U.S. Weekly Unemployment Claims Hit 500,000 Bearing Every Economist's Forecast

Economics / US Economy Aug 19, 2010 - 12:36 PM GMTBy: Mike_Shedlock

Once again the pile of overoptimistic economist estimates continues to mount. Today, weekly unemployment claims hit 500,000 exceeding every forecast. This is (at minimum) the 4th time since March every economist was overly optimistic regarding unemployment claims. Nicely done guys.

Once again the pile of overoptimistic economist estimates continues to mount. Today, weekly unemployment claims hit 500,000 exceeding every forecast. This is (at minimum) the 4th time since March every economist was overly optimistic regarding unemployment claims. Nicely done guys.

Bloomberg reports Jobless Claims in U.S. Rose to Highest Since November

Applications for unemployment benefits in the U.S. unexpectedly increased last week to the highest level since November, showing companies are stepping up the pace of firings as the economy slows.

Initial jobless claims rose by 12,000 to 500,000 in the week ended Aug. 14, Labor Department figures showed today in Washington. Claims exceeded all estimates of economists surveyed by Bloomberg News and compared with the median forecast of 478,000.

Estimates of the 42 economists surveyed by Bloomberg ranged from 460,000 to 495,000. The government revised the prior week’s claims figure to 488,000 from a previously reported 484,000. Initial filings last week were the highest since the week ended Nov. 14, 2009.

Claims have increased in four of the last five weeks.Weekly Claims Report

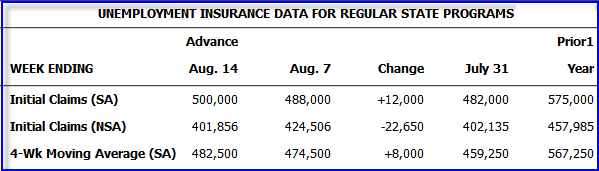

Please consider the Unemployment Weekly Claims Report for August 19, 2010.

In the week ending Aug. 14, the advance figure for seasonally adjusted initial claims was 500,000, an increase of 12,000 from the previous week's revised figure of 488,000. The 4-week moving average was 482,500, an increase of 8,000 from the previous week's revised average of 474,500.

Unemployment Claims

The weekly claims numbers are volatile so it's best to focus on the trend in the 4-week moving average.

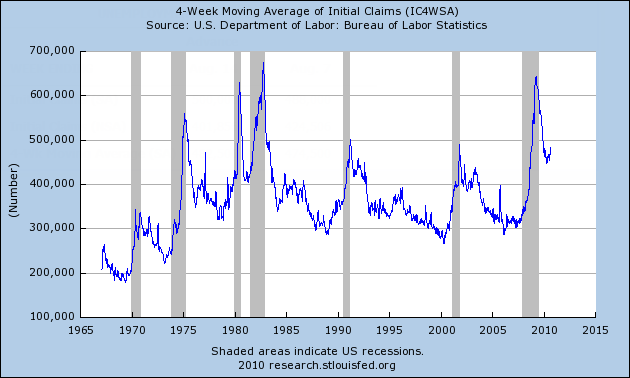

4-Week Moving Average of Initial Claims

The 4-week moving average is still near the peak results of the last two recessions. It's important to note those are raw numbers, not population adjusted. Nonetheless, the numbers do indicate broad, persistent weakness.

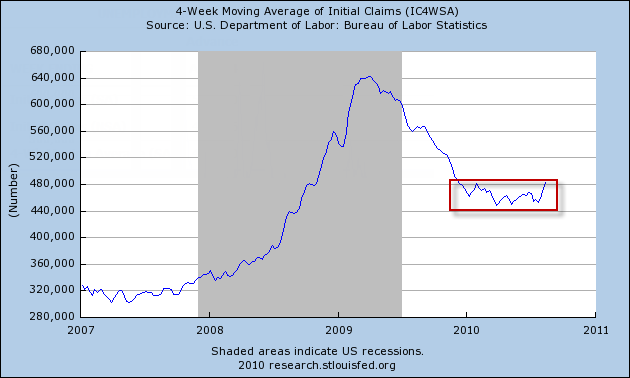

4-Week Moving Average of Initial Claims Since 2007

No Lasting Improvement for 9 Months

There has been no lasting improvement since November 14, 2009, over nine months ago.

To be consistent with an economy adding jobs coming out of a recession, the number of claims needs to fall to the 400,000 level.

At some point employers will be as lean as they can get (and still stay in business). Yet, that does not mean businesses are about to go on a big hiring boom. Indeed, unless consumer spending picks up, they won't.

Questions on the Weekly Claims vs. the Unemployment Rate

A question keeps popping up in emails: "How can we lose 400,000+ jobs a week and yet have the unemployment rate stay flat and the monthly jobs report show gains?"

The answer is the economy is very dynamic. People change jobs all the time. Note that from 1975 forward, the number of claims was generally above 300,000 a week, yet some months the economy added well over 250,000 jobs.

Also note that the monthly published unemployment rate is from a household survey, not a survey of payroll data from businesses. That is why the monthly "establishment survey" (a sampling of actual payroll data) is not always in alignment with changes in the unemployment rate. At economic turns the discrepancy can be wide.

With census effects nearly played out, It may be quite some time before we weekly claims drop to 400,000 or net hiring that exceeds +250,000.

Unemployment claims are clearly in reverse.

Want to know why some businesses aren't hiring? Please consider Creating Jobs Carries a Punishing Price

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.