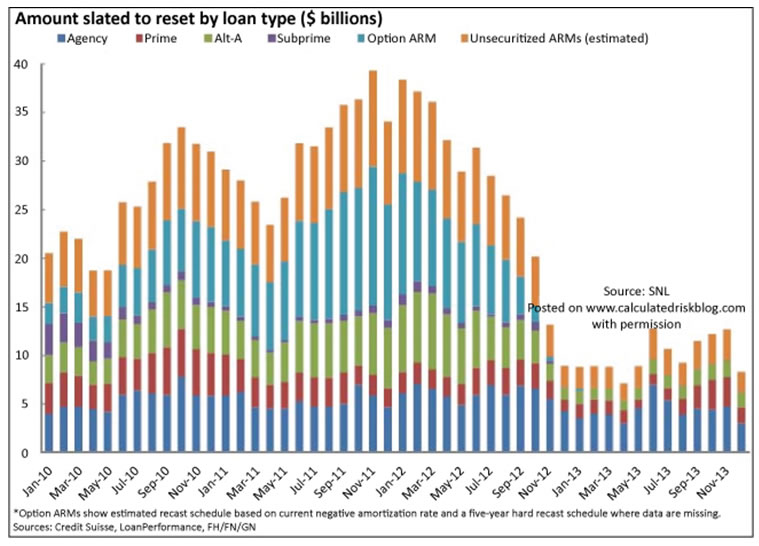

At the current rate of sales, it would take banks nine years to clear this inventory. They are likely to increase the rate of sales as inventory continues to pile up. This will compel prices to go lower. Prices would fall even if a tsunami of Option ARM and Alt-A resets weren’t hurtling down the track – but they are. Beginning in June, a surge in resets will begin and not subside until late 2012. These liar loans were riddled with fraud, and the vast majority of these mortgagees will default after the reset. A surge in foreclosures is just over the horizon.

Reversion to the mean cannot be circumvented. It can be delayed, but it will not be denied. The combination of expiring tax credits, the failure of HAMP, the conclusion of the Fed buying dodgy MBS, the growing shadow inventory of foreclosures, Option ARM and Alt-A resets, and rising interest rates will result in a further fall in home prices of at least 20% in the next two years. Mr. John Paulson will be wrong this time. Maybe we could even arrange a bet. If I'm right, I get to take my clan to one of his 19 mansions for a weekend of fun with the ruling elite. If he is right, he gets to spend a weekend at my underwater condo in Wildwood among the real people.

This article was originally published in the The Casey Report. To get 3 free months of this fantastic report click here.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2010 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.