Gold and Silver Try to Maintain Positive Momentum

Commodities / Gold and Silver 2010 Oct 19, 2010 - 06:34 AM GMTBy: GoldCore

Gold and silver maintained their positive momentum yesterday and eked out another daily gain after initial weakness. Both are marginally lower today and yesterday's lows of $1352/os and $23.70/os are now short term support which could be tested if we have a period of dollar strength. However, the technicals and the fundamentals remain resoundingly supportive of higher prices and the round figures of $1,400/oz (and $24/oz) remain short term price targets.

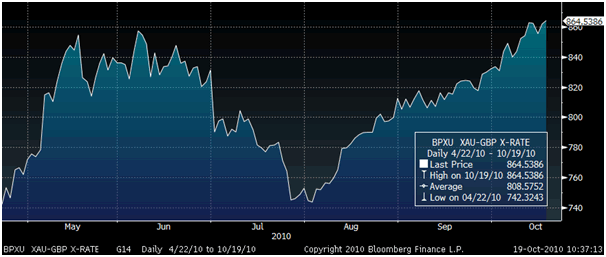

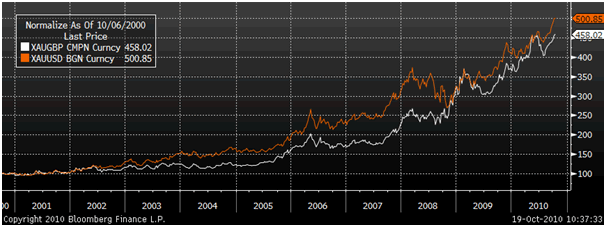

Gold's recent rise has been largest in dollar terms but there have also been gains in all fiat currencies including euros, yen, Swiss francs and particularly sterling (see charts below). Sterling gold is close to the record (interday) nominal high of £867/oz and is being supported by concerns about another round of quantitative easing by the Bank of England.

Gold is currently trading at $1,364.30/oz, €981.85/oz, £865.07/oz.

Gold in GBP - Daily (180 days).

US Treasury Secretary, Timothy Geithner, said overnight that the US would not devalue the dollar and no country could devalue its way to wealth. Geithner said that the US needed to "work hard to preserve confidence in the strong dollar." The dollar is flat after Geithner's comments which will reassure some investors and the US large creditors, particularly the Chinese. However, many will adopt the maxim that 'actions speak louder than words' and will be concerned that QE2 will inevitably lead to the dollar again falling in value.

Federal Reserve purchases of between $500 billion of and $1 trillion of Treasuries may be announced at the Fed's meeting next month. Despite already having lowering US interest rates almost to zero and buying $1.7 trillion of securities, policy makers are discussing another massive expansion in the Fed's balance sheet. Monetary policy is already extremely accommodative and despite that the Federal Reserve and other central banks look certain to embark on a new round of quantitative easing.

Gold in GBP and USD - Daily (10 Year).

Currency and the gold and silver markets await monetary policy makers opinions this afternoon with FOMC members Yellen and Dudley, Bundesbank President Weber, Bank of England Governor King, and Fed Chairman Bernanke all scheduled to speak. Weber has already dissented from the new QE2 proposals and continues to be worried about the long term inflationary risks posed by the most radical monetary policy seen in modern history.

Silver

Chinese silver exports look set to plummet by some 40% which is bullish for silver. The small sized silver market is already under pressure from increasing demand, particularly investment demand, and a marked decline in supply from the world's leading producer will lead to prices continuing to rise.

Silver is currently trading at $24.14/oz, €17.37/oz and £15.31/oz.

Platinum Group Metals

Platinum is trading at $1,681.50/oz, palladium is at $578/oz and rhodium is at $2,175/oz.

This update can be found on the GoldCore blog here.

Mark O'Byrne

Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.