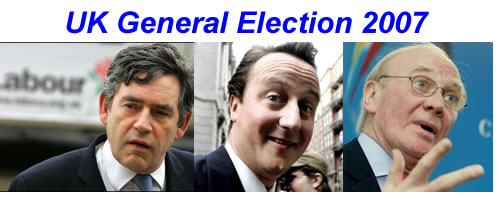

Labour Landslide on Early Election As David Cameron Has Failed to Burst the Brown Bubble

ElectionOracle / UK General Election Sep 30, 2007 - 04:01 AM GMTBy: Nadeem_Walayat

David Cameron steps forth at the Conservative Party Conference on the eve of an early general election. Knowing full well that he has failed as a leader in many respects to make the Conservative Party electable. If the Polls are anything to go by then the Tory party is in meltdown as there is little hope of winning against an 11 point Labour lead, which would have all the hall marks of a Labour landslide win.

David Cameron steps forth at the Conservative Party Conference on the eve of an early general election. Knowing full well that he has failed as a leader in many respects to make the Conservative Party electable. If the Polls are anything to go by then the Tory party is in meltdown as there is little hope of winning against an 11 point Labour lead, which would have all the hall marks of a Labour landslide win.

Despite David Cameron's call for Gordon Brown to stop dithering and come clean, the only hope that the conservative party has is if Gordon Brown does continue to dither and delay an election until next year. For Gordon Browns 10 year economic bubble is about to burst !

The Market Oracle has been illustrating since the beginning of May 2007( UK Housing Market Heading for a Property Crash) , of the many factors converging towards an economic downturn in UK during 2008. With the property market at its tipping point as we speak ( UK Housing Market Crash of 2007 - 2008 and Steps to Protect Your Wealth - 22nd August 07). The UK looks set to follow the US into an economic downturn that unlike 2001 is not going to be cushioned by chinese exported deflation, but more akin to stagflation. US Housing Crash Deepens As the US Drifts Towards Stagflation (26th Sept 07)

Gordon Brown survived the Northern Rock Shock on the back of his 10 year repetitive reputation of economic stability. But as indicated several times at the Market Oracle, the Northern Rock bust is but the tip of the credit crunch iceberg which will hit HMS Britannia during the next 12 months. There will be more banking difficulties in the UK as both home repossessions soar and the credit crunch impacts the corporate sector. This will have a feed back effect on the credit markets resulting in tighter interbank liquidity despite panic interest rate cuts such as the Feds 0.5% cut.

Gordon Brown as the 10 year chancellor should be very aware of the problems facing Britian's economy just over the horizon. Even though a Conservative party win at any point during the next 2 years seems highly unlikely given the alternative that David Cameron represents. I.e. Its clear to the electorate that any crisis no matter what it may be is better in the experienced hands of Gordon Brown, than in David Cameron's. What the Conservatives need to have to beat Labour is a Margaret Thatcher Mark II, until that day the Tories do not stand a chance. At best the Tories can hope for a reduced Labour majority of 10 as against a projected landslide of 100, if Gordon goes for an autumn poll.

Gordon Brown as the 10 year chancellor should be very aware of the problems facing Britian's economy just over the horizon. Even though a Conservative party win at any point during the next 2 years seems highly unlikely given the alternative that David Cameron represents. I.e. Its clear to the electorate that any crisis no matter what it may be is better in the experienced hands of Gordon Brown, than in David Cameron's. What the Conservatives need to have to beat Labour is a Margaret Thatcher Mark II, until that day the Tories do not stand a chance. At best the Tories can hope for a reduced Labour majority of 10 as against a projected landslide of 100, if Gordon goes for an autumn poll.

The only person who can hold Gordon Brown back from an early election and landslide victory is himself. For Gordon Brown is different to Tony Blair in that respect, he is far more cautious and yes whilst that would have avoided Britain entering into an unwinnable war in Iraq, it also may stop Gordon from going to the people for his own mandate to govern. One of the biggest factors is if Gordon perceives an early sunset as a net negative or positive for Labour. But the time window is closing, he will have to make his mind up within the next 10 days, the most likely date now for a decision is 8th October when parliament returns from its summer recess.

By Nadeem Walayat

(c) Marketoracle.co.uk 2005-07. All rights reserved.

Nadeem Walayat is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 100 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.