Why Gold Stocks are Certain to Go Higher

Commodities / Gold and Silver 2010 Aug 02, 2010 - 05:36 PM GMTBy: Jordan_Roy_Byrne

Certain may not be the best word to use in a post-bubble world. Is anything truly certain? Ok maybe not. If you don't like certain then lets replace it with “highly probable.”

Certain may not be the best word to use in a post-bubble world. Is anything truly certain? Ok maybe not. If you don't like certain then lets replace it with “highly probable.”

So why is it highly probable that gold stocks will go higher? Let me digress for a moment. Making big money isn't all that difficult. It doesn't involve making numerous profitable trades or correct investment decisions. Simply put, one needs to find the long-term trends and ride them from their infancy to their apex. Currently, there are three long-term secular trends that still have a ways to go. In future commentaries we will discss the other two trends.

So why are precious metals shares bound to go much higher? Firstly, the trend is firmly in place and no one can argue that we are not in a secular bull market. Now take a look at just a few charts. These charts illustrate that the vast majority remains uninvested in precious metals stocks. This means that the bull market has huge gains ahead whether it lasts five years or ten years.

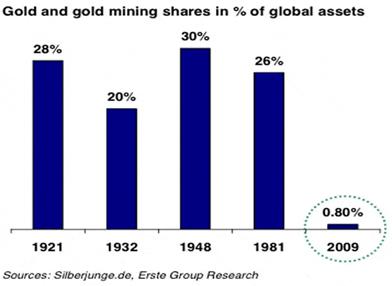

I've used this one before but it is so illuminating that it needs to be seen again and again. Anyone who thinks gold is in a bubble needs to see this chart. Yes, despite a 10-year bull market, gold stocks barely register. And just to confirm this data, there was a chart from Barrick Gold last year that showed precious metals as only 0.7% of all global managed assets.

Aside from looking at gold stocks by theirselves, they should be compared to the S&P 500. This comparison will give us an idea of how far along the bull market in gold stocks is. For the gold stocks we use the Barrons Gold Mining Index which dates back to 1938. Nick Laird of sharelynx provided us this chart and he reconstructed the BGMI back to 1890.

In the mid 1930s, the BGMI/SPX ratio reached 4 and 5. In the 1970s the ratio reached nearly 8 and then 10 in 1980/1981. In the mid 1980s, the ratio rebounded to 7. While the ratio has climbed from near 0.2 to 1.0, it is nowhere close to the peaks seen in previous secular bull markets.

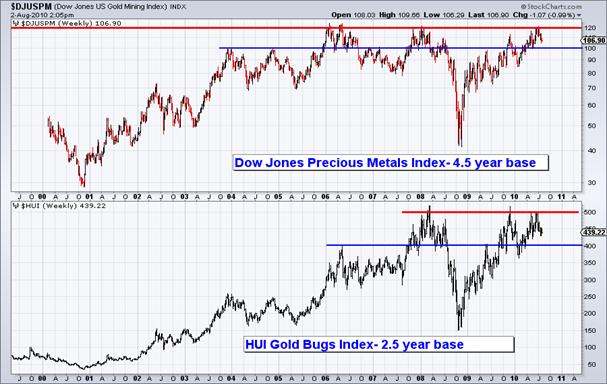

As you can tell from the next chart, precious metals shares are at an inflection point. The Dow Jones PM Index has built nearly a 5-year base while the HUI Gold Bugs Index has built nearly a 3-year base.

Most traders will wait for the breakout rather than buying support. Tell me, if you believe this sector is going higher in the long-term, then why buy at 520 on the HUI instead of at 420 or 400?

In our professional advisory service, we look at numerous technical and sentiment indicators in order to get our subscribers into the market at the best time. Buying weakness can be difficult but not when you have a professional at your side with reliable and time-tested indicators. Furthermore, it is important to know which vehicles and stocks to employ in order to get the best leverage and risk-reward. Consider a no-risk free 14-day trial to our professional service.

As the summer winds down, keep your eyes on the big picture and the opportunities that come only once in a while. Good Luck!

Jordan Roy-Byrne, CMT

Jordan@thedailygold.com

http://www.thedailygold.com/newsletter

Trendsman” is an affiliate member of the Market Technicians Association (MTA) and is enrolled in their CMT Program, which certifies professionals in the field of technical analysis. He will be taking the final exam in Spring 07. Trendsman focuses on technical analysis but analyzes fundamentals and investor psychology in tandem with the charts. He credits his success to an immense love of the markets and an insatiable thirst for knowledge and profits.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.