The $900 billion "Bin Laden" Options trade Expires

Stock-Markets / Financial Markets Sep 22, 2007 - 03:33 AM GMT

On August 29th , a news website picked up on the existence of a gargantuan option trade that had the internet abuzz for the last month. You see, a trade of that size suggests to many that something is afoot. One point of view was that whoever bought or sold that ($900 million) option was anticipating disaster in the markets. Today that option trade expired, worthless. But was it a total loss? Not according to www.moneymorning.com (See “The $900 million Conspiracy Trade That Wasn't.) In the options business, a “box spread trade” can be used to lend someone money that could not get it in other venues and allows the lender (most likely a large banking institution) to keep its money at work.

On August 29th , a news website picked up on the existence of a gargantuan option trade that had the internet abuzz for the last month. You see, a trade of that size suggests to many that something is afoot. One point of view was that whoever bought or sold that ($900 million) option was anticipating disaster in the markets. Today that option trade expired, worthless. But was it a total loss? Not according to www.moneymorning.com (See “The $900 million Conspiracy Trade That Wasn't.) In the options business, a “box spread trade” can be used to lend someone money that could not get it in other venues and allows the lender (most likely a large banking institution) to keep its money at work.

Why would it be necessary to employ such a novel trade to put one's money to work? To answer that question, we must examine the “normal” channels of lending that banks use, the commercial paper market . “Commercial paper investments have declined $354.5 billion, or almost 16 (sic) percent, since the week ended Aug. 8, according to the Fed. The slump began in asset-backed paper and spilled into financial companies' short-term debt.” That is why banks have turned to other means of keeping their money at work. In fact, the Bloomberg article makes a passing mention of this trade, “``There are other funding sources that corporations are able to turn to besides commercial paper,'' said Alex Roever, short- term debt strategist at JPMorgan Chase & Co. in New York. ``That's a healthy sign for the overall financial system.''

Really? Can he explain why banks have borrowed $68.25 billion from the Federal Reserve this week? This is almost a $25 billion increase from last week. Do the math. The commercial paper markets have frozen up so badly that the banks' main source of liquidity is now the Fed.

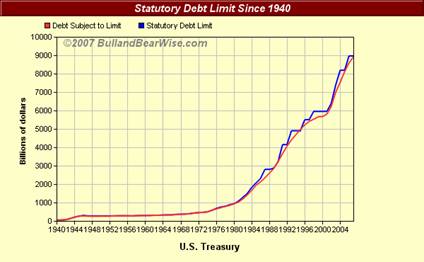

Ka-boink! We hit the debt ceiling again.

The debt ceiling will force the suspension of treasury debt issuance as early as September 27 th . The House of Representatives has already passed a resolution to raise the debt ceiling. This month, the Senate Finance Committee approved increasing the limit on the debt to $9.82 trillion. That boost of $850 billion would be the fifth since President Bush took office in 2001. The full Senate has not voted yet. Treasury Secretary Henry Paulson told Congress on Wednesday the government will hit the current debt ceiling on Oct. 1.

U.S. interest rate cut cheered in Japan .

Last week the Bank of Japan left interest rates alone, after contemplating a rate hike. But the pressure not to hike rates was too great while the U.S. cut rates. “ The world's central banks like to show they are working together to maintain global stability, and the Bank of Japan would find it hard to raise rates at a time the U.S. central bank is cutting them.” What are friends for?

Last week the Bank of Japan left interest rates alone, after contemplating a rate hike. But the pressure not to hike rates was too great while the U.S. cut rates. “ The world's central banks like to show they are working together to maintain global stability, and the Bank of Japan would find it hard to raise rates at a time the U.S. central bank is cutting them.” What are friends for?

Bubble prevention...the medicine isn't working.

Last Monday, the Central Bank of China raised interest rates again. “ Excessive liquidity in the Chinese economy is being fed by the country's large and growing trade surplus, which grew $25bn in August to $162bn for the year to date – a 71 per cent increase over the same period a year earlier.

Last Monday, the Central Bank of China raised interest rates again. “ Excessive liquidity in the Chinese economy is being fed by the country's large and growing trade surplus, which grew $25bn in August to $162bn for the year to date – a 71 per cent increase over the same period a year earlier.

The increasing frequency of interest rate rises shows how seriously the government regards food inflation in China, because of the disproportionate impact it has on the nation's poor and its propensity to incite social discontent.”

“I get by with a little help from my friends.”

The Federal Reserve's ½% interest rate cut has been viewed by many on Wall Street as a rescue of a failing market. I would like to remind my readers that similar cuts in 2001 and 2002 did nothing to stop the decline taking place. They were merely “flashes in the pan” that gave a temporary respite to the decline. In a baseball analogy, the rate cut was not a home run but a pop-up fly that hasn't left the infield.

The Federal Reserve's ½% interest rate cut has been viewed by many on Wall Street as a rescue of a failing market. I would like to remind my readers that similar cuts in 2001 and 2002 did nothing to stop the decline taking place. They were merely “flashes in the pan” that gave a temporary respite to the decline. In a baseball analogy, the rate cut was not a home run but a pop-up fly that hasn't left the infield.

Bond vigilantes to the Fed, “Thanks for nothing.”

Many analysts had expected the Fed to cut rates by just a quarter percentage point, which likely would have elicited a more positive response in the bond market. But the “bond vigilantes” have decided that a half percent cut signals something more ominous, especially when it is clear that inflation is still an issue. I suggested last week that the bond market could be in for a disappoint-ment at the Fed announcement. Do they know something we don't?

Many analysts had expected the Fed to cut rates by just a quarter percentage point, which likely would have elicited a more positive response in the bond market. But the “bond vigilantes” have decided that a half percent cut signals something more ominous, especially when it is clear that inflation is still an issue. I suggested last week that the bond market could be in for a disappoint-ment at the Fed announcement. Do they know something we don't?

Massive Motown foreclosure auction.

HSBC shut its Decision One mortgage lending unit today and took a $880 million hit. It was the leading subprime mortgage originator in 2006, selling almost $53 billion in subprime loans. HSBC Finance will continue to service and support current Decision One loans that haven't been securitized yet. There are $349 million of such mortgages. Is there more trouble ahead for HSBC?

.

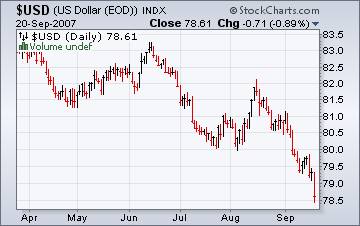

The U.S. Dollar affected by economic worries.

Sentiment soured for the dollar after Ben Bernanke, chairman of the Federal Reserve, stoked speculation that he might continue to lower rates following this week's aggressive trim of half a percentage point. Bernanke said Thursday that the sell-off in credit markets could make the housing recession more severe.

Sentiment soured for the dollar after Ben Bernanke, chairman of the Federal Reserve, stoked speculation that he might continue to lower rates following this week's aggressive trim of half a percentage point. Bernanke said Thursday that the sell-off in credit markets could make the housing recession more severe.

The dollar recovered somewhat during European trading, but investors believe that the currency will continue to lose ground, as it has for much of the past six years. Can it get any worse?

A new high in gold...

…has put the gold speculators in the lead in the contenders for the best performing asset in 2007. With a further liquidity crisis in the offing, this market may, at least, take a rest.

…has put the gold speculators in the lead in the contenders for the best performing asset in 2007. With a further liquidity crisis in the offing, this market may, at least, take a rest.

However, with the rate cut, “the Fed revealed that it has no interest in defending the dollar or containing inflation,” said Peter Schiff, President of EuroPacific Capital. “This kind of irresponsibility is all gold needs to move higher from its current levels.”

Diesel looking better than gasoline.

The EIA's report on Wednesday reported that, “…gasoline was at a premium to diesel for most of the 2007 summer driving season, maintaining about a 23 cent-per-gallon average premium over May through July. This past summer's gasoline price premium was attributable to some of the factors mentioned in the April edition of TWIP ; notably, strong summer gasoline demand, longer-than-expected delays in refinery maintenance programs, and lower imports.” With the new cleaner diesel formulation and cheaper, could we see a new popularity for diesel cars?

Natural gas less vulnerable to hurricanes.

“ In contrast to last week's significant increases, the price of the futures contract for October delivery at the Henry Hub decreased 25.8 cents, or about 4 percent, to $6.180 per MMBtu since last Wednesday, September 12.”, says the Energy Information Agency . Hurricane Humberto proved to have little impact on the futures prices for natural gas. In addition, we have an excess of 8.2% more natural gas in storage over the five-year average. Hurricane season winding down, but the price of natural gas is still vulnerable, short term.

“ In contrast to last week's significant increases, the price of the futures contract for October delivery at the Henry Hub decreased 25.8 cents, or about 4 percent, to $6.180 per MMBtu since last Wednesday, September 12.”, says the Energy Information Agency . Hurricane Humberto proved to have little impact on the futures prices for natural gas. In addition, we have an excess of 8.2% more natural gas in storage over the five-year average. Hurricane season winding down, but the price of natural gas is still vulnerable, short term.

Peter Schiff weighs in with “ Helicopter Ben Earns His Wings ”.

“…a fifty basis point cut was not an act of bravery but one of cowardice. The brave thing to do would have been to raise rates and allow market forces to purge the economy of the imbalances built up during the Greenspan bubbles. It would have taken some real courage to level with the American public and let them know that our profligacy has consequences, rather than pretending it can ride to the rescue with a wave of its magic wand and a crank of the printing press.”

Back on the air again.

Tim Wood of www.cyclesman.com , John Grant and I have had a running commentary on the markets again this week. You may listen to our comments by clicking here .

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: It is not possible to invest directly into any index. The use of web-linked articles is meant to be informational in nature. It is not intended as an endorsement of their content and does not necessarily reflect the opinion of Anthony M. Cherniawski or The Practical Investor, LLC.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.