Welcome to the Muddle Ages of the U.S. Economic Recovery

Economics / Economic Recovery Aug 18, 2010 - 04:45 AM GMTBy: EconGrapher

Before diving into the analysis, a theme occurred to me the other day; more and more the economic data from the US is looking confused. There are some parts of the economy that are showing some relatively promising signs e.g. manufacturing, but then there are other parts (e.g. consumers, housing, etc) which say - "you know, this recovery... it's not that great, things are still hard!" And thus we are at the muddle ages of the post-great-recession recovery. And so, I was just looking at the US total bank assets statistics, and there were a few noteworthy standouts in the data:

Before diving into the analysis, a theme occurred to me the other day; more and more the economic data from the US is looking confused. There are some parts of the economy that are showing some relatively promising signs e.g. manufacturing, but then there are other parts (e.g. consumers, housing, etc) which say - "you know, this recovery... it's not that great, things are still hard!" And thus we are at the muddle ages of the post-great-recession recovery. And so, I was just looking at the US total bank assets statistics, and there were a few noteworthy standouts in the data:

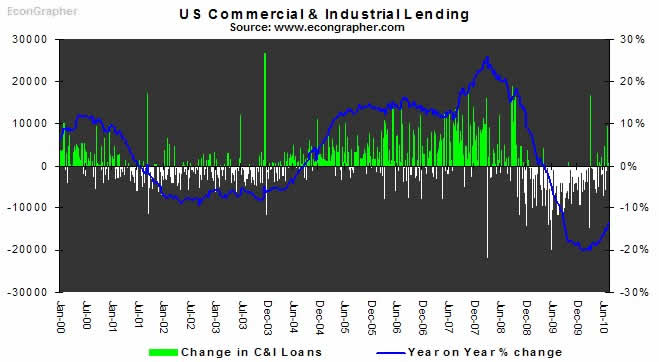

The first chart is in someways an acknowledgment that there are a few bright patches in the US economy at present. Commercial and Industrial lending is one of the most cyclically sensitive sectors of lending, if you track it over a longer time period on a year on year percentage basis it shows a fairly persistent cyclical ebb and flow. Not to be calling the all clear, but the turning of the (still negative) year on year % change, and pick up in new lending in C&I loans is certainly an interesting data point in the context of my previous comments.

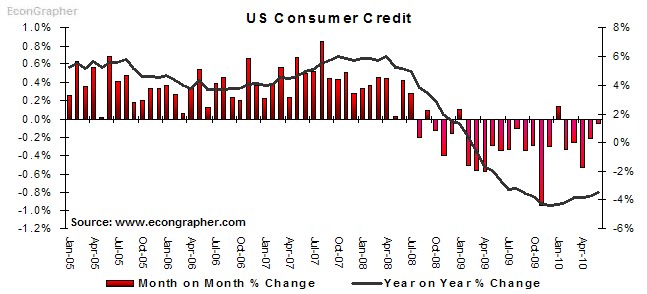

And that's the good part over, you can stop reading now if you're a blind optimist. The above chart is monthly consumer lending, with monthly percent change vs year on year percent change. It's tempting to call a turn on this one by looking at the course of the year on year percent change. But if you look beyond the data and think about what's going on, it's hard to make a case for any credible short term strength in this lending category.

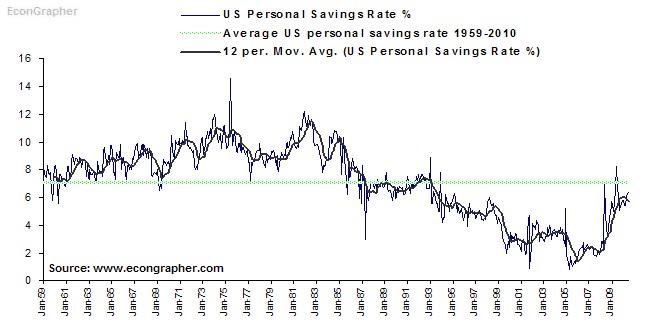

In what is in some ways the antithesis of consumer lending, the US personal savings rate has reversed its decades long downward trend, which for the long term is a good thing. It is things like this that will help bring the coming of the economic renaissance (eventually)... if it can be sustained. But of course a sustained higher personal savings rate will also mean more consolidation of consumer lending, and lackluster short-term consumer spending (and then there's the government sector side of the savings coin...).

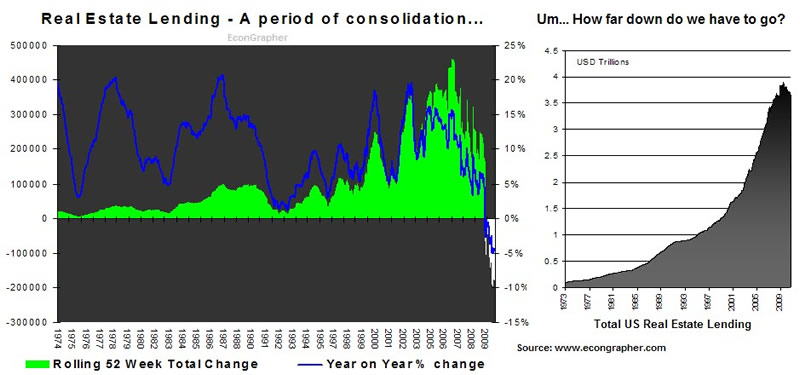

Oh and before we finish, real estate lending has continued its downward spiral and with the US housing market going no where fast, personal savings rates on the rise, unemployment still at highs, and consumer confidence still in the doldrums... it's like; "hmm, where to next on the real estate lending front?" It's hard to see any strong near-term drivers of a reversal in this sector; this is where the consolidation really needs to take place, not that there's really a choice. So, once again; welcome to the muddle ages.

Sources

Econ Grapher www.econgrapher.com

US Federal Reserve www.federalreserve.gov

Article source: http://www.econgrapher.com/18aug-muddleages.html

By Econ Grapher

Bio: Econ Grapher is all about innovative and insightful analysis of economic and financial market data. The author has previously worked in investment management, capital markets, and corporate strategy.

Website: http://www.econgrapher.com

Blog: http://econgrapher.blogspot.com

© 2010 Copyright Dhaval Shah - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.