If the U.S. Dollar Were to Fall How Important is Gold to the States?

Commodities / Gold and Silver 2010 Aug 06, 2010 - 01:10 PM GMT Since the demise of the Gold Standard, monetary authorities have tried as many ways as possible out there to sideline gold as part of the monetary system. Since the early eighties they have succeeded to some extent, but this was by discrediting it and by emphasizing the benefits of paper currencies. Paper money in a paper system was working very well and everybody felt that much more prosperous, so ignored gold's departure.

Since the demise of the Gold Standard, monetary authorities have tried as many ways as possible out there to sideline gold as part of the monetary system. Since the early eighties they have succeeded to some extent, but this was by discrediting it and by emphasizing the benefits of paper currencies. Paper money in a paper system was working very well and everybody felt that much more prosperous, so ignored gold's departure.

Since then the developed world has had a full twenty-five year long growth period. Then began the real rise of the east! Then, in mid-2007, a 'credit crunch' knocked the stuffing out of the solidness of that system. Seven years before that crunch, when boom times were enriching the developed world the most, the gold price started to rise, when it was realized that central banks were not keen to sell all their gold at all. Only small amounts were sold and the bulk retained in the vaults of central banks. So why is it still in the system?

In 1999 the announcement of the 'Washington Agreement' laid emphasis on central bank held gold, stating, "That Gold will remain an important element of Global Monetary Reserves". This has been emphasized in subsequent agreements. If central banks were so keen to get gold out of the way, why didn't they keep selling gold constantly until, like silver, it was out of their reserves? The purpose of that statement is critical to the understanding of gold in the monetary system.

Why is Gold a Reserve Asset?

A nation's reserves serve two prime functions: -

- To act effectively as the savings of a nation and to earn their keep. Many analysts state that gold is a useless reserve item because it does not earn any income. Quite frankly this is a fatuous argument, because as any good fund manager knows, investments are measured on the basis of 'total return', not just on income. A glance at gold's total return puts it a huge distance ahead of other reserve assets in central banks.

- It must be sufficiently liquid to supply 3 months or more international trade obligations for a nation facing difficulties in its international trade. Asset Managers are often prevented from buying a great company share, simply because there is not enough liquidity in its market to get in without sending the price skyrocketing and to get out without sending the price into a tailspin. The same applies to currencies. Liquidity in all situations is vital.

When a currency loses credibility it is unacceptable as an international asset. It is not accepted in payments for goods. It is sold quickly by foreign holders and becomes an entirely localized means of exchange. A look into the history books shows us many examples of currencies that have become unacceptable outside their borders and many that failed miserably inside their borders. With politics and local demands influencing money management, a solely paper money system has been subject to debilitating influences often. Even a look around the currency world today highlights many currencies that are not managed solely with their international exchangeability and value in mind. The U.S. Dollar leads the way in that herd.

When this happens to the point of damaging the international reliability and value of a currency a real danger exists, because that 'reserve tank' of reserves becomes a lifeline to that country in the event that other nations start to turn away from the currency.

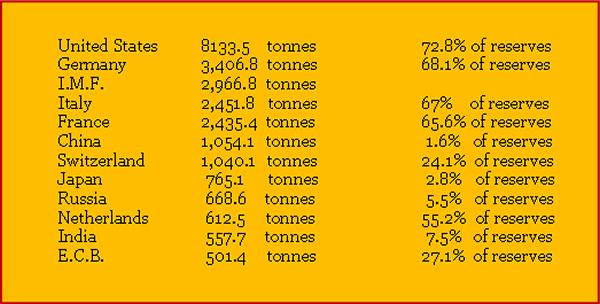

To clarify, imagine if Europe and Asia stopped accepting the U.S. Dollar and oil and Chinese goods were priced in other currencies? The U.S. would have to try to sell Dollars to buy other currencies. We assume that U.S. power would have waned at this point and other governments would not be keen to even 'swap foreign currencies for U.S. Dollars. The U.S. would have to use gold as collateral to raise these foreign currencies [through swaps] rather than sell it outright. Now we have perspective on the value of reserve assets, "in extremis". Take a look at U.S. gold reserves as a percentage of their reserves: -

Gold in tonnes and as a percentage of reserves

Please note that the percentage that gold occupies in reserves enlarges with any rise in the gold price. That's why a swap is preferable to an outright sale. It allows that central bank to benefit from such a rise.

As the days get more stressful and extreme we expect the gold price to keep on rising, reflecting falling confidence in all currencies and acting as one would want a reserve asset to act. While a local currency will fall against all currencies gold will rise against all currencies, even the ones deemed sound [as in the last decade].

In Extremis

Look back across the last three years and note these points about the developed world's monetary system: -

- Downgrades are reducing the pool of eligible assets internationally, whether they are government bonds or currencies.

- Currently, significant planned bond issues together with the contagion risks we saw made government bonds increasingly unattractive.

When this happens, gold's rising price and liquidity add to its value as a reserve asset. Last year for instance the U.S.'s gold was only 57% of its reserves, now it is 72.8%

Liquid asset in times of financial stress

Gold should not be measured for its liquidity and value in times of growth and global financial health because that's not when gold is likely to be used as reserve assets are designed to be used. Reserve assets are there for times of financial stress or worse. In really extreme times [not necessarily as bad as wartime] what counts in a reserve asset is its ability to settle foreign obligations timeously. It is at that time that gold as a reserve asset comes into its own.

One of the situations we believe is possible in the monetary world is very extreme. Let's imagine that oil producers decide to accept all 'hard' [main global] currencies and likewise China does so for its export goods. Let's imagine too that the Yuan invades the currency markets of the world. What will lie ahead for the U.S. Dollar? With the quantitative easing that is needed currently, it is possible that the Dollar will lose a significant portion of its global use and will tumble on foreign exchanges. The currency turmoil ensuing would encourage other nations to ask for more than simply the Dollar in payment. Its gold reserves would have to come into play, even as backing to a Dollar/foreign currency swap. By that time, the gold price would be considerably higher than at present, possibly even multiples of present prices. Would gold be liquid enough to satisfy foreign obligations then?

Thanks to the excellent work of the Gold Council in London we can see in measured terms just how liquid it is. At the moment, before the scene we drew exists, gold liquidity is third after U.S. Treasuries and Japanese bonds. Gold is 2 to 6 times more liquid than U.K. Gilts and twice as liquid as U.S. Federal Agency Securities. This measure is against the gold traded on the London gold market alone, recently. If we were to add the rest of the gold traded worldwide its liquidity would jump still more, today.

Now factor in the above scene. Japan is heavily dependent on the U.S. for its own financial stability, so the liquidity of its bonds would follow that of the States. Gold would then undoubtedly be the most liquid reserve asset out there.

We believe this scene is possible, not yet probable, but possible. That would certainly move gold confiscation onto the agenda of the U.S. economy if it had not already happened.

[We are issuing a further 'Confiscation article' in the next issue of the Gold Forecaster].

Gold Forecaster regularly covers all fundamental and Technical aspects of the gold price in the weekly newsletter. To subscribe, please visit www.GoldForecaster.com

![]()

By Julian D. W. Phillips

Gold-Authentic Money

Copyright 2009 Authentic Money. All Rights Reserved.

Julian Phillips - was receiving his qualifications to join the London Stock Exchange. He was already deeply immersed in the currency turmoil engulfing world in 1970 and the Institutional Gold Markets, and writing for magazines such as "Accountancy" and the "International Currency Review" He still writes for the ICR.

What is Gold-Authentic Money all about ? Our business is GOLD! Whether it be trends, charts, reports or other factors that have bearing on the price of gold, our aim is to enable you to understand and profit from the Gold Market.

Disclaimer - This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Gold-Authentic Money / Julian D. W. Phillips, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; Gold-Authentic Money / Julian D. W. Phillips make no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Gold-Authentic Money / Julian D. W. Phillips only and are subject to change without notice.

Julian DW Phillips Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.