Deflation Hits Small Businesses, No One Wants Obama's $30 Billion

Economics / Deflation Sep 25, 2010 - 06:49 AM GMTBy: Mike_Shedlock

When government passes out the money normally people are lined up, in advance, with both hands out. When that does not happen, it's because the offer smells like a rotten fish.

When government passes out the money normally people are lined up, in advance, with both hands out. When that does not happen, it's because the offer smells like a rotten fish.

Please check out Obama's latest rotten fish offering as described in Small businesses, community bankers may snub Obama's $30 billion loan program

President Barack Obama's $30 billion small community business lending program faces one big challenge: many of the community banks and businesses it's supposed to help don't want it.

The lending program is part of a bill that passed the House of Representatives on Thursday and now awaits the president's signature. The legislation contains a mix of tax cuts and credits aimed at helping small businesses. The centerpiece of the bill is an effort to make billions of dollars available to community banks for loans to small businesses.

Bank executives say their customers don't want loans, even at low interest rates, because the sluggish economy has chilled expansion plans. Some say the federal money isn't worth it because they fear it will come with too much regulatory oversight.

"We have taken a strategic decision not to have our primary regulator, the government, also be a partner in our bank," said William Chase Jr., CEO of Triumph Bank in Memphis.

Chase said the bank already has enough capital to meet the paltry demand for loans. "Our business customers are mired in uncertainty and are reluctant to invest in their businesses," Chase said.

The $30 billion fund will be run by the Treasury Department, and money will be awarded to banks deemed strong by regulators. Banks that have less than $10 billion in assets are eligible.

"It will provide incentives to invest and create jobs for 4 million small businesses," Obama said at a news conference Sept. 10. "It will more than double the amount some small business owners can borrow to grow their companies."

Obama has to bridge the gulf between money that's available and the needs of businesses. The NFIB survey found businesses don't intend to borrow until they have more customers.

Community banks will have to pay an annual dividend of 5 percent to the U.S. Treasury. However, when banks increase their lending to small businesses, their dividend rate declines on a sliding scale. So, if a bank increases its small-business lending portfolio by 2.5 percent, the dividend payment goes down to 4 percent and so on, said Paul Merski, chief economist at the Independent Community Bankers of America, the lobbying group for small banks.

The dividend payment increases to 7 percent if banks don't lend to small businesses.

Noah Wilcox, CEO of Grand Rapids State Bank, with two branches in Minnesota, said he already has more capital at his $250 million bank than he can lend out.

"Many of our clients, business owners, put their projects on ice in 2008 because their job number one is to see their company through to the other side of this economic crisis," said Wilcox.Somehow Obama takes credit for creating 4 million jobs from $30 billion that will never be spent because the terms for banks are preposterous and small businesses do not want the money anyway.

This is just what I predicted yesterday in Ass Backwards: Senate to Shelve Bush Tax Cuts for Individuals; House to Pass Small Business Tax Cuts

Buying Preferred Shares Amazing Convoluted

Buying preferred shares of banks to get them to lend is amazingly convoluted. Banks need to decide business risks of lending and make those decision on risk, not on government prodding.

The only possible saving grace for such monstrous stupidity is that Zandi is likely correct when he says banks may not take the offer in memory of TARP. Nonetheless, this is yet another step down the path of more seriously misguided government intervention.

Republicans were correct to object to this foolishness.

Tax Credits for Capital Spending Make Little Sense

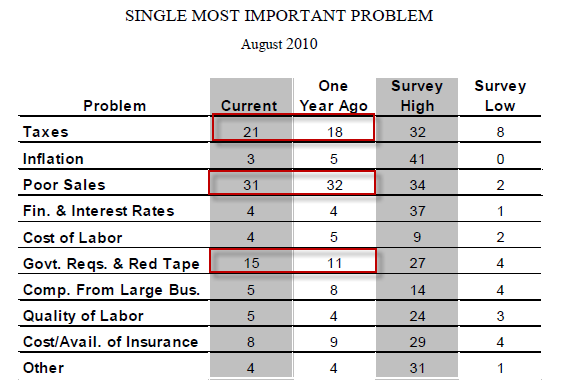

Given the #1 problem facing small corporation is lack of customers, it makes little sense to entice businesses to increase capacity. Payroll tax credits suffer the same flaw.

Please see my response to both those ideas in Response to Nouriel Roubini on "America Needs a Payroll Tax Cut"NFIB Small Business Trends

Inquiring minds are taking a look at NFIB Small Business Trends for September.

LABOR MARKETS

There is no life in the jobs market. The Bureau of Labor Statistics (BLS) reported 67,000 new private sector jobs in August, but 45,000 were from education and health care which are heavily dependent on government spending, not exactly “Main Street”companies. Eleven (11) percent (seasonally adjusted) reported unfilled job openings, up one point from July but historically very weak. Over the next three months, eight percent plan to increase employment (down one point), and 13 percent plan to reduce their workforce (up three points), yielding a seasonally adjusted net one percent of owners planning to create new jobs, down one point from July but positive for the fourth time in the last 22 months.

CAPITAL SPENDING

The frequency of reported capital outlays over the past six months fell one point to 44 percent of all firms, again hitting the 35 year record low. The environment for capital spending is not good. Interest rates are low but the record long recession has eroded financial strength. More importantly, the prospects that investment spending and/or hiring will somehow increase profits are low. Four percent characterized the current period as a good time to expand facilities, down one point. A net negative eight percent expect business conditions to improve over the next six months, seven points better than July but still more owners expect the economy to weaken than strengthen. Owners do not trust the economic policies in place or proposed, fear the economic implications of massive deficits and are distressed by global and national developments that make the future more uncertain.

INFLATION

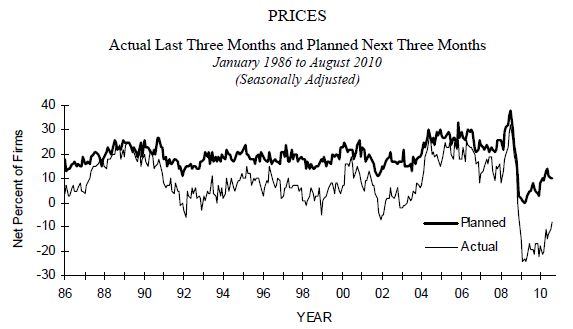

The weak economy continued to put downward pressure on prices. Seasonally adjusted, the net percent of owners raising prices was a negative eight percent, a four point increase from July. August is the 21st consecutive month in which more owners reported cutting average selling prices that raising them.

COMMENTARY

The Index has been below 93 every month since January 2008 (32 months), and below 90 for 25 of those months, all readings typical of a weak or recession-mired economy.

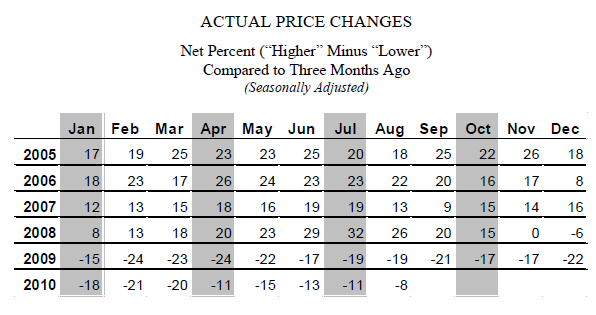

Inflation? Not a threat. Far more owners have cut prices than raised them for 21 months in a row. Deflation? It certainly feels that way to a quarter of the owners reporting price declines for the goods and services they produce and sell.Here are a few charts from the article.

Prices Received

Actual Price Changes

Single Most Important Problem

The single most important problem is lack of customers. Access to credit is not even on the list. Small businesses don't want loans because they don't have any customers and prices they receive are falling like a rock.

This is deflation in action, and it is crucifying small businesses.

So what does Congress do?

Why it sets up a convoluted $30 billion program, onerous on small banks, so those small banks (who don't want the money) can offer loans to small businesses that do not want the money either!

But hey, it creates another 4 million jobs according to president Obama. Why he must have saved or created 20 million jobs this year alone.

One just might not know it judging from Question of the Day: How Many People Have Exhausted All Their Unemployment Benefits?

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post ListMike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2010 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.