U.S Government Tops in Google User Data Request - 4,287 in Six Months!

Politics / US Politics Sep 23, 2010 - 02:43 AM GMTBy: Static_Chaos

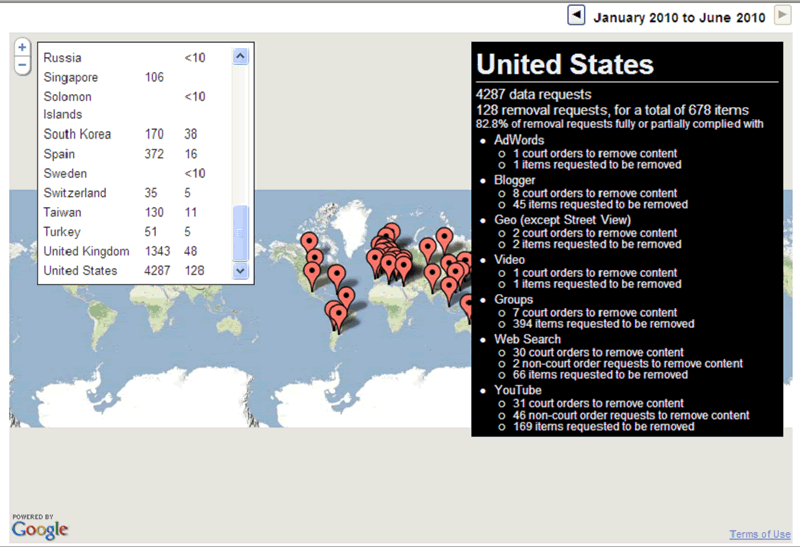

In one of my posts published in April this year, I briefly mentioned that Google unveiled a “transparency tool” that gives information about requests it receives for user data or content removal from government agencies. The government data is recorded from around the world in an effort to shed light on censorship and flow of information according to Google.

As of September 2010, the Google Transparency Report includes information on government requests from the 12 months beginning July 2009 and ending June 2010.

In the first six-month period--July 2009 to Dec. 2009--Brazil ranked number 1 as the country with the most government data requests - 3,663, while the United States was at a close second place with 3,580 requests.

The most recent data set--Jan. 2010 to Jun. 2010--the U.S. reign supreme this time around with 4,287 data requests, up almost 20% (see graph). Meanwhile, the defending champion--Brazil--dropped to the second place with 2,435 requests, down 34%. India, UK and France finished out the top five.

Here are some definitions according to Google (emphasis mine):

While this info is far comprehensive, it is worth noting the 20% increase the U.S. contrasting with the huge 34% drop of Brazil. This would suggest a positive evolvement for the Brazilians. However, for the U.S., it seems to indicate one (or a combination) of the following:What do the numbers represent?

These numbers represent the requests we received from government entities for the removal of content or the disclosure of user data in six-month blocks..... Because of the complexity of these requests, the numbers we are sharing do not reflect the total number of accounts subject to data disclosure requests by governmental agencies. Also, this report doesn’t indicate whether Google complied with or challenged any request for user information, although we do provide percentages about our compliance with requests to remove content.

- A reversal of freedom fortune

- Heightened suspicious Internet activities

- Too many workers on the the Federal payroll with too much time on their hands

Well, since Reuters reported "more than 120 former or retired military personnel points to an ongoing and alarming intervention by unidentified aerial objects at nuclear weapons sites, as recently as 2003," I would not rule out number two.

However, I personally think it is a combination of all three, but mostly Factor #1, in light of the course of policy development since President Obama took office. In any case, regardless of the possible mitigating factor, this is definitely the wrong direction for America and bad news for Americans.

By Static Chaos

http://static-chaos.blogspot.com

© 2010 Copyright Statoc Chaos- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.