Hindenburg Omen - A More Balanced View

Stock-Markets / Financial Crash Aug 26, 2010 - 04:05 PM GMTBy: Chris_Ciovacco

In the last few weeks, Wall Street has been spooked by a technical occurrence know as the Hindenburg Omen. The basis for the concern is we have recently seen both relatively high numbers of new 52-week highs and new 52-week lows. Wikipedia has a good summary of the Hindenburg Omen calculations.

In the last few weeks, Wall Street has been spooked by a technical occurrence know as the Hindenburg Omen. The basis for the concern is we have recently seen both relatively high numbers of new 52-week highs and new 52-week lows. Wikipedia has a good summary of the Hindenburg Omen calculations.

The recent triggering of the omen is concerning and aligns well with our models in that it is indicative of a weak stock market. However, comments and data about the omen seem to do a good job covering the “bad” outcomes after the omen was triggered, but give little performance data for stocks when “good” outcomes occurred following a Hindenburg sighting.

In a very well researched article on the Hindenburg Omen by Robert McHugh, he states the following:

There is a 30 percent probability that a stock market crash — the big one — will occur after we get a confirmed (more than one in a cluster) Hindenburg Omen. There is a 40.8 percent probability that at least a panic sell-off will occur. There is a 55.6 percent probability that a sharp decline greater than 8.0% will occur, and there is a 77.8 percent probability that a stock market decline of at least 5 percent will occur.

McHugh does a good job covering the “bad” above. Here is the same data presented from the “good” perspective:

There is a 70 percent probability that a stock market crash — the big one — will NOT occur after we get a confirmed (more than one in a cluster) Hindenburg Omen. There is a 59.2 percent probability that at least a panic sell-off will NOT occur. There is a 44.4 percent probability that a sharp decline greater than 8.0% will NOT occur, and there is a 22.2 percent probability that a stock market decline of at least 5 percent will NOT occur.

The first Hindenburg trigger came on August 12, 2010 when the S&P 500 closed at 1,083,61. Since then stocks have already dropped 4.04% using yesterday’s intraday low of 1,039,83. Therefore, some pressure on the markets has already been relieved from a basic technical perspective.

A balanced view of both the “bad” and “good” outcomes was presented by Mark Hulbert in How Bearish is the Hindenburg Omen? Below are some excerpts:

That’s the urgent warning coming from devotees of an esoteric market timing gauge known as the Hindenburg Omen. They say that it is a reliable indicator of an imminent stock market crash. But I’m not so sure. In fact, my review of the data suggests that those using the Omen to predict a crash are good candidates to win the Chicken Little award…Upon closer scrutiny, the Omen’s triggering earlier this month turns out to be not very scary at all.

At CCM, our models flashed some warning signals on August 11, 2010 as described in the post Odds of a Multi-Week Correction Have Increased. Like the followers of the Hindenburg Omen, we have been and continue to be concerned about the current market environment. We believe the markets need to be monitored very closely in the coming days and weeks.

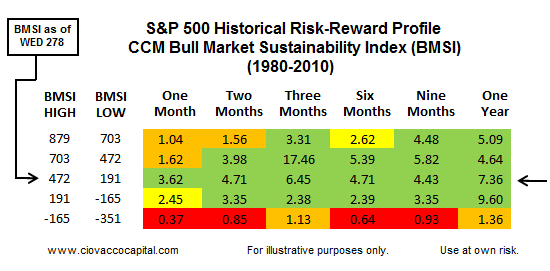

Taking into account the S&P 500’s recent slide from 1,129, from a historical standpoint (1980-2010), the markets risk-reward profile is indicating some patience is now in order. We respect the risk-reward profile could deteriorate from current levels, but at present it favors bullish outcomes over bearish outcomes. The markets have been and remain fragile, so our bullish bias here is tentative and subject to change if the CCM BMSI drops below -165 (see table below). The August 25th BMSI level was 278 leaving us with a positive bias for the time being.

According to the Wall Street Journal, significant stock market declines have followed Hindenburg Omens only 25% of the time. Said another way, 75% of the time significant stock market declines did NOT follow a triggering of the Hindenburg Omen. There are plenty of technical and fundamental reasons to be concerned in the current environment, but the Hindenburg Omen seems to be getting a little too much hype relative to the statistical realities associated with it.

By Chris Ciovacco

Ciovacco Capital Management

Copyright (C) 2009 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.